Shiba Inu (SHIB) became a massive sensation in the crypto world after increasing over 17 million percent within 15 months after its launch.

The incredible success of the “Dogecoin killer” left crowds guessing when to buy it and even how to mine Shiba Inu.

Sponsored

DailyCoin explains how SHIBs are created and the most popular ways to mint them.

What Is SHIB?

Shiba Inu (SHIB) is a decentralized meme token, built on the Ethereum blockchain back in 2020 by anonymous founder “Ryoshi.” The ERC-20 standard token features a shiba inu dog as its symbol.

Because of that, and because of its meme token nature, SHIB is widely called the “Dogecoin killer.” Dogecoin, the iconic meme token, is seven years older than SHIB; however, both tokens were born for the same reason: pure fun.

Sponsored

SHIB founders also wanted to test what it would be like to create a fully decentralized and community-driven token. This means its growth potential strongly depends on the community growth, not on a utility.

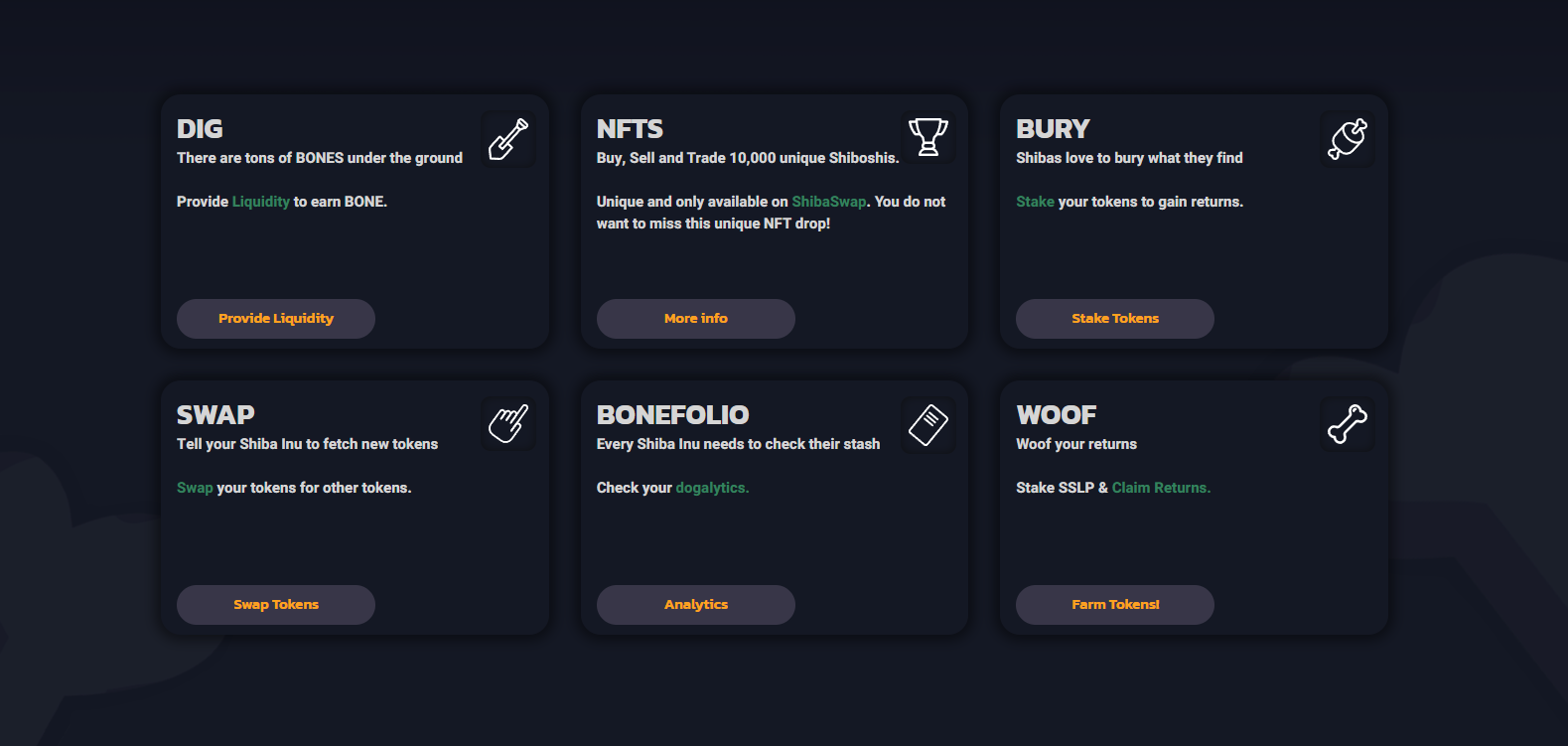

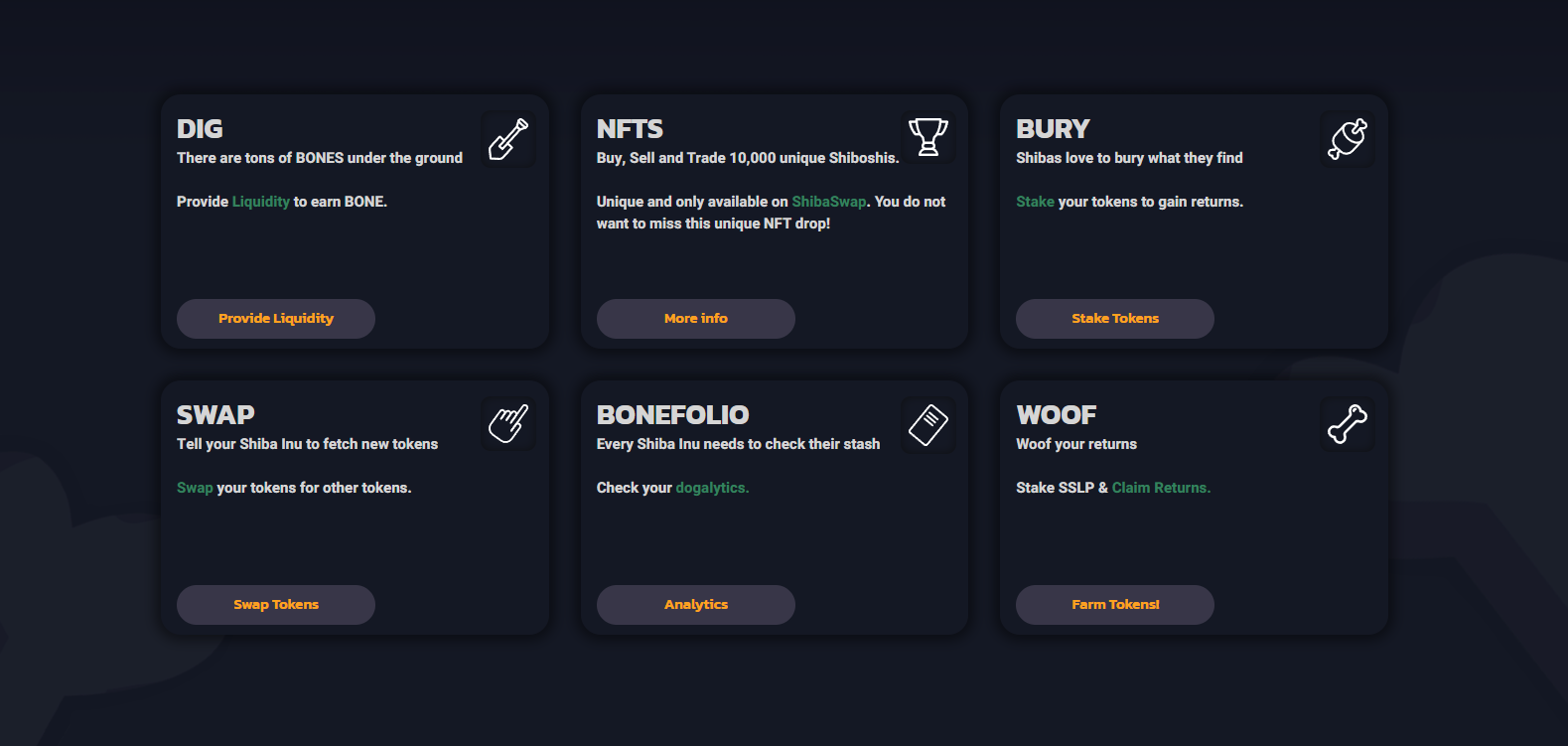

On the other hand, SHIB founders developed an ecosystem around SHIB, which includes two other tokens (LEASH and BONE) and a decentralized exchange, ShibaSwap, where tokens can be swapped, staked, or deposited in a liquidity pool.

Read more: Types of Cryptocurrency

How to Mine Shiba Inu

Shiba Inu (SHIB) is an ERC-20 standard token that does not have a native blockchain. It is created and hosted on the Ethereum blockchain.

This means SHIB cannot be mined in the same way as Bitcoin (BTC) or Ethereum (ETH) by using a traditional proof-of-work (PoW) algorithm that adds newly created transaction blocks into the blockchain and rewards miners with cryptocurrency.

ERC-20 tokens can only be minted. Typically, the process involves smart contracts, programming, and all the development stuff. But it’s a way to go for those who plan to create a brand new token.

For those who simply want to increase their SHIB holding, minting comes in a different way: by staking or liquidity pools.

How to Stake the Shiba Inu Token

In a nutshell, staking is locking your tokens on smart contracts in order to earn high-yield returns. Typically they are called an annual percentage yield (APY) and vary depending on where the token is staked.

You can stake SHIBs directly on its own decentralized exchange, ShibaSwap, or do this via centralized crypto exchanges like Binance or Crypto.com.

How to stake Shiba Inu on ShibaSwap

- Connect your wallet

Let’s pretend you already have SHIB tokens in your cryptocurrency wallet. Connect it to the ShibaSwap exchange by scanning a QR code.

At press time, ShibaSwap supports MetaMask, CoinbaseWallet, Ledger Live, Infinity Wallet, Encrypted Ink, and Wallet 3 desktop wallets.

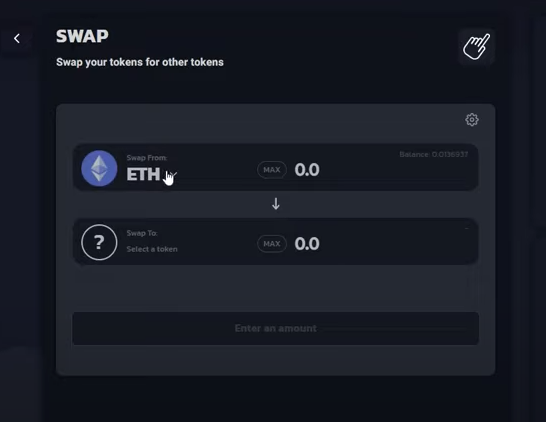

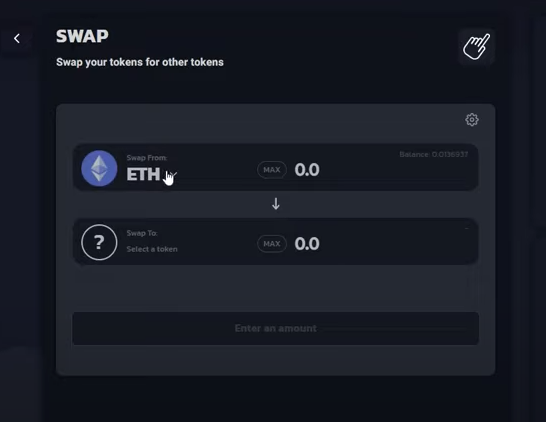

2. Swap to Shiba Inu

This step is necessary only if you don’t have SHIB tokens in your wallet. In this case, swap your chosen tokens for Shiba Inu (SHIB). You can select from multiple cryptocurrencies in the Swap section. Simply enter what amount of tokens you want to swap and approve.

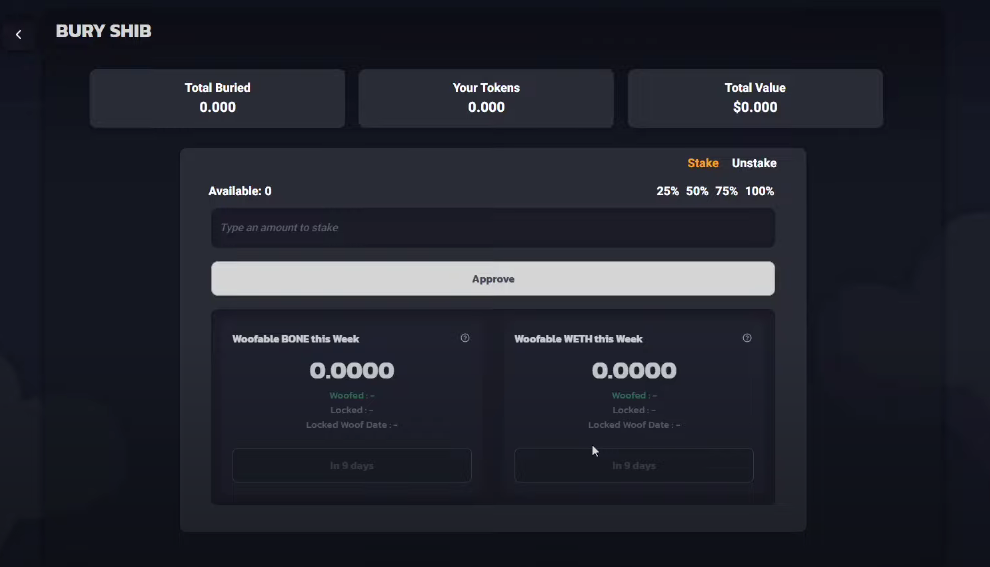

3. Stake SHIB

Open the “Bury SHIB” tab on the DEX interface, type an amount or select how much (25%, 50%, 75%, or 100%) of your balance you’d like to stake. Click “Approve” to confirm token locking for a fixed period of time.

How to stake Shiba Inu on centralized exchanges

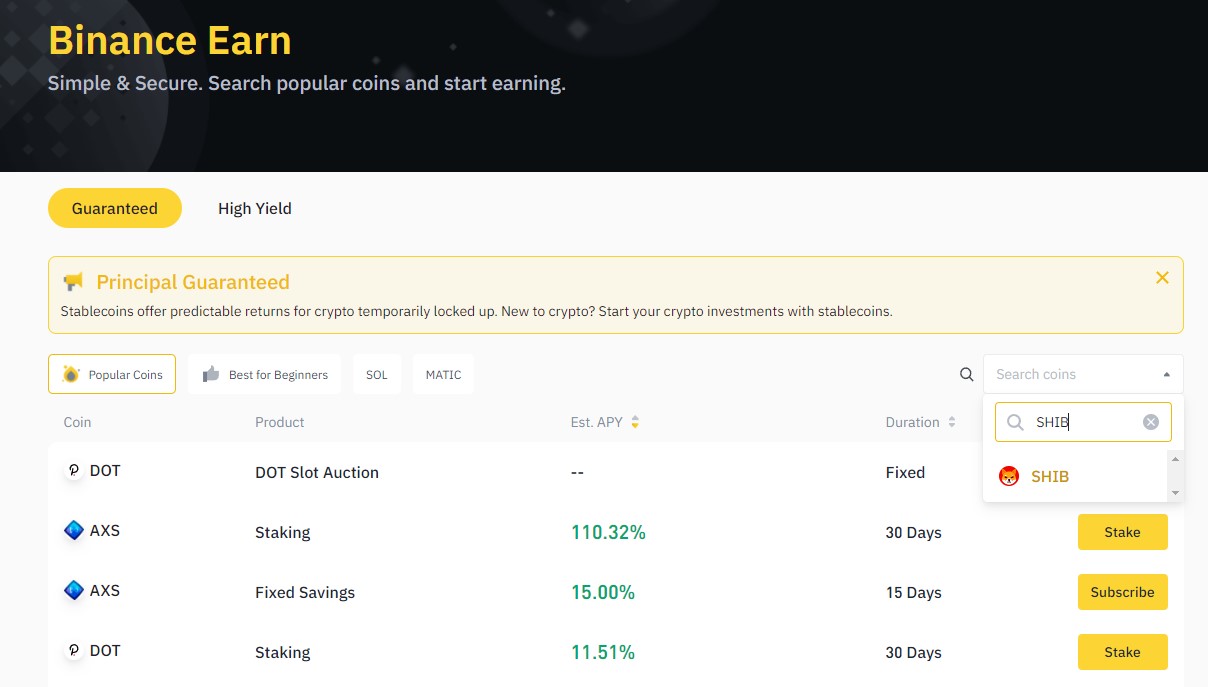

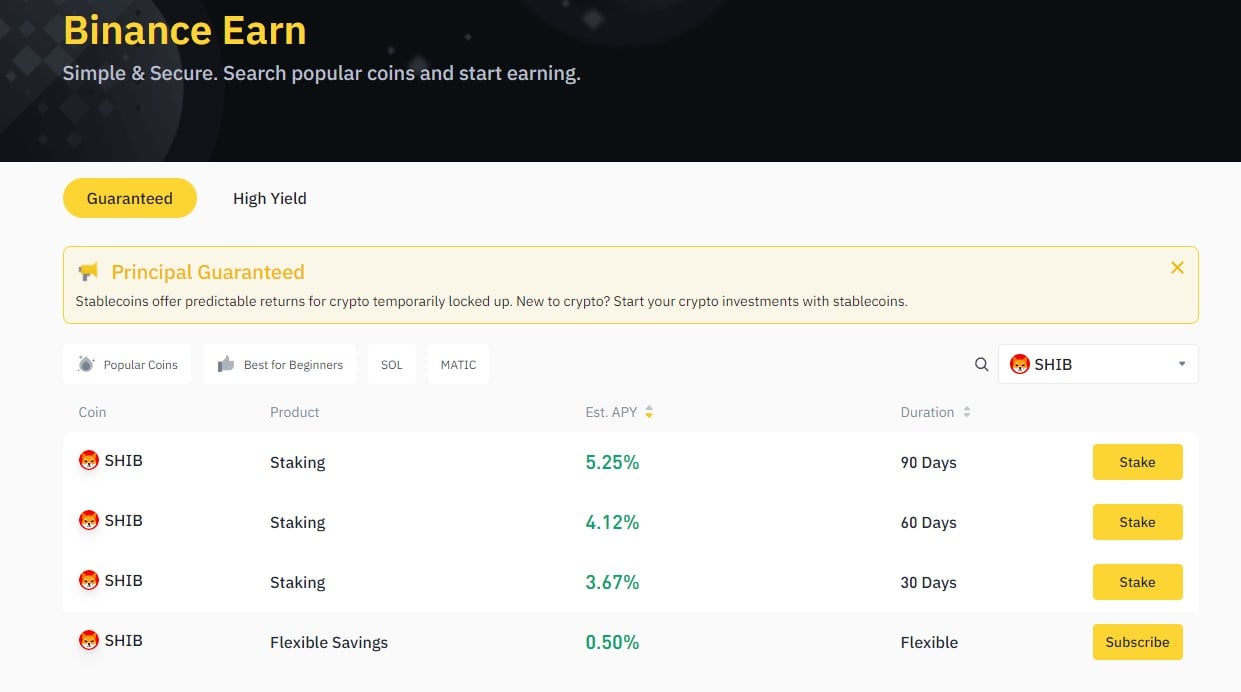

Binance, one of the biggest crypto exchanges, allows staking SHIB with 5.25% APY at the time of writing.

Here is how you can stake your Shiba Inu tokens on Binance:

1.Open your Binance account.

2. Buy Shiba Inu tokens if you don’t have them yet.

3. Go to the “Finance” menu section and click on “Binance Earn.”

4. Enter SHIB in the search tab or scroll to find the Shiba Inu token.

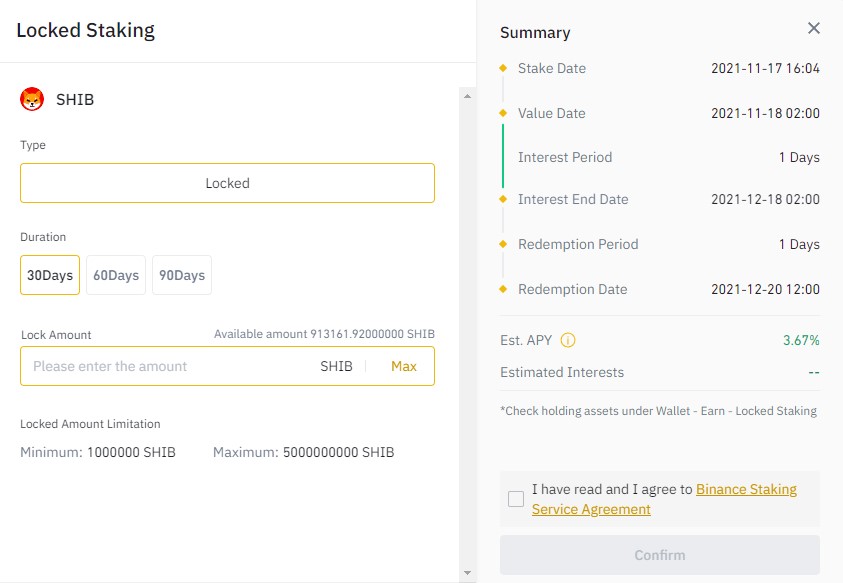

5. Choose how long you would like to lock tokens, and press “Stake.” Keep in mind that APYs increase with longer timeframes. On Binance, APY is adjusted daily based on the on-chain staking rewards.

6. Enter the amount of SHIB you want to stake. On Binance, the amount can’t be lower than 1,000,000 SHIB tokens. Then mark that you’ve read and agree to the Binance Staking Service Agreement and confirm it. Your SHIBs are staked and generating new coins.

SHIB interest is calculated proportionally to the amount of SHIB tokens the holder has staked. They are accredited to the holder’s wallet right after locked tokens are redeemed at the end of the fixed staking term.

How to Mine Shiba Inu with Liquidity Pools

Liquidity pools enable trading on decentralized exchanges (DEXs) and support the DeFi ecosystem.

Token holders, called liquidity miners, deposit their assets in shared liquidity pools. They create liquidity for a certain DEX that allows other traders to trade against the pool. It’s important because on DEXs, traders do not trade against each other, but against the decentralized liquidity pool.

Liquidity providers get rewarded for depositing their tokens into the pool. Typically, they earn returns on trades proportional to their share of the pool.

Read more: What is a Liquidity Pool?

How to deposit SHIB on ShibaSwap liquidity pool

- Connect your wallet

Just like with staking, first open the ShibaSwap exchange and connect your cryptocurrency wallet to it.

2. Swap tokens

If you do not have any SHIB tokens in your wallet, choose the “Swap” option and swap your chosen tokens for Shiba Inu (SHIB). Then select from various crypto options, specify the amount of tokens you want to swap, and confirm your choice.

3. Provide liquidity

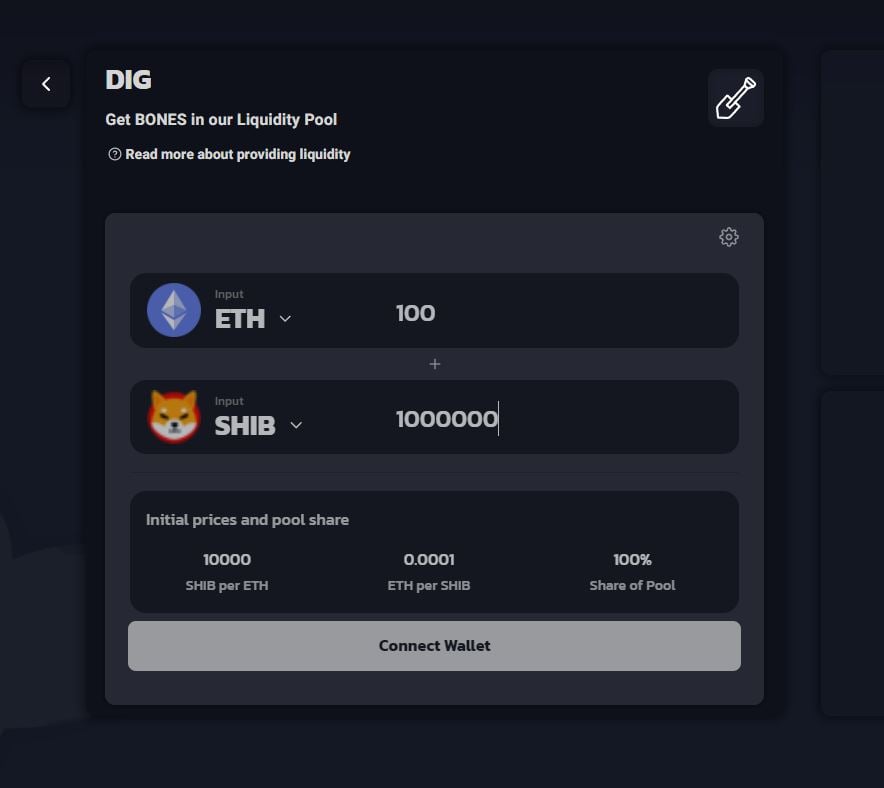

Press DIG and choose “Add Liquidity” section. Select a liquidity pool (or liquidity pair) that includes the Shiba Inu token. This will be the pool where your tokens will be locked until you redeem them along with the reward. Determine the number of tokens you want to lock on the pool, click “Supply” and approve your choice.

Once everything has been approved, you will be able to supply liquidity and start generating passive income for locking your tokens into the liquidity pool. However, to claim those returns on ShibaSwap, you have to complete the final step.

4. Claim your returns

Open the WOOF section on the ShibaSwap interface. Find your liquidity pool (liquidity pair), open it, and approve your choice to stake your tokens. This will allow ShibaSwap to spend your tokens and generate real-time returns at the determined rate.

The exchange allows you to claim 33% of your returns instantly, while the remaining 67% are locked for 6 months.

On The Flipside

- Being an ERC-20 token, SHIB is highly dependent on Ethereum gas fees, which become extremely high whenever the network gets overcrowded with demand.

- One of the biggest risks in staking and liquidity providing are impermanent losses, caused by the potential change in tokens’ price direction. This determines how many of the tokens you will get back. For instance, the APY of a staking asset might be 10%, but if its value drops 50% during the fixed period, you will still incur a loss.

- When deciding how to stake Shiba Inu tokens (or how to mine Shiba Inu coins, as the crypto community likes to say), it is important not to make decisions solely based on the percentage of the APY, but also to look at more fundamental factors.

Why You Should Care?

Shiba Inu (SHIB) attracted wide audiences and hit record highs in 2021. Although it is an extremely volatile asset with massive corrections, SHIB followers expect it to repeat impressive price rides. Besides, SHIB is on its way to being accepted as a payment method. With this in mind, knowing how to multiply SHIBs could be useful for those who want to “grow dogs” in their crypto portfolio.