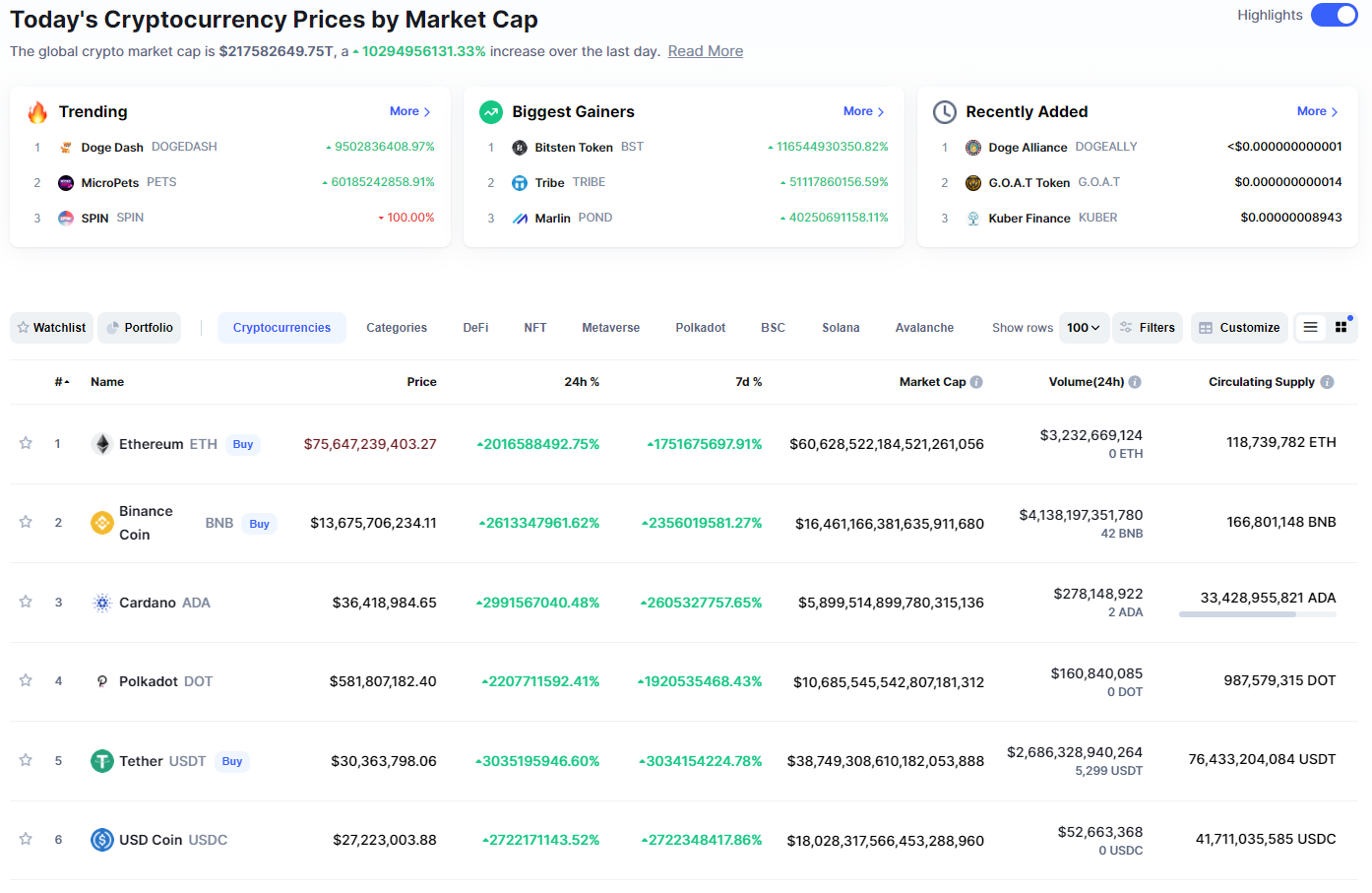

Late Tuesday afternoon, cryptocurrency pricing aggregation site – CoinMarketCap.com – experienced a major cyber attack or programming failure that artificially sent some prices skyrocketing to valuations in the tens of billions of dollars range for single tokens. This screen image below, taken at 4:34pm ET, shows that Ethereum had an erroneous listing of more than $75 billion per coin. Binance Coin was inflated to more than $13 billion, while Cardano pumped higher than $36 million per unit.

Centralized and decentralized exchanges (DEXs) scrambled to remove the pricing feed from their trading platforms in an effort to prevent hyperinflated trades that could cost the exchanges mind-boggling losses. Most exchanges have trading “circuit-breakers” that suspend trading on crypto assets that spike out of range on preset algorithms to control such fraudulent behaviors.

Sponsored

At 5:00pm ET, the official CoinMarketCap Twitter account posted this tweet to its 4 million followers confirming the pricing irregularities and it reads: “Our website is currently undergoing Price Issues – The Engineering team is aware of incorrect price information appearing on CoinMarketCap.com. We are currently investigating and will update this status when we have more information.”

Competing crypto market capitalization aggregation website, CoinGecko.com, seemed to be unaffected and had typical pricing information throughout the duration of CoinMarketCap’s vexing valuations. As of this writing, the pricing amounts on CoinMarketCap seemed to stabilize back to more normal levels. The CoinMarketCap team posted this follow-up tweet at 7:54pm ET.

On The Flipside

- Redundant data feeds for all systems are crucial within the crypto-space. DEXs and centralized exchanges that only relied on CoinMarketCap for pricing data potentially lost tens of millions in exploitive transactions.

- Timing for this is pretty bad as the Senate Banking Committee hearing earlier today was pretty negative against stablecoins and crypto in general.

Why You Should Care?

It’s unlikely that retail investors would be hurt by such inflated prices on trading exchanges, because if they tried to buy an Ethereum coin for $76 billion the transaction would be declined due to insufficient funds. It will be interesting to check the blockchain, when this is over, to see if anyone successfully sold their tokens at the sky high – yet highly fake – valuations.