Although Bitcoin’s price seems to be stuck for a while, the institutional appetite for the world’s benchmark crypto does not show signs of decrease.

Bitcoin and Ethereum investment volumes explode and are the largest in history, reveals the quarterly “Digital Asset Investment Report” published this week by digital asset manager Grayscale Investments.

Grayscale Investments is the world’s largest digital currency asset manager, with more than $4. billion in assets under management at the time of publishing.

The company raised over $905.8 million of total investment into its digital asset products during the second quarter of the year. The figures mark almost double growth compared to the results of the first quarter, which accounted $503.7 million, according to the report.

Sponsored

Grayscale’s Bitcoin Trust continues to be the best performing trust with the record quarterly inflows of $751.1 million. The Grayscale Ethereum Trust increased to the levels of $135.2 million respectively.

Growing demand

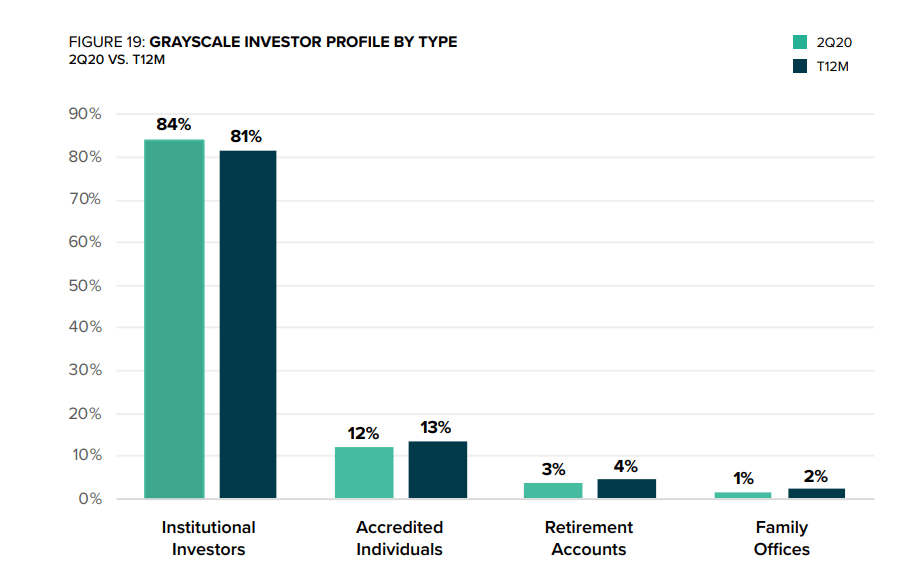

Institutional investors continued to be the leading type of investors during the second quarter of 2020. As stated, the current figure of 84% has increased over time and is 7 times higher compared to the following number (12%) of accredited investors.

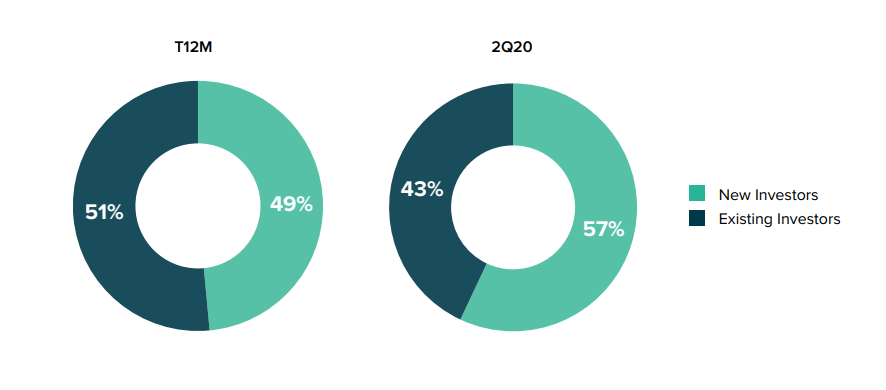

Additionally, the statistics reveal that Grayscale increased its investors base by gaining 57% of new ones during the second quarter. The number of new investors alone generated the $124.1 million of inflows during the timeframe.

The majority (60%) of them have been classified as offshore (compared to the US) investors, which shows the new trend while historically the geography has been a more evenly split between both the US-based and offshore investors.

A shift to altcoins

Grayscale has been widely mentioned across the crypto community during the recent months since its Bitcoin acquisitions surpassed the supply of newly-mined Bitcoins within the months after the third Bitcoin halving in May.

Despite the fact that Bitcoin is still the leading digital asset within Grayscale’s investors, which mainly are traditional hedge funds, the vast majority of investors are shifting to other digital coins.

According to a report, 81% of returning institutional investors allocate to multiple investment products, that include other assets than Bitcoin. During the second quarter, Grayscale Ethereum Trust alone saw $135 million of inflows, almost 15% of total inflows into Grayscale products.

Grayscale’ Ethereum Trust comes as the second most interesting trust, with the average weekly investment of around $10.4 million, quite a solid part compared to the total weekly investment of over $69 million. Institutional investors tend to include digital assets and thus diversify their investment portfolios due to economic uncertainty. As DailyCoin reported earlier, they find digital currencies as a hedge against inflation.