- Grayscale Investments has transferred more Bitcoin to Coinbase Prime Deposit.

- The investment management firm has had a floppy start to the launch of Bitcoin ETFs.

- Other Bitcoin ETF issuers have recorded positive inflows of funds.

The trade of Grayscale Investments’ Bitcoin ETFs got off to a rocky start, recording significant outflows as opposed to other issuers. Since the launch on January 11, Grayscale has recorded nearly $2 billion in sell-offs, marking an unexpected turn of events given its once-favorable market position.

Despite recent market predictions forecasting an imminent reversal, the streak does not appear to be ending anytime soon as Grayscale continues to transfer assets.

Grayscale Bitcoin Sell-Off

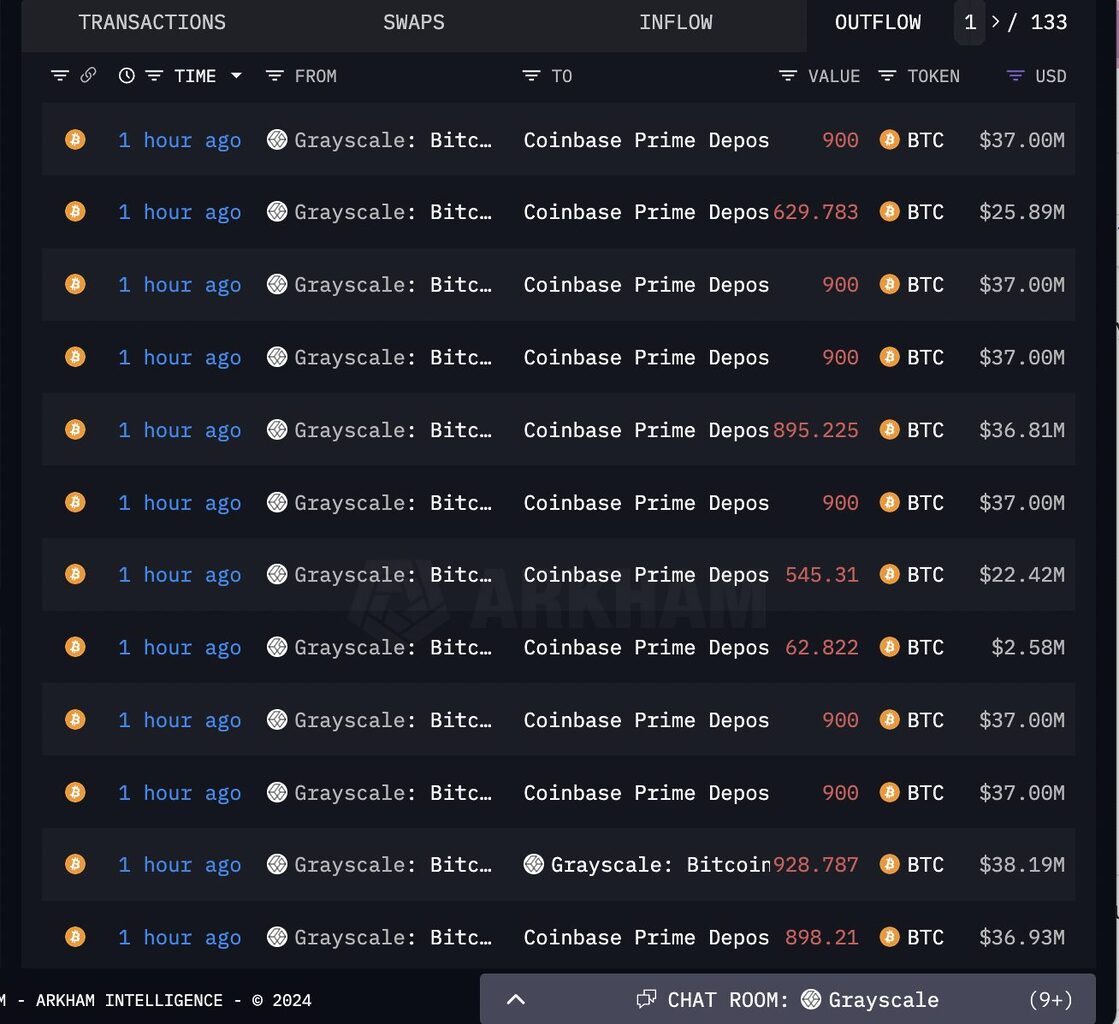

According to Arkham Intelligence data on January 26, Bitcoin ETF issuer Grayscale has moved an additional 10,923 BTC to Coinbase Prime Deposit, worth approximately $449 million.

Sponsored

The transfer, which is likely directed towards investment redemptions as investors continue to make their exit from GBTC, brings the total value of Grayscale’s transfer to 123,923 BTC.

The Grayscale Bitcoin sell-off has seen the divestment of approximately $5.1 billion so far, bringing its Bitcoin holdings down to 518,281 from a previous stash of over 640,000.

GBTC’s performance contradicts the broader market performance of all other 10 Bitcoin ETF issuers, including BlackRock and Fidelity Investments, who collectively recorded over $10 billion in inflows.

Sponsored

Bitcoin is experiencing significant price fluctuations in response to the continual sell-offs. The market giant slipped below $39,000 two days ago, before rebounding to its current trading rate of $41,286.

This ironic Bitcoin whale is gearing up for BTC sell-off, find out more:

Surprise 4th Largest Bitcoin Holder Plans $130M Selloff

Investors anticipate Ethereum ETF following BTC approval, but the SEC has other plans, read more:

BlackRock Ethereum ETF Joins the Wait as SEC Delays Decision