- Genesis has no imminent plans to declare bankruptcy.

- The lending company instead hopes to reach a “consensual” arrangement with its creditors.

- Gemini plans to work together with Genesis to resolve the situation.

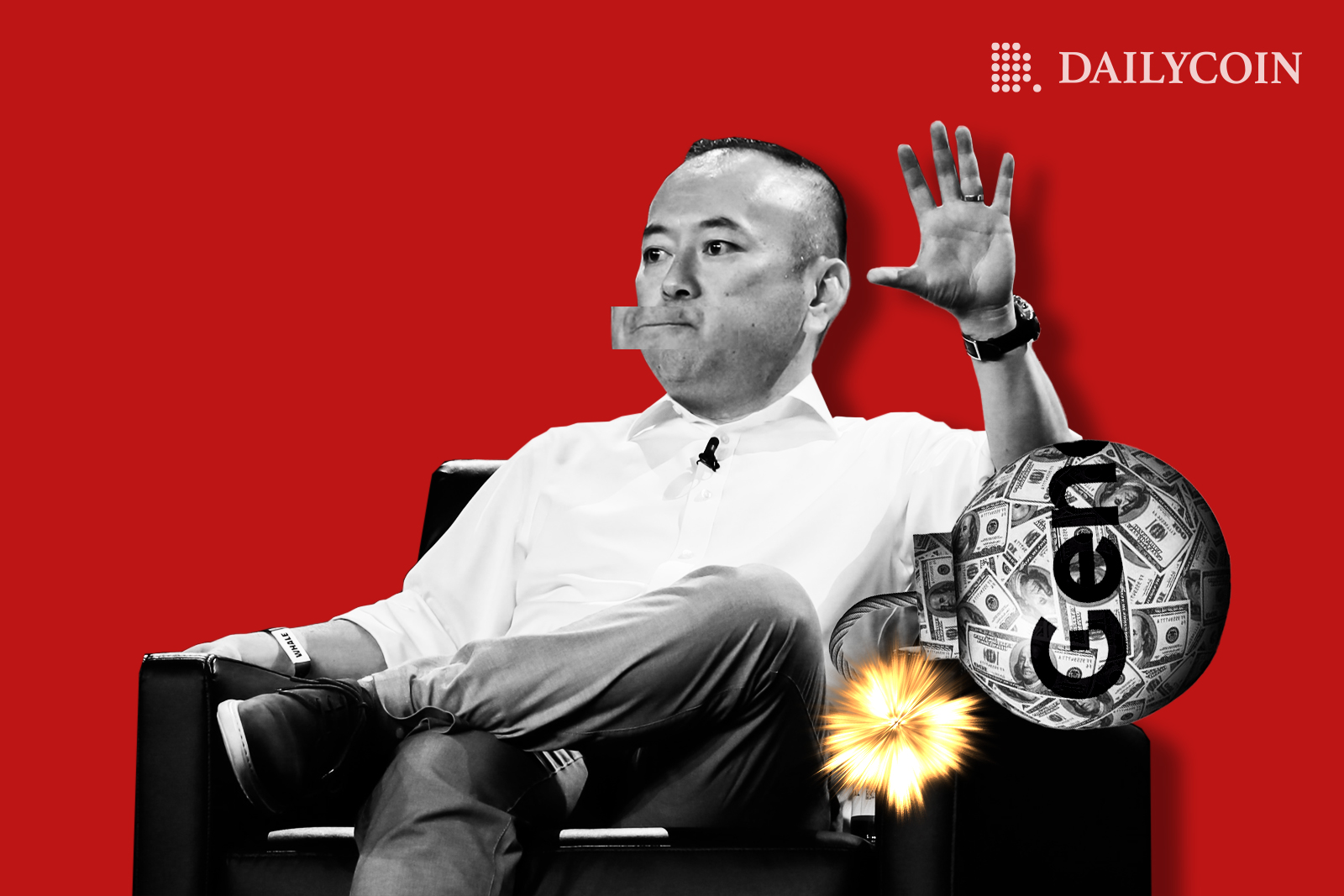

Days after halting withdrawals in response to the FTX cryptocurrency exchange’s collapse, digital asset financial services provider Genesis has denied bankruptcy reports.

Bloomberg reported that Genesis is in dire straits as it seeks to raise new funding for its lending unit or risk potential bankruptcy. However, the cryptocurrency lender dismissed the reports on Monday, stating that it has “no plans” to declare bankruptcy and instead hopes to reach a “consensual” arrangement with its creditors. In an email statement to Reuters, Genesis said:

"We have no plans to file bankruptcy imminently. Our goal is to resolve the current situation consensually without the need for any bankruptcy filing. Genesis continues to have constructive conversations with creditors."

On Wednesday, Genesis tweeted that the company was experiencing a liquidity crisis due to the exceptional market instability caused by FTX’s collapse. This led to “abnormal withdrawal requests which have exceeded our current liquidity,” Genesis said. The company has “temporarily ceased redemptions and new loan originations in the lending business.” However, the ban has not been lifted since its initial implementation.

Sponsored

The Wall Street Journal reported that Binance, a cryptocurrency exchange, turned down an investment offer from Genesis because of a possible conflict of interest. The company reportedly also sought investment from private equity firm Apollo Global Management.

Gemini’s Take on the Genesis Funds Crisis

Gemini and Genesis work together to offer a cryptocurrency loan product. On Tuesday, Gemini tweeted that the two companies would continue to work together to make it easy for customers to withdraw funds from Genesis’s “Earn” program, which generates interest for users.

1/5 Update for Earn customers: we continue to work with Genesis Global Capital, LLC (Genesis) — the lending partner of Earn — and its parent company Digital Currency Group, Inc. (DCG) to find a solution for Earn users to redeem their funds.

— Gemini (@Gemini) November 22, 2022

Last week, Gemini blogged that the temporary halt in Genesis withdrawals had no influence on the company’s other offerings.

Sponsored

Sam Bankman-Fried‘s doomed FTX Exchange is still making waves, and Gemini and Genesis’s actions are just the most recent ones. The implosion of FTX has wiped out a number of businesses, including trading desks and venture firms, and caused other lending establishments to cease withdrawals.

On the Flipside

- Genesis revealed on November 10th that the company had $175 million in “locked money” in its FTX trading account. They guaranteed their users that the figure “does not impact our market-making activities.”

Why You Should Care

Genesis is one of the most important organizations in the cryptocurrency industry. Some believe that if Genesis is experiencing significant problems that have a low probability of being resolved, then the company’s negative impact on the market and the industry may be much worse than that of FTX.

Read more on the contagion facing the cryptocurrency industry:

Paradigm Co-Founder “Deeply Regrets” Investing in FTX, Writes Down Investment to $0

Genesis Sought a $1 Billion Emergency Loan Before Halting Withdrawals