- FTX creditors are taking its legal counsel to court in a class-action suit.

- Creditors complain that Sullivan & Cromwell participated in perpetuating the FTX fraud.

- The lawsuit details damning counts of illicit activity the law firm was involved in.

In the ever-evolving FTX saga, each passing week brings interesting developments, ranging from new cases to strategic pivots, and this week is no different.

With news of FTX scrapping revival plans still fresh, the bankruptcy case takes a surprising turn as the exchange’s creditors target its legal counsel, Sullivan & Cromwell (S&C), in a class-action lawsuit.

FTX Targets Sullivan & Cromwell

In a court filing on February 16, FTX creditors alleged that its primary legal counsel overseeing the bankruptcy case, Sullivan & Cromwell, “actively” participated in the “FTX Group’s multibillion-dollar fraud,” asserting that the company benefited significantly from the exchange’s fraud.

Sponsored

The creditors painted a detailed portrait of conspiracy and oversight in their lawsuit, claiming that S&C disregarded legal and ethical standards, perpetuating the deception leading to the FTX fiasco.

The lawsuit highlighted illicit activities such as large financial transactions and internal communication, suggesting S&C’s involvement given its close advisory relationship with FTX leadership.

Creditors argued that S&C’s relationship with FTX wasn’t merely superficial, citing the law firm reeled in $8.5 million in fees during the 16 months before FTX went under. According to the filing, since overseeing the FTX bankruptcy, S&C has reportedly made over $180 million, representing 10% of its total revenue for 2022.

Sponsored

Additional reports suggest that S&C invoiced upwards of $153 million between November 2022 and November 2023 for its services in the exchange’s bankruptcy case, with a monthly revenue averaging nearly $11.8 million.

FTX creditors are pursuing damages for several counts, including civil conspiracy, aiding and abetting fraud, and aiding and abetting fiduciary breaches.

FTX and S&C’s Ties

Sullivan & Cromwell is a century-old law firm that has served as outside counsel to FTX in several deals, including its bid for the assets of Voyager Digital Holdings and the acquisition of LedgerX, receiving significant compensation for its services.

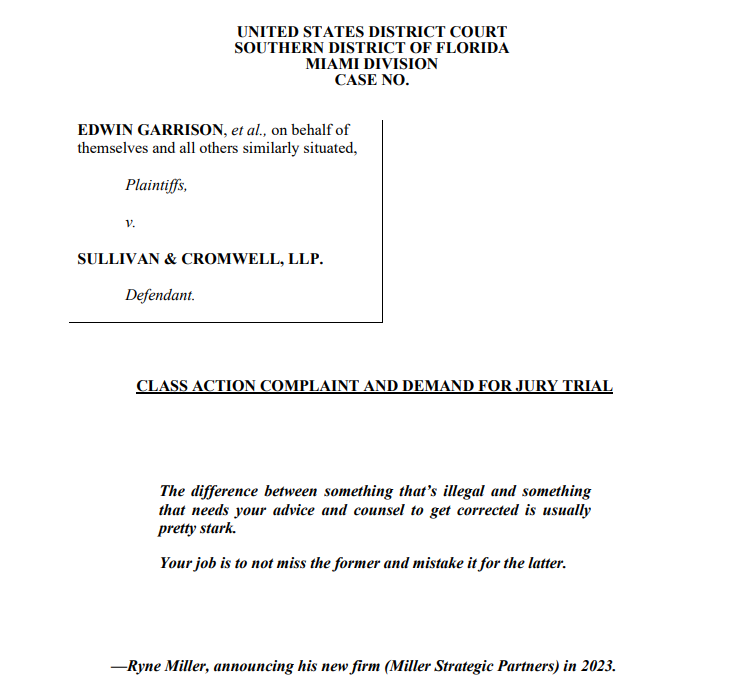

Ryne Miller, a former partner at S&C, established the relationship between the exchange and the law firm before assuming the exchange’s general counsel role in August 2021. FTX creditors allege that Miller funneled at least 20 cases from the exchange back to his old firm.

In another court filing, former FTX chief regulatory officer Daniel Friedberg stated, “Mr. Miller informed me that it was very important for him personally to channel a lot of business to S&C as he wanted to return there as a partner after his stint at the Debtors.”

Adding to the controversy, news of the class action comes just as reports surface indicating that S&C is poised to secure the role of an independent monitor for Binance Holdings Ltd. While official confirmation is pending, the class action suit could potentially hinder S&C’s prospects in this regard.

On the Flipside

- In January 2023, a bipartisan group of United States senators urged for an independent examiner, citing concerns over S&C’s ability to conduct a thorough investigation.

- The lawsuit also notes that former FTX CEO Sam Bankman-Fried would often work in S&C’s offices in New York.

Why This Matters

The class-action lawsuit marks a significant turn in the ongoing FTX saga, introducing a new layer of complexity that could mire the bankruptcy case in conflict of interest concerns. The developments add another dimension to the already brittle legal landscape surrounding the exchange, raising questions about the impartiality and integrity of the proceedings.

Catch up on Cardano’s price analysis:

Cardano (ADA) Smashes Through $0.60 Amid Market Correction

Is Grayscale in trouble?:

Genesis Greenlit to Dump $1.3 Billion in GBTC Shares