- FTX is asking politicians to give back almost $40 million in Sam Bankman-Fried’s donations.

- Justin Sun’s Huobi listed the FUD token, which raises questions from the crypto community.

- FTX Users’ Debt (FUD) did not release proof that they hold title to any of the debt by FTX users.

As the FTX bankruptcy unfolds, thousands of former FTX users wait anxiously to get their money back. According to court documents, FTX owes $3.5 billion to its 50 largest creditors and some 102 million to depositors.

Unfortunately, the process will take a long time, and it’s unclear whether users will get any money. The new FTX leadership, under John Ray III., is trying to recover as many assets as possible to repay the creditors.

After encountering issues with selling off its subsidiaries, FTX sought alternative ways to recover funds.

FTX Asks Politicians to Give Money Back

FTX also wants to recover the money notorious founder Sam Bankman-Fried donated to politicians. The former FTX CEO was the biggest donor in the US 2022 midterm elections, donating $39.8 million.

The bankrupt exchange said they reached out to politicians and organizations that received donations from FTX. They told them to give back the money by Feb. 28 or face potential legal action.

Sponsored

This potentially includes the $5.2 million Sam Bankman-Fried gave to President Joe Biden’s campaign. To date, the White House has remained silent on the donation. However, if they decide to challenge FTX in court, this might become a potential scandal for the President.

FTX Users’ Debt (FUD) Token Raises Questions

Unlike politicians, Justin Sun is not one to shy away from controversy. Tron’s Founder promoted a token that claims it will help repay the debt owed to FTX users. Soon after launch, the FTX Users’ Debt (FUD) token was listed by Sun’s crypto exchange Huobi.

The listing raised many questions in the crypto space. Firstly, the FUD token claims to own title to FTX users’ debt. The DebtDAO, which has no connection to the bankrupt FTX exchange, offered no proof that they hold any calm to user debt.

“As the most cost-effective and prioritized FTX debt on the network, FUD creditors have the first right to assert their claims on FTX debt. DebtDAO will publish the contract or notarized proof of the debt at an appropriate time,” DebtDAO wrote in its post on Saturday.

Secondly, Huobi announced it would list the token the day after its launch. The FUD token just launched on Saturday, which calls into question the potential ties between Justin Sun and the FUD token. The token, which trades under the ticker FUD, is reminiscent of the well-known acronym of the same name, meaning fear, uncertainty, and doubt.

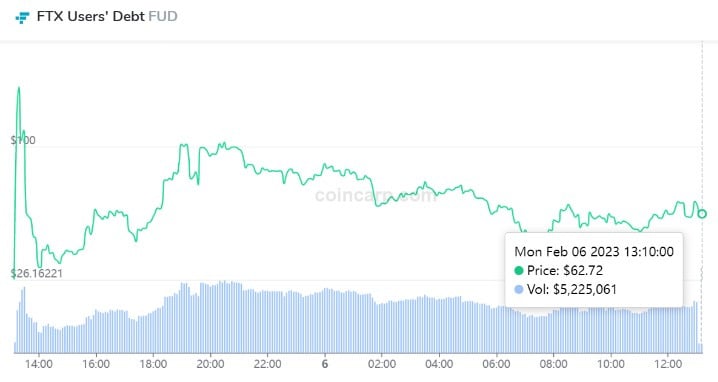

$FUD surged after its Huobi listing, trading at $133 at its height. The token’s price at the time of writing is $62.

Source: coincarp.com

At the same time, scammers are trying to exploit the FUD token’s surge. Someone is distributing a counterfeit FUD token on the Ethereum blockchain. So far, the FUD token is only available on Tron.

FUD Token Could Breach Securities Regulation

Finally, even if the FUD token developers had the best intention, they might still be in breach of financial law. That’s according to one London Finance Lawyer that goes by @wassielawyer on Twitter.

“For the love of Christ, this isn’t even a debt token; it’s a securitization. This is such a terrible idea on so many levels. Also – not all debt claims are equal and fungible,” wassielawyer said. The token is “1000000%” in breach of securities regulations, they added.

This means that, even if the creators of the FUD token had the best intentions, financial regulators could shut down the token.

On the Flipside

- According to several bankruptcy lawyers, FTX users are likely to be last in line regarding getting money from FTX. This likely means that they will get no money at all.

- Instead of investing in questionable tokens, the crypto community could take the time to lobby for fairer rules in bankruptcy proceedings.

Why You Should Care

FTX bankruptcy will impact even users that didn’t lose money in the exchange. If users don’t get their money back, this will likely pressure regulators to rein in crypto.