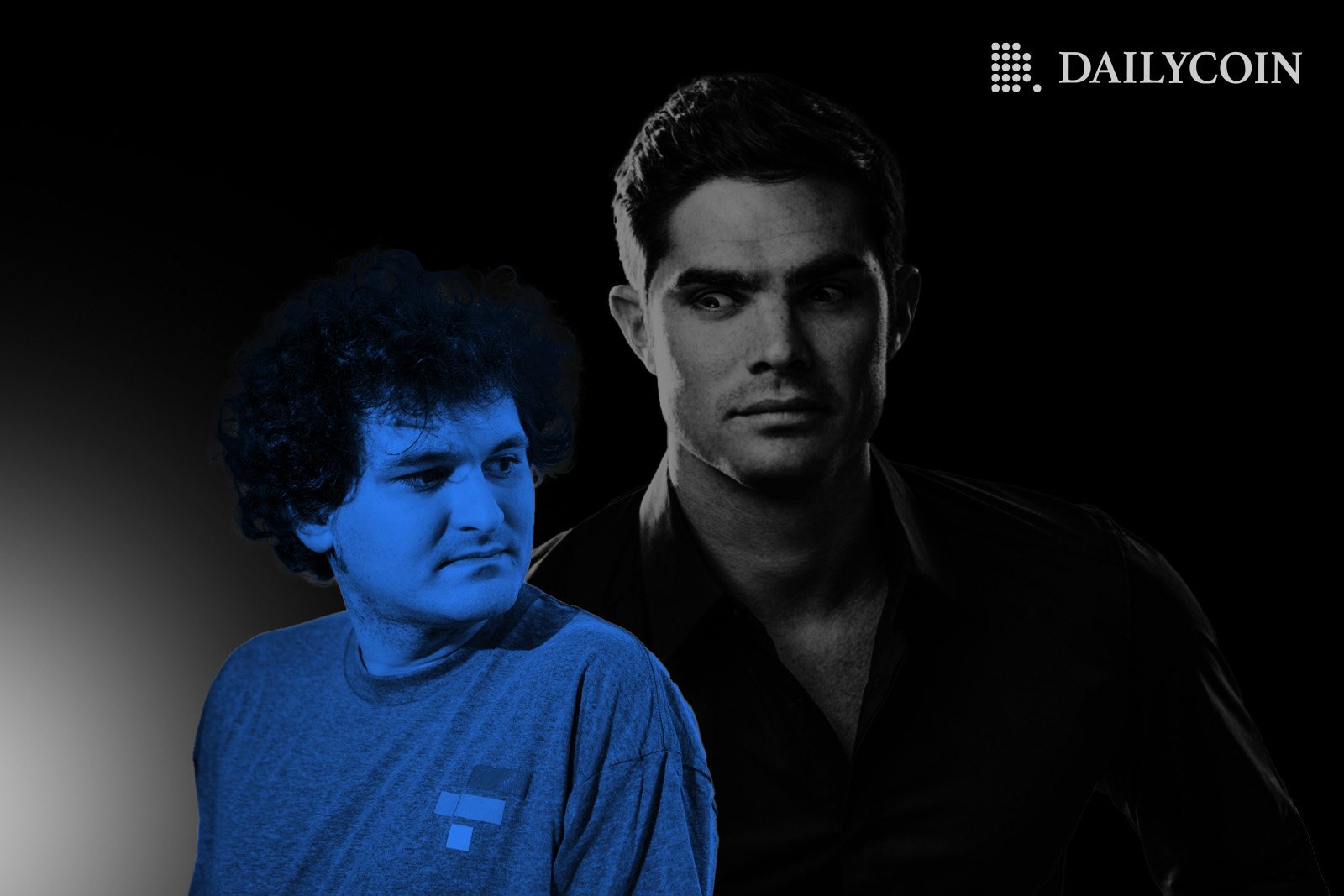

- New Bahamian court filings show that FTX Digital Markets former co-CEO Ryan Salame contacted the Securities Commission of the Bahamas (SCB) on November 9. Salame alleged that the exchange sent customer funds to Alameda Research.

- Salame said the funds were sent to “cover financial losses of Alameda.”

- Salame also said these transfers were “not allowed or consented to by their clients.”

- According to Salame, only former FTX CEO Sam Bankman-Fried, FTX co-founder Gary Wang, and FTX director of engineering Nishad Singh had the required access to move the funds to Alameda.

Ryan Salame, the former co-CEO of FTX Digital Markets, a Bahamian entity of FTX, told Bahamian authorities that the now-defunct exchange sent customer funds to Alameda Research, new Bahamian court filings show.

According to the records filed on December 14, Salame contacted the Securities Commission of the Bahamas (SCB) on November 9. He claimed that FTX sent customer funds to Alameda, SBF’s sister hedge fund, to “cover financial losses of Alameda.”

Sponsored

Salame also said that the transfer of funds was “not allowed or consented to by their clients.” He added that only three people had access to the systems to do that. They were Bankman-Fried, FTX co-founder Gary Wang, and FTX director of engineering Nishad Singh. This statement is consistent with the rumor that Bankman-Fried engineered a backdoor system to funnel customer funds to Alameda.

Salame has been quiet on social media since FTX’s bankruptcy. His last post on Twitter on November 7 reads:

“It’s so powerful learning who your friends are! Very excited to grow with them in the long term. It’s not hard to genuinely figure out who cares about customers and who doesn’t if you look past the insanity.”On November 10, a day after Salame’s reported whistleblowing, the SCB froze FTX Digital Markets’ assets and appointed a liquidator. On November 11, FTX Group filed for Chapter 11 bankruptcy in the U.S. FTX then suffered an apparent hack that drained the exchange of more than $400 million.

However, the SCB later acknowledged that it ordered FTX to transfer its assets to government-controlled wallets, seemingly confirming it was behind the “hack.” At the same time, FTX’s new CEO, John Ray III, said that access to the exchange and the subsequent transfers were unauthorized.

Have Other FTX Insiders Blown the Whistle?

Salame seems to be the first FTX insider to blow the whistle. However, rumors have been circulating on social media that Alameda’s former CEO, Caroline Ellison, will also throw Bankman-Fried under the bus.

Sponsored

Ellison was reportedly spotted at a cafe in New York City on December 5. Users on Twitter were quick to speculate that Ellison is in the U.S. to cooperate with authorities. They believe she aims to obtain a “get out of jail free card” and gain immunity.

The rumors have only intensified since the sudden arrest of Bankman-Fried on November 13. Subsequent charges of money laundering, wire fraud, and other conspiracies followed. However, there’s no official confirmation that Ellison played any role in this.

There’s also no information on Gary Wang, Nishad Singh, former Alameda co-CEO Sam Trabucco, and other FTX insiders’ whereabouts or their involvement in the FTX conspiracy.

On the Flipside

- It’s unclear what role Salame played in the FTX debacle or if he had anything to do with sending customer funds to Alameda.

- Other reports suggest that FTX sent customer funds to Alameda for quite some time. Reports say engaging in risky bets and maximizing profits was an ongoing practice.

Why You Should Care

Ryan Salame’s decision to inform Bahamian regulators of FTX commingling customer funds shows how fragile and chaotic the internal state of the exchange was before the bankruptcy filings. Investors should be extra careful when deciding what to believe in the FTX debacle.

You Might Also Like:

Bahamas Authorities Arrest FTX Founder Sam Bankman-Fried; May Extradite Him to U.S.