- Ethereum has surged to yearly highs above $3,000, while Bitcoin has barely moved.

- Amid the asset’s gains, Layer 2 tokens have also rallied.

- The recent market moves add to the debate of whether Ethereum can outperform Bitcoin in 2024.

With Bitcoin‘s momentum slowing down in the past week, Ethereum now appears to be leading the crypto market. Amid the asset’s rally, tokens and assets linked to the Ethereum ecosystem have also enjoyed a positive run.

Ethereum Layer 2 Market Moves With ETH

Over the past week, Ethereum has surged from lows of around $2,850 to new yearly highs of about $3,120. Amid ETH’s move, the market cap of the Layer 2 ecosystem has surged.

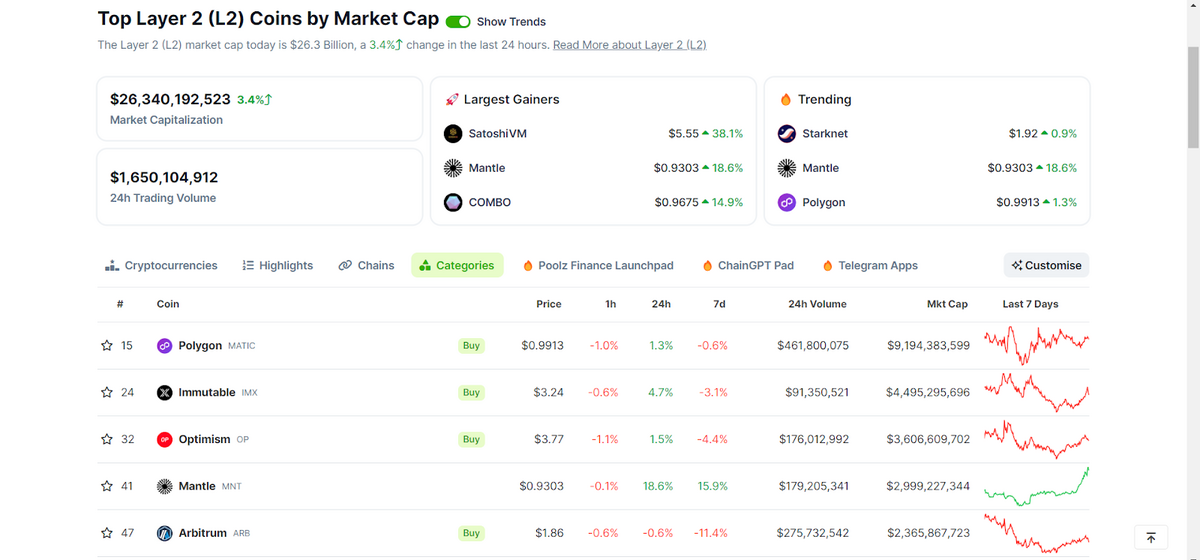

According to CoinGecko data at the time of writing, the market cap of Layer 2 tokens, an ecosystem dominated by Ethereum-linked tokens, is around $26.3 billion, representing a 3.4% gain in the past 24 hours.

Sponsored

Among the biggest gainers is Mantle (MNT), which surged as much as 30% to all-time highs around $0.95. The modularity-focused Ethereum Layer 2 has seen several ecosystem developments in recent weeks, with its liquid-staked ETH offering mETH crossing $1.5 billion in TVL.

Aside from Mantle, other assets like Immutable (IMX), Optimism (OP), and Polygon (MATIC) are also recording marginal gains of 4.7%, 1.5%, and 1.3%, respectively.

The recent market moves add to the debate of whether Ethereum can outperform Bitcoin in 2024.

Will Ethereum Outperform Bitcoin in 2024?

In 2023, Bitcoin trumped Ethereum in price gains, soaring over 150%, while the latter only recorded price gains of around 90%. Bitcoin’s impressive showing in 2023 came amid anticipation of increased capital inflows into the asset from potential spot ETF approvals.

Sponsored

In 2024, however, the speculation has shifted to ETH with pending spot ETF applications from many of the same firms that recently received the SEC’s greenlight to launch spot Bitcoin ETF products.

At the same time, members of the Ethereum community are excited about the near Dencun upgrade, which marks a significant step in scaling the network.

Despite the potential Ethereum catalysts, solid arguments exist for another strong Bitcoin showing in 2024. So far, approved spot Bitcoin ETFs have seen record inflows exceeding some expert predictions. At the same time, the Bitcoin halving is expected in April 2024. Experts further expect the asset to receive further tailwinds with an anticipated Fed easing.

On the Flipside

- Ethereum remains over 37% below its all-time high of about $4,800.

- Controversial Bitcoin Layer 2 SatoshiVM is up over 40% in the past 24 hours.

Why This Matters

The recent rise in Ethereum ecosystem tokens hints at shifting crypto market dynamics with Ethereum in the lead.

Read this for more on Ethereum:

Ether ETFs Could Be Approved by May, Experts Predict

Learn more about Uniswap UNI’s recent rally:

Here’s Why Uniswap’s UNI Surged Over 80% to Near 2-Year High