Ethereum is becoming the dominant stablecoin value transfer platform in the cryptocurrency world.

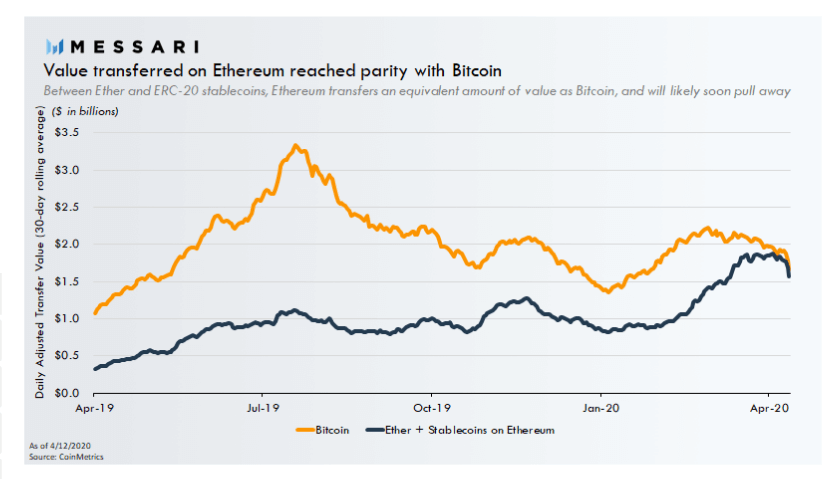

The value of average daily transactions made on Ethereum network are now equal to those made on Bitcoin, says the blockchain analytics Messari. The daily value transfer – in other words, the total value of assets moved on the blockchain over the day – shows that Ethereum is now moving similar amounts of money as Bitcoin.

The parity indicates the wide use of blockchain as both Ethereum and Bitcoin networks currently account for over $1.5 billion of the daily transaction value.

Growth of stablecoin transactions

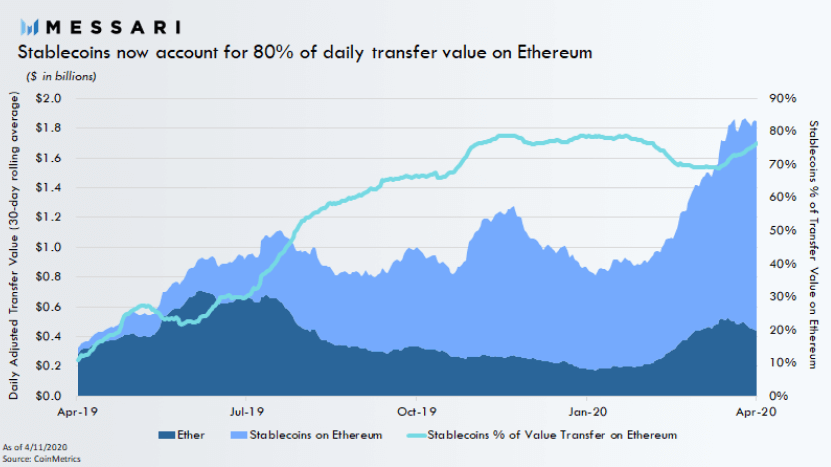

The value transferred on Ethereum network is mainly associated with a boost of stablecoin usage in the first quarter of 2020. According to Messari, Q1 was the best ever for stablecoins.

Sponsored

Due to the massive turn to safe assets amidst the coronavirus pandemic, the issuance of stablecoins skyrocketed to over $8 billion in the first quarter. Stablecoins added nearly the same market capitalization in the first three months of 2020 as they did in all of 2019.

The coins like Tether (USDT), TrueUSD and USD Coin account for 80% of daily transfer value on Ethereum, says Messari. Furthermore, they are used for significantly larger transfers on average than Bitcoin. Since Ethereum hosts the majority of USDT, the stablecoin drives the most of its growth.

Ethereum overtook Tether last year, when the major stablecoin company moved 300 million of USDT coins from Omni to ERC-20 standard and increased the share of ERC20-based USDT up to 44%.

Ethereum becomes a leading platform

The Ethereum platform is already established as operating large transfers, since average transfer on stablecoin is almost two times larger than transfer made on Bitcoin. According to Ryan Watkins, the researcher at Messari:

Ethereum is by far the leading platform for stablecoin issuance, and will likely extend its lead due to its maturity and lively project ecosystem. [..] Ethereum is Wall Street in the cloud. Stablecoin issuers are following the money.

Analytics conclude that while the global economy faces uncertainty from the coronavirus pandemic, stablecoins might provide some real world value. They are already on their way to quadruple the growth they made in 2019. This might bring a flood of new liquidity to Ethereum’s ecosystem and further. If they succeed, the Ethereum network will be flooded with new liquidity and will be established as the dominant stablecoin platform.