Cryptocurrency companies are making a push for the highly regulated U.S. derivatives market with the main goal of meeting demand from retail traders making bets on digital assets.

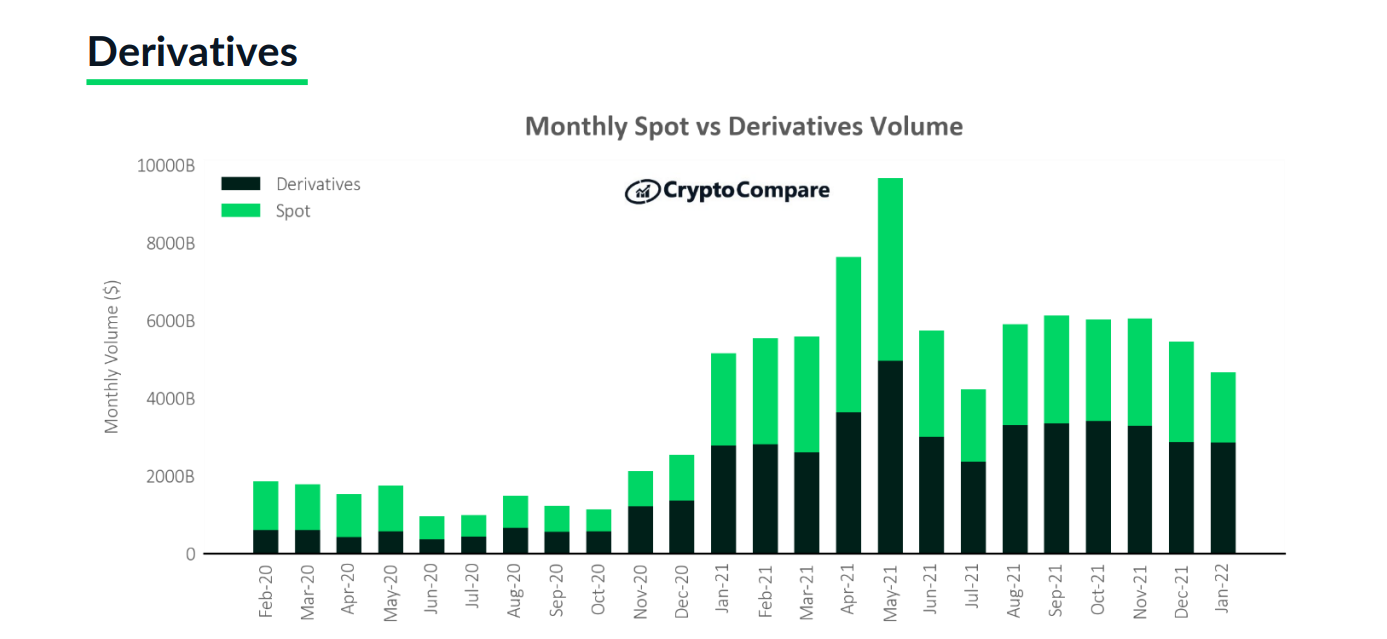

Increased Volumes in Crypto Derivatives

Based on data from CryptoCompare, volumes in the crypto derivatives sector have registered at almost $3 trillion over the span of the previous month, which in turn accounted for more than 61% of all trades in cryptocurrencies.

Source: CryptoCompare

Most of the activity in this area took place at offshore venues, such as those which have been overseen by Binance, which are subject to little to no regulatory oversight.

Crypto groups are thus seeking to build “beachheads” within the tightly supervised U.S. market through the buying up of smaller companies which already hold licenses to operate within America.

Sponsored

Coinbase agreed in January to buy FairX, a smaller Chicago futures exchange, and this occurred after Crypto.com struck a $216 million deal for two retail businesses from the U.K.’s I.G. index; CBOE bought ErisX, a digital asset trading business, and FTX US bought derivatives platform LedgerX.

On the Flipside

- The crypto industry has been shifting further into regulated markets as it works towards building a larger user base and challenging the status quo enjoyed by existing financial companies.

- This includes brokerages which already offer trading in equities as well as other financial assets.

Why You Should Care

This tight regulations could pose a number of restrictions and obstacles for exchanges, which may need to think of creative ways to introduce their services into the U.S. market.