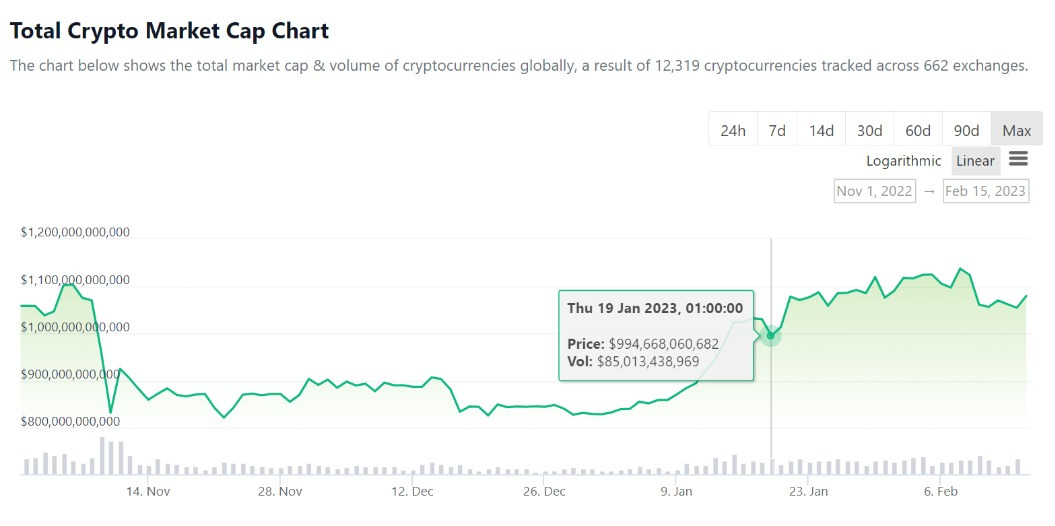

- Crypto market cap surged to $1 trillion in January, as bitcoin climbed to $20,000.

- Since then, the total market capitalizations for crypto and bitcoin have maintained their gains. Experts believe that this is a sign of things to come.

- Managing Director for Bitget, Gracy Chen, says the exchange is betting on a sustained recovery as it relaunches its launchpad platform.

After a tumultuous 2022 for the cryptocurrency market, 2023 could be the year of recovery. Several key indicators, as well as a changing macroeconomic environment, suggest that crypto is headed for a bullish year.

On January 20, the crypto markets reattained a market cap of $1 trillion for the first time since the FTX bankruptcy in November.

source: coinmarketcap

Sponsored

Since Bitcoin’s January surge, the total value of all crypto assets has consistently remained at or above $1 trillion. The leading digital asset led the way, firmly holding on above the $20,000 level and trading at $24,600 at the time of writing.

Experts credited bitcoin’s rise to cooling inflation figures, potentially leading to a more dovish Fed policy. If all else is equal, lower interest rates could boost institutional crypto investment.

Sponsored

Major financial institutions treat crypto projects as risk plays, similar to technology stocks, due to the substantial but uncertain returns of such technologies. The digital asset class typically benefits most when interest rates are low. When interest rates are high, institutional investors retreat to safer investments.

Throughout 2022, the Federal Reserve increased interest rates to combat record inflation levels. In 2023, inflation data is cooling, which may lead to a more dovish Fed. This, in return, is projected to benefit the crypto sector.

Signs of Sustained Recovery for Crypto – Bitget Managing Director

“BTC’s market has become more volatile since January 10,” said Gracy Chen, managing director at Bitget.

She added that with markets showing a “strong desire to buy,” the volatility has “recently turned to have a positive trend” as prices and trading volumes reached new highs over a six-month period.

Bitget itself is betting on a bullish 2023 with the relaunch of its Launchpad program. The program aims to help new blockchain-related projects find investors. The initiative reflects Bitget’s confidence in the sustained recovery of the crypto market, Chen said.

Bitget initially introduced its Bitget’s Launchpad in February 2022. Though the program launched five early-stage projects, the bear market forced the exchange to put the project on hold. As a result, the Bitget Launchpad has been inactive since June 2022.

Now, the Bitget Launchpad is restarting. The first launch will be the GameFi project Panda Farm (BBO), which aims to build a fully on-chain game metaverse on the Arbitrium blockchain.

Improving market conditions mean that projects like BBO will have better opportunities to raise funding through decentralized means.

“We are happy to support more early-stage blockchain-based projects that can make a real impact in the crypto space,” she concluded.

On the Flipside

Bitcoin maximalists believe BTC is different from other crypto assets because it is also a hedge against inflation.

However, Recent BTC performance doesn’t seem to support that view. This suggests that major financial players don’t yet see bitcoin as an inflation hedge.

Why You Should Care

Renewed institutional interest in crypto is a bullish sign. Institutional investors helped push up crypto prices to their all-time highs. Moreover, their pullback likely helped cause the crash.

Read about why many institutional investors are still wary of holding crypto assets:

J. P. Morgan Survey: Only 8% of Institutions Trade Crypto as FTX Shadow Still Lingers

Learn about more reasons to be excited for 2023:

Crypto in 2023: 10 Things to Be Excited About in the Next 12 months