Like stocks, bonds, gold or Bitcoins, art holds value. Last year, tokenized or crypto art made waves in art communities and mainstream culture as it caught headlines the world over – but is there tangible value in crypto art?

Professional artists and amateurs alike jumped onto the bandwagon of non-fungible tokens (NFTs). A new kind of artwork collector emerged, one that may not understand a lot about art in the traditional sense but see it as a speculative asset to generate future profits.

The traditional art market has long been considered a high-risk environment, with multiple factors influencing the value of art pieces. So how risky is the crypto art market to those unfamiliar with the art world?

The current state of crypto art market

The total value of the crypto art market sits nearly at $444 million at the time of writing. In comparison, the traditional fine art was around $67 billion market in 2018, with 7.4% average annual returns from it’s highest performer – contemporary art.

Sponsored

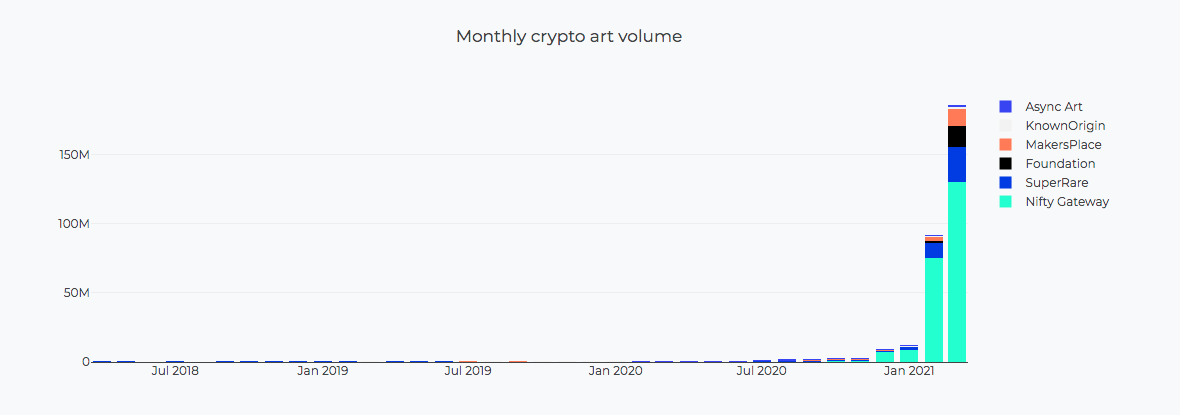

The NFT art trading volumes reached an all-time-high of $170 million in March, nearly double the total for February, and more than ten times higher than January.

The spike is certainly related to one of the most successful and expensive digital art sales when the digital artwork of Mike Winkelmann, professionally known as Beeple, was sold at Christie’s for $69 million in March. Plenty of other high-ranking digital artists besides Beeple have generated millions from selling their works on various cryptoart trading platforms.

Sponsored

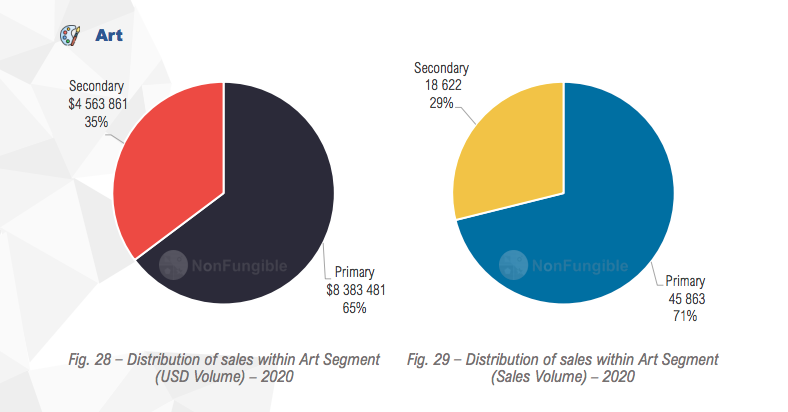

According to NFT Report 2020, the distribution between primary and secondary crypto art markets was uneven. The primary market clearly dominated the charts, meaning that crypto art works were sold for the first time and settled in portfolios.

Meanwhile, the secondary market, where collectors trade among themselves, remains limited. The market is considered mature when the secondary market becomes the dominant one, indicating that the production of assets has slowed down and peer-to-peer trading is taking over.

The quality of crypto art

For now, memes, gifs, videos and other digital creations fall under the “art” category and are selling like hot cakes. As almost anything can be named NFT art these days, how does it affect the aesthtic quality of the crypto art market?

“The current NFT artist community is certainly enthusiastic and enamored with the technology and the new way of monetizing their works,” says Israel-based crypto art curator Alyssa Travis, noting that the quality of the NFT art works varies across different marketplaces.

“Although this is a bit of a generalization, we’re witnessing the concentration of the best artists with the largest followings on a handful of curated NFT marketplaces, such as Nifty Gateway or SuperRare.”

The expert indicated that most popular artists with huge follower bases tend to concentrate on curated NFT marketplaces, such as Nifty Gateway or SuperRare.

“The more amateur artists, experimenters, or meme-makers are minting their works on marketplaces without a curatorial gatekeeper, like Rarible or OpenSea”, said Alyssa and warned “if you’re searching for NFT art on OpenSea, be prepared to encounter plenty of pixelated, collectible characters, cryptocurrency memes, and amateur art.”

What determines value in crypto art?

Successfully navigating online marketplaces is just the beginning for potential investors. Amidst the ocean of crypto art pieces, how should the inexperienced NFT art collector know what to buy and how much to pay?

At the end of the day, says Alyssa Travis, the value of NFT artworks are determined by the same factors that determine the prices of traditional fine art:

The notoriety of the artist, value of other works sold by the same artist, scarcity of their work, provenance, historical significance and the amount of work and skill required to produce the work.

According to Travis, new collectors should research the artist’s following and popularity before investing. “Review what the artist has sold for previously and consider the prices of artworks for similar artists,” she advises, adding that “that’s one of the beauties of NFT art: all these statistics, including provenance, are readily available to you.”

Another NFT art curator and collector, Crypt0xNinja from France, recommended following clear criteria when choosing which crypto art piece to invest in. “Talented artist. Dope art piece. Good pricing and low editions numbers”, he listed, “the art piece must be innovative and with the identity”.

The trap of editions

“A single edition 1/1 artwork is worth far more than an edition of 1,000,” noted Alyssa Travis. According to her, the quantity of editions is a criteria to consider before investing, especially as the prices of large quantity editions appear to be highly inflated.

“On February 25, Nifty Gateway hosted a 7-minute open edition for Trevor Jones’ “Bitcoin Angel.” People could buy as many editions as they wanted for $777 within that 7-minute window. He sold 4,157 editions, earning $3,229,989. To put this in perspective, “Bitcoin Angel 1/1” last sold for around $206K and his most expensive work “Genesis” sold for $540K’ Travis explained, “although there was a lottery aspect to this open edition with owners being able to potentially receive a commissioned self-portrait or a 1/1 NFT of my Conor McGregor portrait, the price for this large quantity edition appears massively inflated when compared to the prices of his single edition NFTs.”

Room to grow

Currently all sectors of the NFT art market are experiencing rapid growth, says crypto art expert Alyssa Travis, who sees even more room for the crypto market to expand.

“One of the largest potential areas for growth is the certification and tokenization of physical, analog art”, she remarks. “Confirming authenticity and provenance has always been an issue in the art world, so NFTs could help provide a solution to this problem.”

The technology behind NFTs could yet be confusing for traditional fine art creators, thus preventing them from tokenizing their works. However, it is only a matter of time until traditional artists become more familiar with NFTs, as the process is already changing the art world.

Brasilian visual artist and collagist Hugo Bastos sold his first NFT artwork just hours after it was minted. In his message to DailyCoin he confirmed the sale came much faster and was more profitable compared to traditional ways of art selling.

It was “faster than putting an artwork up for licensing on a website or waiting for people to ask for prints of it,” said Bastos, “and, financially speaking, definitely more worth it.”

Is crypto art ‘collecting for everyone’?

Traditionally, art has been seen as a long-term investment; years if not decades. If a fresh and promising artist maintains a successful career and his or her status increases, the value of his or her works climbs up simultaneously. This process can be extremely time-consuming.

The art market is dependent on trends; what is in vogue now, may be completely out of fashion a few years later. This is further complicated with regards to contemporary art, as the “star-quality nature of the contemporary artist” might be a more important factor than the quality of the artwork itself, stated contemporary British artist Oliver Watt.

The crypto art market is young and still figuring out the rules. Due to the hype surrounding crypto artwork, there is a significant risk that NFT art pieces are overpriced, making it even harder for collectors to evaluate their future worth. Anyone jumping into the crypto art market purely for speculative reasons, should keep in mind the broader contexts and the current climate to ensure a successful investment.