- Convex issues an update to its staking mechanism amidst competition from Yearn Finance and Stake DAO.

- The update includes issuing a new wrapper contract that will impact stakers on Convex.

Convex Finance announces an update to its staking mechanism and rewards distribution amidst competition from other yield aggregator protocols like Yearn and Stake DAO. The update impacts CVX holders, cvxCRV holders, and liquidity providers on Curve.

Happy 2023 🎉! The first update of the year is here; updated dynamics for $cvxCRV staking are coming soon. More inside!https://t.co/tXey1HicjX

— Convex Finance (@ConvexFinance) January 2, 2023

What’s Changed for Convex (CVX) Users?

As per the announcement, the following changes are being implemented:

- Impact on cvxCRV holders: The new update will issue a new wrapper contract for cvxCRV staking. This will allow Convex to add additional incentives for cvxCRV holders. The update will also let cvxCRV holders choose the token they want to be rewarded in – CRV, CVX, 3CRV, or any weighted mix of the three.

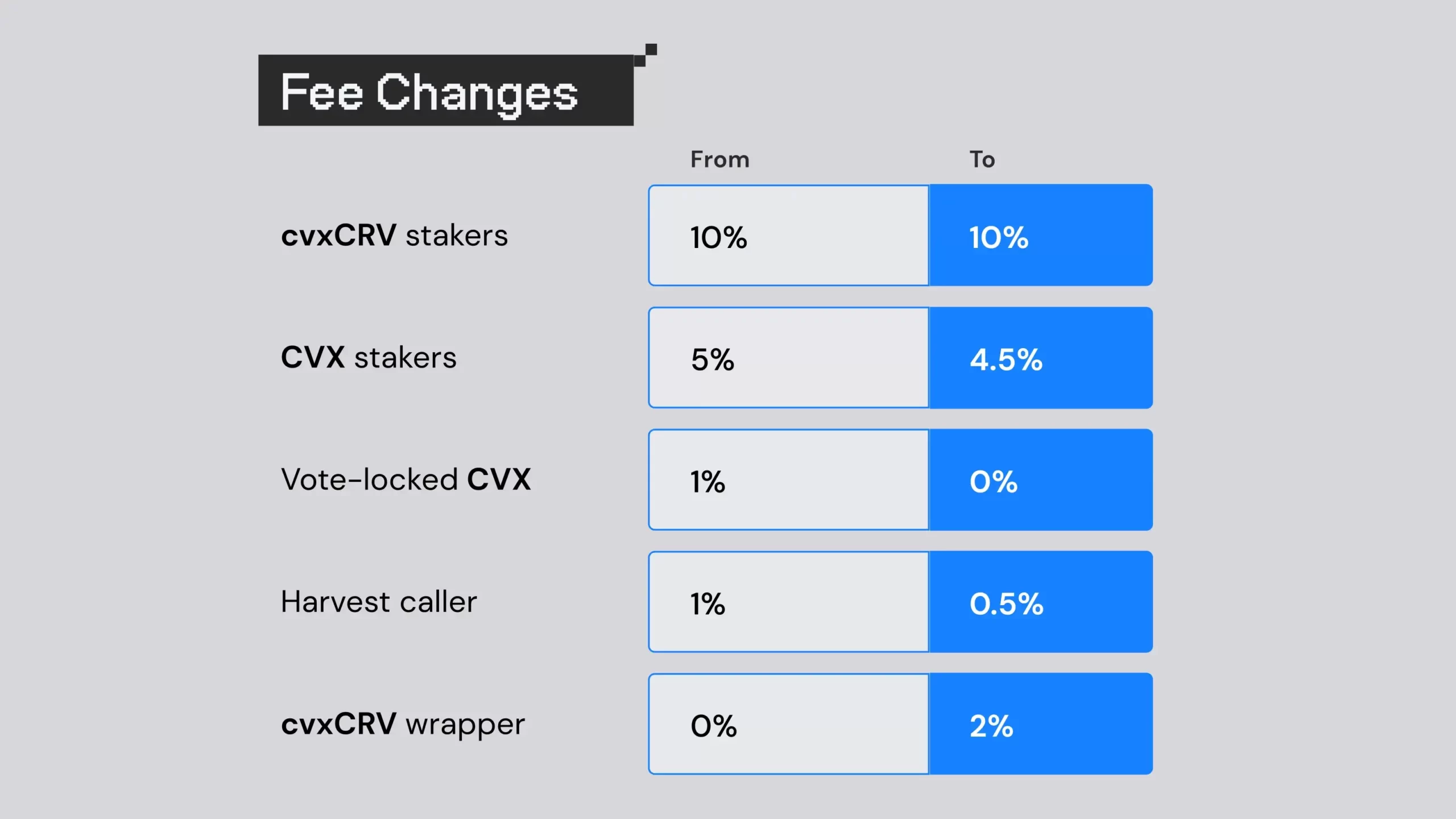

- Impact on CVX holders: In an attempt to utilize the new wrapper contract and remove the old cvxCRV from circulation, Convex will introduce a new proposal to divert some of the platform fees to the cvxCRV wrapper contract. Also, the protocol will divert some of the existing CVX emissions to this wrapper. The new fee distribution will look as follows:

Source: Convex Finance

- Impact on liquidity providers on Curve: Convex has plans to deploy a new Factory contract for the cvxCRV/CRV pool to take advantage of an internal price oracle and prevent price manipulation.

This update from the team comes in response to Convex losing its market share to Yearn Finance and Stake DAO over the past several months. Furthermore, the ownership of Convex’s veCRV has also been dropping as the protocol struggles to hold its price. The Convex team hopes that the new update to its staking process will help the protocol regain its majority ownership of CRV tokens.

Sponsored

The impact of who owns a majority share of CRV tokens will determine the future of a major DEX in the ecosystem. Currently, the fight is seemingly between Convex, Yearn and Stake DAO.

On the Flipside

- The TVL and price of Curve (CRV) have been falling. This has consequently meant less revenue for yield-aggregating protocols like Convex as they earn their revenue in CRV tokens.

Why You Should Care

Curve is one of the most important DeFi protocols in crypto. Whoever owns its CRV tokens can vote to direct future CRV emissions to a pool of their choice. Protocols like Convex have created their economic model based on directing these emissions, so they get to influence the liquidity and incentives for pools on Curve.