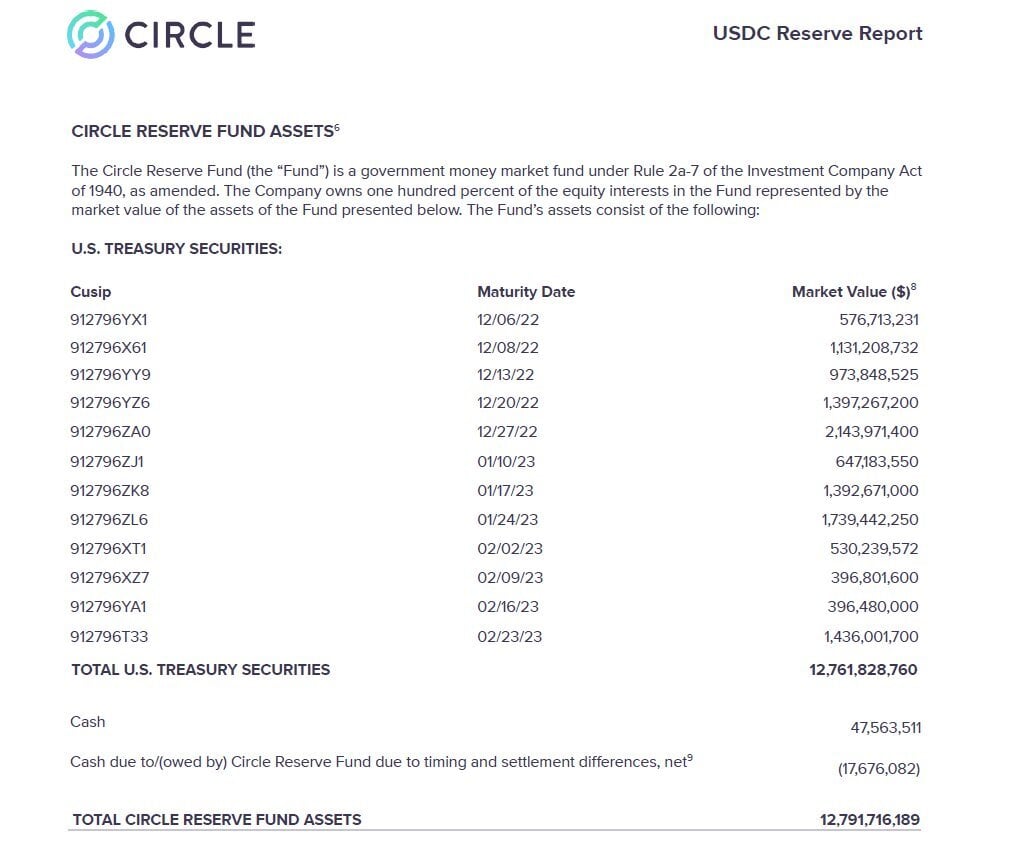

Circle, the issuer of the USD Coin (USDC) stablecoin, has revealed in its latest attestation report that 75% of the Circle Reserve Fund is now held in the United States treasury bills, with $12.79 billion managed by BlackRock.

BlackRock Now Manages $12.79 Billion of Circle’s Reserves

Circle’s latest attestation report shows that the stablecoin issuer has 30% of USDC’s reserves. $12.79 billion of the Circle Reserve Fund is now managed by BlackRock.

As of Q4 2022, Circle held $43.4 billion in USDC reserves to back 43.23 billion USDC in circulation. It holds $32.2 billion, or around 75% of total reserves in treasury bills. Additionally, it holds $11.15 billion in cash at U.S.-regulated financial institutions.

Circle Yields USDC Control to External Managers

Circle created the Reserve Fund on November 3rd and has since transferred $28.6 billion, or 65% of the stablecoin, to the Fund. However, the inclusion of BlackRock has caught the crypto community’s attention.

Sponsored

John Paul Koning, a popular crypto analyst, explained that Circle’s decision to allow external fund managers to control USDC is a win for users. Koning says it will improve the transparency of the crypto. He tweeted:

This seems like a win for USDC users. Circle is yielding some of its control over USDC's reserves to an external manager subject to SEC regulation, which ultimately makes USDC safer. Transparency improves too, since USDC users can now get regular updates from BlackRock.

— John Paul Koning (@jp_koning) January 8, 2023

In addition to BlackRock, Circle holds cash at major banks across the U.S. These include Bank of New York Mellon, Citizens Trust Bank, Customers Bank, New York Community Bank, Signature Bank, Silicon Valley Bank, and Silvergate Bank.

On the Flipside

- Of the total USDC reserves of $43.4 billion, Circle directly holds and manages $19.41 billion worth of USDC in treasury bills.

Why You Should Care

By sharing the management of the USDC reserve fund with BlackRock, the stablecoin becomes safer and more transparent.

What to expect from Circle in 2023? Read:

Circle Announces USDC Multi-Chain Expansion and Transfers

The recent public plan of Circle is covered below:

USDC Issuer Circle Calls Off Plans to Go Public: What Does It Mean for Crypto?