With the whole decentralized finance (DeFi) sector booming, tokens like Chainlink’s LINK emerge becoming one of the best-performing assets. And the most targeted ones as well.

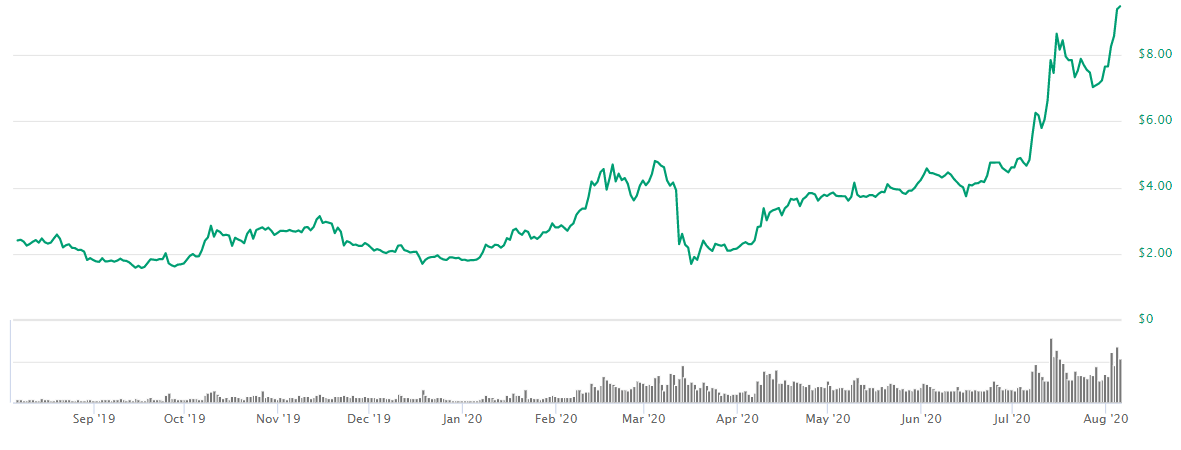

Chainlink, the decentralized oracle network, has been on fire lately, with the price of its native LINK token rocketing more than 150% within the last three months, more than 75% during the last 30 days and more than 33% during the past week, according to the data of Messari.

The coin is breaking it’s new all-time highs and is approaching the level of $10 at the time of publishing. The massive surge brought LINK to the top-10 digital currencies, where Chainlink ranks 9 with the current market capitalization of $3.38 billion, shows CoinMarketCap.

Chainlink is a decentralized oracle network that connects blockchain smart contracts with the information sources outside the blockchain. The oracle that performs as intermediary software allows blockchain smart contracts to read off-chain information in a language it understands.

Sponsored

Accordingly, oracles are an essential piece of infrastructure that helps to eliminate the risk of unverified and inaccurate data accessing smart contracts. And since the trusted information is crucial for various DeFi protocols, oracles become of critical importance to the whole booming decentralized finance industry.

The reasons behind price surge

The massive bull run on LINK however might be explained. The company has made a number of partnerships and integrations recently, starting with China’s national blockchain infrastructure Blockchain Service Network (BSN) activating 135 nodes, with Chainlink’s oracles integrated.

Chainlink has also partnered with cryptocurrency exchange Huobi, the Proof of Stake (PoS) protocol Tezos and cryptocurrency lending platform Nexo earlier this year. The oracle network also announced the collaboration with top Keoran banks, Deutsche Telekom’s IT service and consulting company T-Systems, Binance Smart Chain and numbers of other brands across the globe.

Sponsored

Furthermore, Chainlink introduced its Community Grant Program last week, which aims to make smart contracts the dominant form of digital agreement.

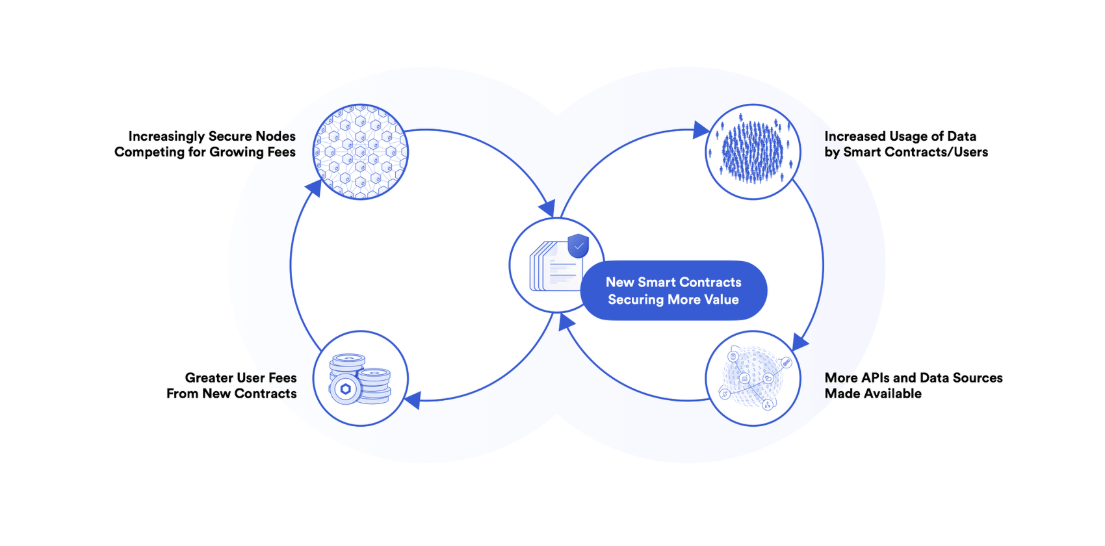

According to the announcement, the company is going to achieve its goal by “accelerating two positive feedback loops around both placing more data on-chain and continuing to increase the security guarantees with which that data is delivered. Combining these two positive feedback loops, will rapidly increase the amount of oracle validated data that can be securely utilized to generate even more universally connected smart contracts, in various industries.”

Mysterious FUD report

The massive success of Chainlink however evoked the accusations of the pump and dump fraud from the mysterious company Zeus Capital LLP. The company that presents itself as an alternative asset management firm, seems to be regularly targeting Chainlink since July 17.

A little known Zeus Capital LLP with a domain registered just a few months ago accused the oracle network of market manipulation and being a giant pump and dump fraud. The company, imitating the reputable London-based investment company Zeus Capital Limited, was later linked with Nexo Finance, the crypto lending platform that partnered Chainlink at the beginning of July.

I tried to stay neutral during this whole @NexoFinance being @ZeusCapitalLLP debate, but we may have just found the smoking gun, ontop of all the other evidence found

— ChainLinkGod.eth 👨🌾🌽💾 (@ChainLinkGod) July 19, 2020

They leaked themselves in the site's typeform source code, screenshots below, I checked it my self$LINK https://t.co/9hjn3zk8LQ pic.twitter.com/ii7U8GsXos

Nexo Finance however denied any connections with the fake Zeus Capital, which has been later caught up offering payments to the crypto sphere influencers for spreading negative news about the oracle network. The real intentions behind the information attacks against Chainlink are not revealed yet.

However, the same Twitter user, that disclosed Nexo Finance to be behind fake Zeus Capital, brought out the version of Nexo Finance borrowing millions of LINK tokens with the open short position just days before the FUD reports were published.