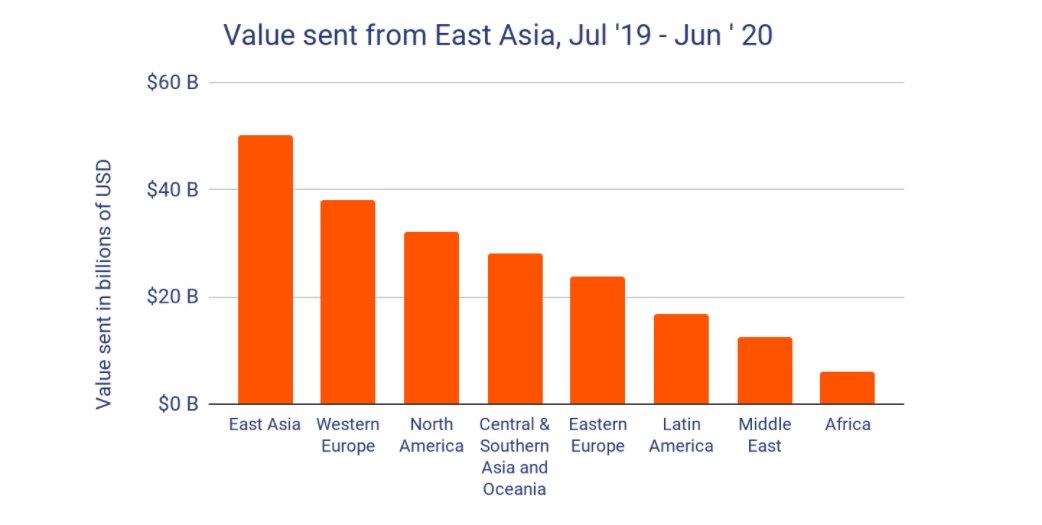

East Asia is the world’s largest cryptocurrency market, but the amount flowing out of the region is also impressive. And Bitcoin is not the only key cryptocurrency here.

China, one of the leading cryptocurrency markets in East Asia, witnessed a massive $50 billion worth of cryptocurrency capital flight abroad from the economy during the past year. Moreover, nearly a third of these outflows came in the world’s leading stablecoin Tether, claims blockchain analytics firm Chainalysis in its East Asia-dedicated report.

The report called “East Asia: Pro Traders and Stablecoins Drive World’s Biggest Cryptocurrency Market” stated that over $50 billion of cryptocurrency moved from China-based digital wallets to addresses in other countries and regions over the past 12 months. It also noted that local crypto investors were transferring abroad more money than allowed in communist China.

Since 2017 Chinese government has forbidden the citizens to move more than $50.000 out of the country per year. The move was mainly made to keep the capital in the country. However, the massive capital outflows were mainly addressed to the struggling Chinese economy according to Chainalysis. The country has been in a trade war with the United States, suffered the severe Covid-19 pandemic and devaluation of the yuan.

Sponsored

Despite the fact, the president Xi Jinping announced in 2019 China’s plan to issue its national Central Bank Digital Coin (CBDC), the digital version of national fiat yuan, “which could mean the government won’t allow the support of other digital coins”, claimed the report.

The significant role of Tether

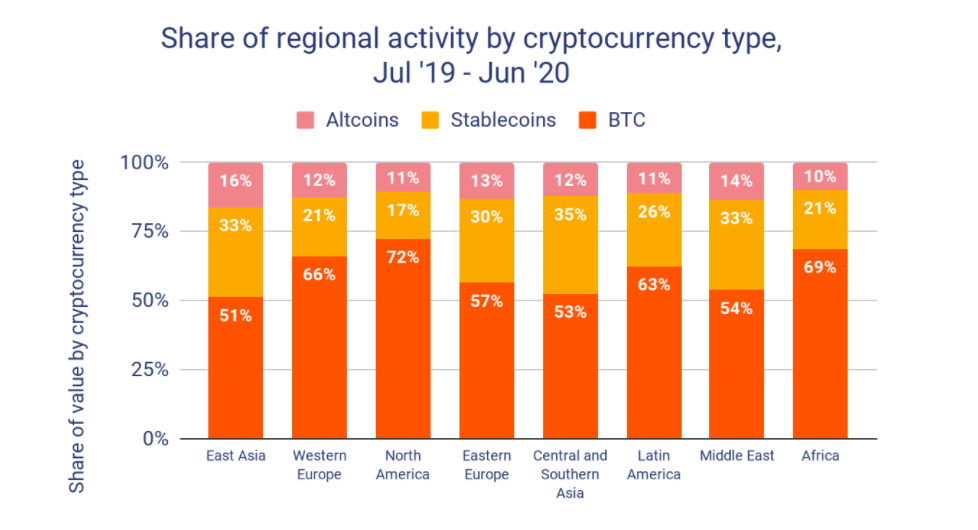

The massive capital flight of digital currencies reveal another interesting trend in East Asia and China as well. Investors are using Tether (USDT) to move their funds abroad. According to the report, the largest stablecoin by market cap was used to transfer the bigger than $18 million value from the East Asia region during the past year.

Tether, the stablecoin pegged to the United States dollar, is the most popular and most widely used stablecoin in the region, making up 93% of all stablecoin value transferred by addresses in the region.

Sponsored

Despite Bitcoin being the dominant crypto across various continents, the usage of stablecoins is especially high in East Asia. Tether (USDT) in a meantime, has even beaten up the Bitcoin during the last few months and became the most-received cryptocurrency in the region, according to Chainalysis’ data of June 2020.

The reason behind the popularity of Tether stems from the same capital outflow restrictions, the Chinese government carried out on its citizens back in 2017. The country, which is one of the biggest cryptocurrency markets in East Asia, turned to USDT as a primary fiat alternative, as moving funds via the bank accounts and cryptocurrency exchanges became restricted.

The investors used to buy USDT for yuans via the OTC brokers or by using foreign accounts. Since Bitcoin is still a volatile asset and buying it is limited in the country, Tether became an alternative to avoid wide price fluctuations while the assets are locked in the wallets or kept on the cryptocurrency exchanges abroad. As stated in Chainalysis’ report:

Stablecoins like Tether are particularly useful for capital flight, as their USD-pegged value means users selling off large amounts in exchange for their fiat currency of choice can rest assured that it’s unlikely to lose its value as they seek a buyer.

East Asia, the world’s largest cryptocurrency market, processed over a third of all global cryptocurrency transactions within the past year. The addresses based in East Asia obtained $107 billion of digital assets within the same period of time, which is over 75% more compared to the second highest-receiving region Western Europe. The high numbers of transactions, however, might be related to the intense mining activity. Here China alone generates almost 65% of Bitcoin’s total computing power.