A spectacular start to November, which saw Bitcoin peak at $68,789, came to an abrupt end on November 10. In the last 18 days, Bitcoin has dropped by more than 17% and now trades under $57k.

Although Bitcoin has underperformed in the market, investors have continued accumulating Bitcoin. This is evident by the increasing institutional inflow and the growing number of wallet addresses holding Bitcoin.

Bitcoin Whale Buys the Dip

As the price of Bitcoin plunged to $56k, Bitcoin whales purchased as much as 59,000 BTCs in the span of a week.

The third-largest Bitcoin whale joined the trend, purchasing nearly 1,000 BTC in 48 hours when Bitcoin traded between $59,250 to $54,000. This is the 11th purchase on the whale’s wallet address this month, which now holds a total of 114,999 BTC.

On The Flipside

- While long-term holders have continued to hold and increase their positions, short-term BTC holders have liquidated more significant BTC portions.

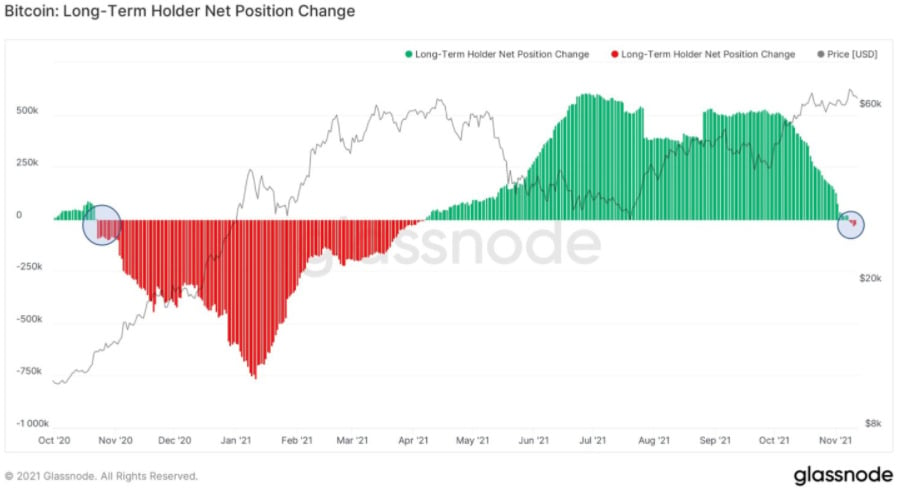

Data from Glassnode shows that the current price of Bitcoin is still considered a discount. Hence, the huge accumulation of BTC by whales.

The Bitcoin Long-term holder net position change. Source: Glassnode

From the data, there is a higher purchase of Bitcoin by whales around the prices of $52k and $58k. At this time, the $50k+ range may be the lowest accumulation point or price floor for BTC whales.

Why You Should Care?

The actions of Bitcoin whales debunks the myth that Bitcoin is on a long-term slide, giving Bitcoin-believers the hope that it won’t be long until another bullish outbreak