While the crypto market, including Bitcoin (BTC), continues to correct, institutional investors have remained calm, pouring more funds into cryptocurrencies.

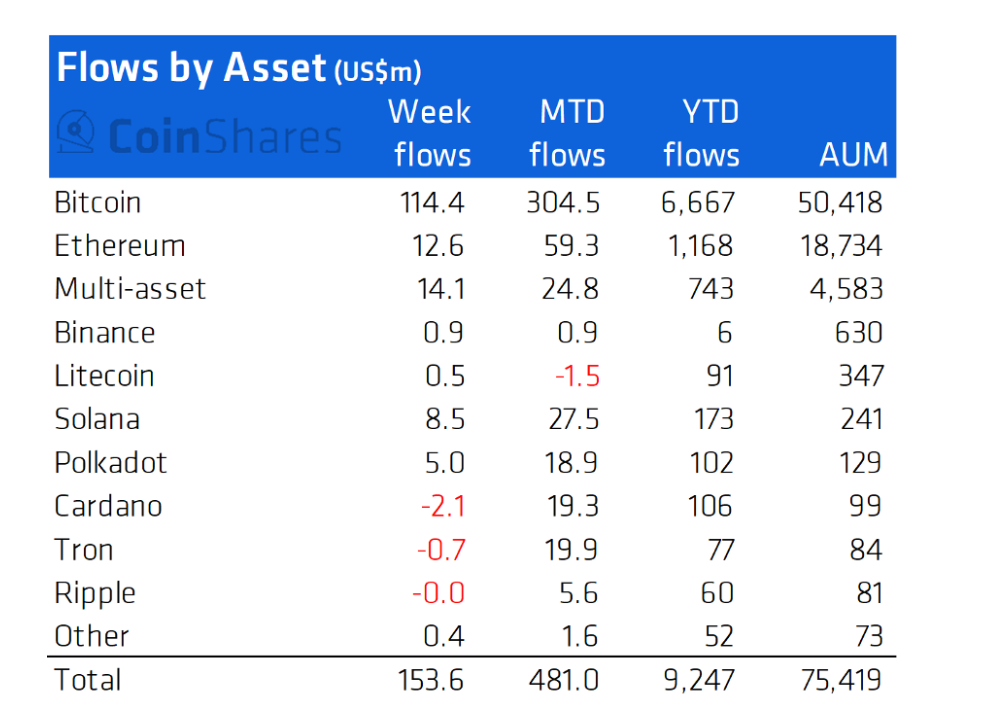

During the week ending Saturday, November 20th, cryptocurrencies recorded inflow from institutional investors of $154 million (excluding exchange-traded funds). This brings the year-to-date institutional investment in cryptocurrencies up to $16.97 billion.

Bitcoin Leads in Institutional Investment

Continuing the trend of November, Bitcoin once again recorded the highest institutional inflows among digital assets. In the week ending November 20th, investments into Bitcoin accounted for $114.4 million of the $154 million total.

Crypto Institutional Inflows for November 22nd. Source: Coinshares

This most recent round of investment into Bitcoin brings the total institutional Bitcoin investment for 2021 up to $6.6 billion. In October, Bitcoin recorded its highest levels of institutional investment at $2 billion, as its price neared its ATH.

On the Flipside

- Amidst this rising institutional investment, Bitcoin still continues to correct, and analysts believe that the pullback could last a little longer.

Ethereum has brought in a total of $1.17 billion in 2021, while other Altcoins have collectively recorded $9.2 billion drawn from institutional investment.

Grayscale leads the investment in crypto assets. As of November 19th, the investment firm hold assets worth over $51.9 billion under its management.

Why You Should Care

Institutional investors buying the dip reaffirms their bullish sentiments about Bitcoin, regardless of the asset’s current performance.

Sponsored