In January, when it was announced that the U.S annual inflation rate had hit a 40-year high of 7%, Bitcoin dropped below the $40k level when the Fed reacted by stating it would raise interest rates for the first time in more than three years.

Less than a month later, the inflation rate has accelerated from 7.0% to 7.5%. The NASDAQ 100 ended the day with a 2.10% loss in response.

Sponsored

The downtrend has seemingly spilled over into the crypto market, with Bitcoin dropping by more than 4% over the last 24 hours. The reactionary price drop has sent Bitcoin crashing down from $45,661.17 to an inter-day low of $42,850.

Marginal gains over the last few hours now see bitcoin trading at $43,482 as of this writing.

The 24 hour price chart for Bitcoin (BTC). Source: Tradingview

With Bitcoin’s first major support level standing at $42,578, its price will look to reclaim $44,208 before retesting the resistance level at $45,161. Should the world’s leading digital asset fall below the support level, it could see Bitcoin spiral down to as low as $41,625.

The Broader Crypto Market Joins the Decline

The price plummet which started with Bitcoin has spread through the broader cryptocurrency market, with Ethereum losing 5% to drop to $3,097.4.

The 24 hour price chart for Ethereum (ETH). Source: Tradingview

Other Altcoins have recorded even bigger losses, with XRP and Polkadot (DOT) both showing at -9% over the last 24 hours to trade at $0.8193 and $20.5, respectively. Solana (SOL) is also trailed by 8% and is now trading at $106.15 at the time of writing.

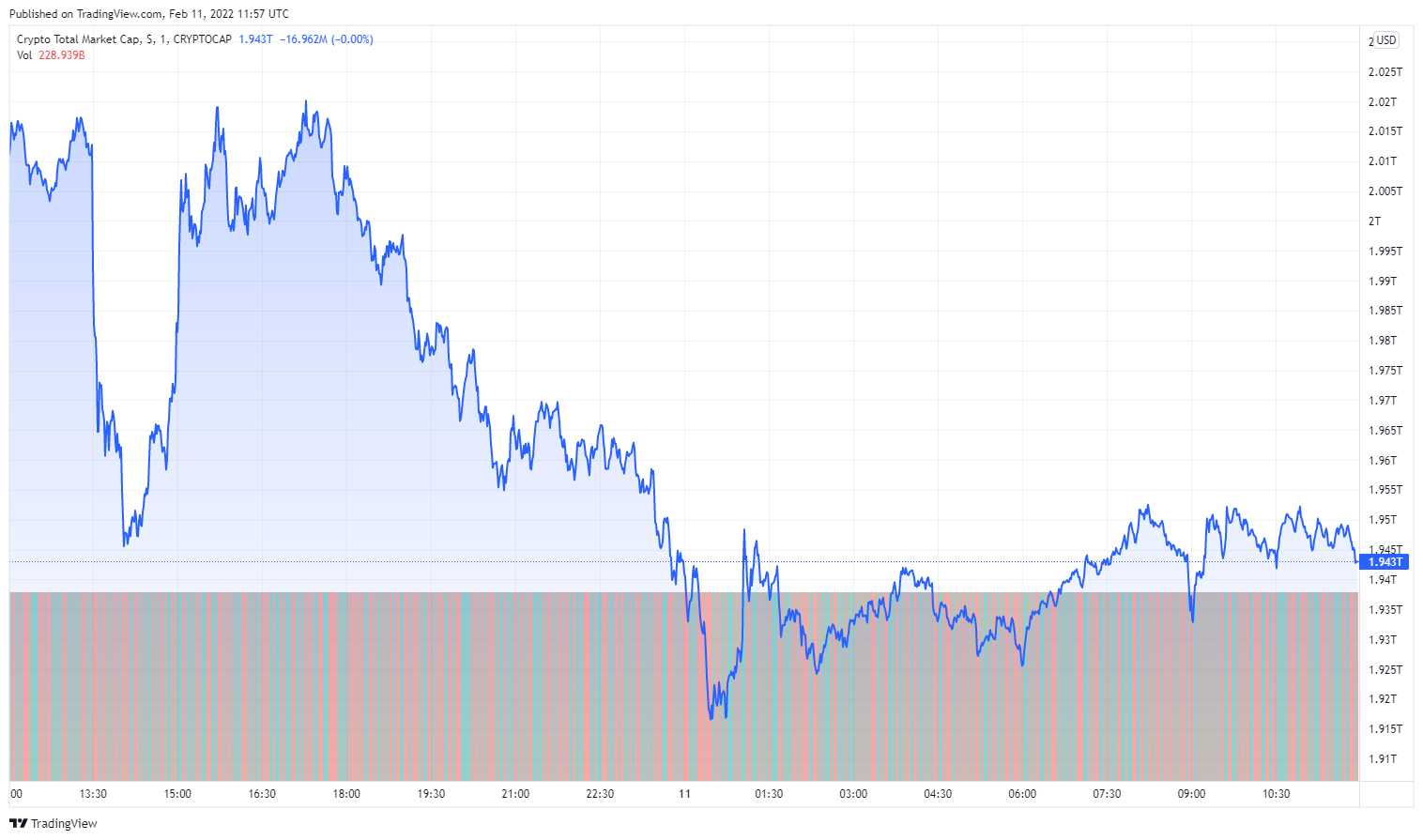

As a result of the sudden downtrend, the global market cap has fallen by approximately 3% in valuation, dropping from above $2 trillion down to $1.943 trillion.

The 24 hour chart of the global crypto market cap. Source: Tradingview

On the Flipside

- In spite of Bitcoin’s pullback, the Bitcoin Fear & Greed Index has held strong at 50/100 – which signifies neutrality.

Why You Should Care

While this disappointing news ends Bitcoins winning streak, it demonstrates once again Bitcoin’s increasingly synced movements with traditional stocks.