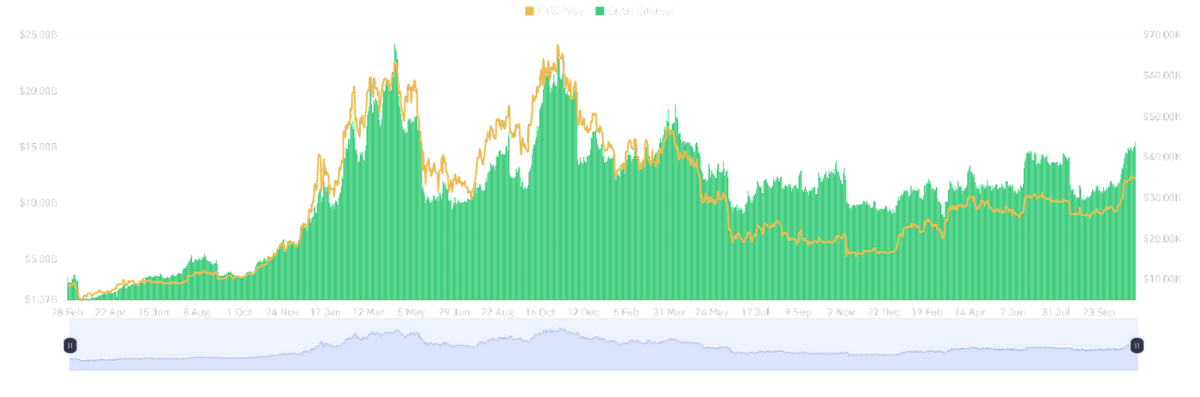

- Bitcoin futures open interest (OI) is at pre-UST crash levels.

- The move comes as CME OI has tapped new all-time highs.

- Analysts believe a significant price move is coming.

Bitcoin futures open interest (OI) has risen steadily since October 2023 and shows no signs of slowing down. With these mounting futures bets likely to impact the asset’s price in the coming days, onlookers are on the edge of their seats, wondering if bulls can maintain dominance.

Will Bitcoin break above $36k? Or is a pullback to $31k more likely?

Bitcoin Open Interest Taps Pre-UST Crash Levels

According to data from Coinglass at the time of writing, Bitcoin futures OI has surpassed the $15 billion mark for the first time since before the UST de-pegging incident in early May 2022. The feat suggests that the value of Bitcoin and the capital flowing into the futures market are at levels last seen before the crypto industry descended into the depths of the bear market.

Binance and the Chicago Mercantile Exchange (CME) continue to lead the way with 117.8k BTC (approximately $4.10 billion) and 105.38k BTC (approximately $3.67 billion). For the latter, the current notional value represents a new all-time high, highlighting the increased interest from institutional investors amid growing optimism that the SEC would soon approve a spot Bitcoin ETF product.

Sponsored

There is significant uncertainty about how the mounting OI will play out, but several analysts agree that a significant price move is on the horizon.

Analysts React

Reacting to the growing OI, CryptoQuant Author Maartunn noted that, at the moment, it is unclear where investors are piling their bets.

Prominent trader “Skew,” highlighting that the piling bets would likely lead to a sharp price move, warned that those caught on the wrong side would likely get wrecked.

The analyses of these traders appear to corroborate a recent opinion shared by “Duo Nine.” On Tuesday, November 7, the technical analyst highlighted that a massive price move was on the cards for Bitcoin as the asset’s price had formed an ascending triangle pattern on the 4-hour chart. “Once the price break [sic] this formation we will know where BTC goes next,” he added.

At the end of October 2023, Duo Nine had suggested that Bitcoin’s next leg up could take it to $36k while arguing that a pullback could take it to $31k.

At the time of writing, CoinMarketCap data reveals that Bitcoin is trading for $34.8k, representing a 1.11% decrease in the past 24 hours.

On the Flipside

- Several factors influence the price of Bitcoin, including macroeconomic data.

Why This Matters

Bitcoin’s rising futures OI suggests that the asset’s price will make a massive move soon.

Read this to learn more about Bitcoin’s recent OI surge:

Bitcoin Sentiment Soars as Open Interest Shatters Highs

Kraken is taking a cue from Coinbase with plans to venture into the Ethereum Layer 2 space. Find out more:

Kraken Eyes Layer-2 Launch Following Coinbase’s Base Success