In January, Bitcoin lost 18% of its value, marking its worst start to a year since the crypto winter of 2018. February brought a much-needed breath of fresh air for investors as Bitcoin crossed $42,000 for the first time in three weeks over the weekend.

Bitcoin Reaches Highest Level in Over a Month

Continuing its strong run that began over the weekend after the Fed released its better-than-expected U.S. jobs data, Bitcoin has gained an additional 5% to rise to its highest level in over a month.

Sponsored

Bitcoin’s recent gains saw its price peak at an interday high of $45,300, a level last reached on January 5. Since then, Bitcoin has dipped back to stabilize around the $43,930 level.

The 24-hour price chart of Bitcoin (BTC). Source: Tradingview

Over the last five days, the price of Bitcoin has risen by 18%, moving from $37,310 to its current price of $43,934. As a result, Bitcoin’s market cap has risen from $704 billion on Friday morning, February 4, to $832 billion.

The five-day price chart of Bitcoin (BTC). Source: Tradingview

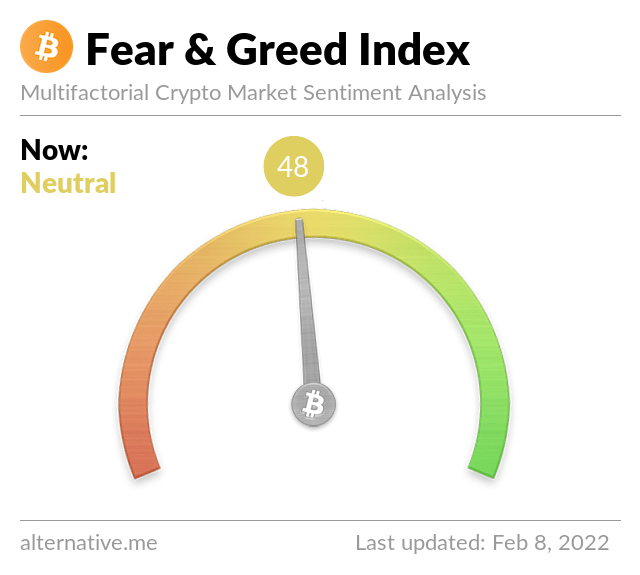

Bitcoin’s gain has helped the global crypto market cap briefly cross $2 trillion for the first time in more than three weeks. The Bitcoin Fear and Greed Index is now at 48 (neutral), its highest score since November 23 (50), when BTC was priced at $56,689.

On the Flipside

- Analysts, including Noelle Acheson of Genesis, aren’t convinced on Bitcoin’s recent gain, suggesting it may be just a short-lived “bounce.”

Why You Should Care

With Bitcoin now stabilizing around the $43,800 zone, the sentiment around the world’s largest crypto has changed from when it traded below $40k.