Crypto market leaders Bitcoin (BTC) and Ethereum (ETH) saw major declines on Tuesday, November 16, as the crypto market shed more than 10% of its value.

According to Elliott Wave analysis, the drop means that the global crypto market cap completed the fifth wave of a five-wave cycle.

At the time of this writing, the global crypto market cap is valued at $2.73 trillion. With the crypto market completing the five-wave cycle, what’s next for Bitcoin and Ethereum (which contribute more than 62.5% of the global market cap)?

Bitcoin

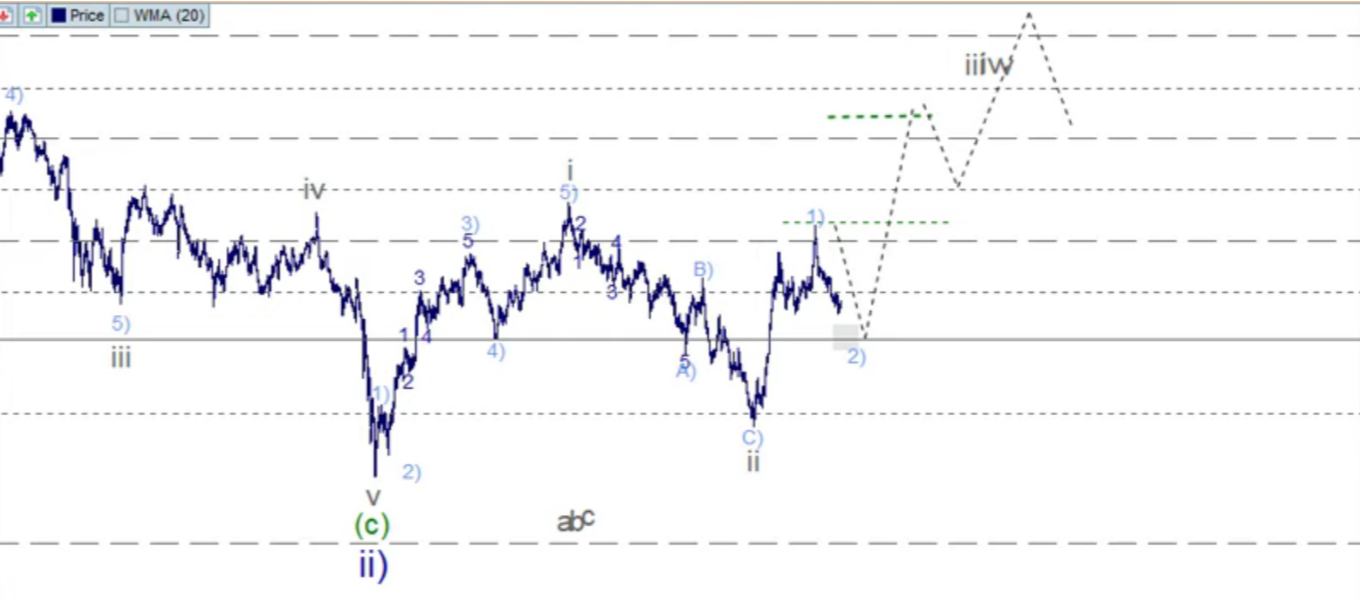

Bitcoin (BTC) took a hard hit from the sell-off, dropping almost 15% in the process. Bitcoin technical analysis using the Elliott Wave shows that Bitcoin is trading around the key $60k-$58k support zone.

If the price of Bitcoin falls below the $58k support zone, then it signals the start of a bearish outbreak. At the time of this writing, Bitcoin is trading at $59.6k, still in the support zone.

Sponsored

As BTC consolidates, predictions are that Bitcoin could rally up to $62k. Stronger bullish pressure could see BTC reclaim an important support zone at $63k.

Ethereum

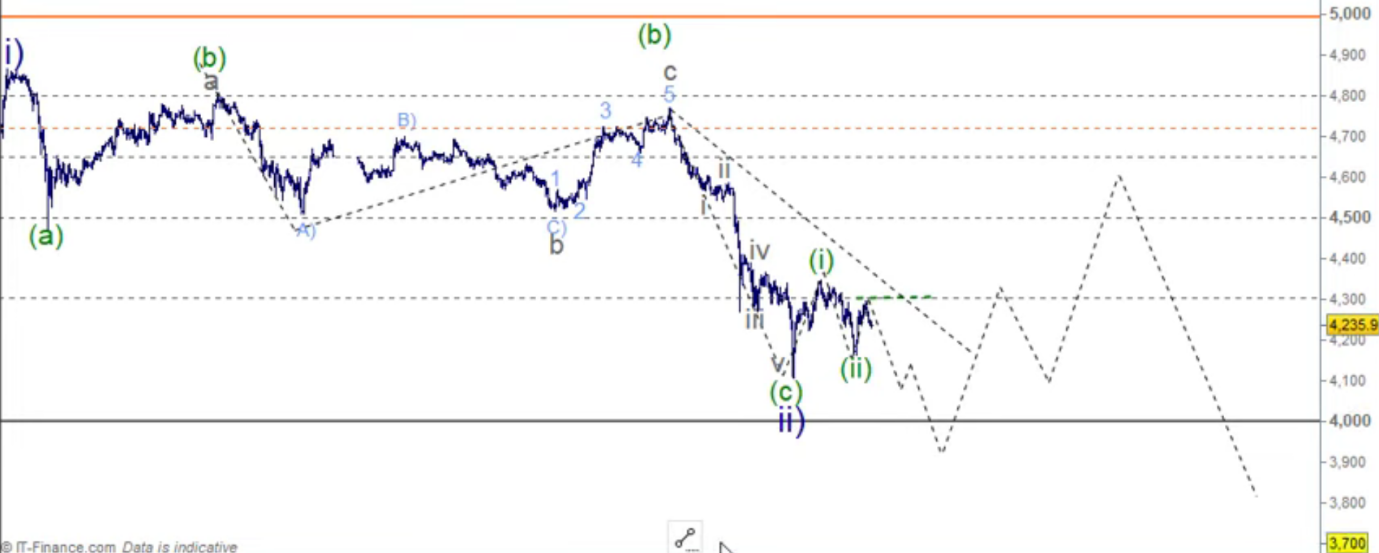

While ETH has consolidated, we could see the world’s second-largest cryptocurrency retest the $3,900 zone. This is because there are still signs of bearish momentum on ETH.

If that is the case, a serious signal for the bearish cycle could see ETH break below its $3,900 support zone. After that, Ethereum could be ready to rally to $5,000.

On The Flipside

- Despite Ethereum’s current loss, Raoul Pal believes that ETH could rally as much as 100-300% before the end of 2021

Why You Should Care?

Both Bitcoin and Ethereum lie at key support zones, which could determine the price action of both assets in the coming weeks.