- Bitcoin’s blistering price rally has slowed in Q2 2023.

- Glassnode data suggests that the asset’s price is at a turning point.

- Analysts have weighed in on the asset’s price.

After leading an impressive price rally in Q1 2023, Bitcoin has slowed its roll in Q2, with its price ranging for several weeks amid bouts of downward volatility.

However, in a tweet on Thursday, June 1, blockchain analytics platform Glassnode suggested that the asset could be at an inflection point, highlighting a transfer of funds from long-term holders to new ones.

Glassnode based its analysis on the one-day to three-month HODL Wave, which had seen an 86% increase from 11.5% to 21.4%.

What Does the Wealth Transfer Mean for Bitcoin’s Price?

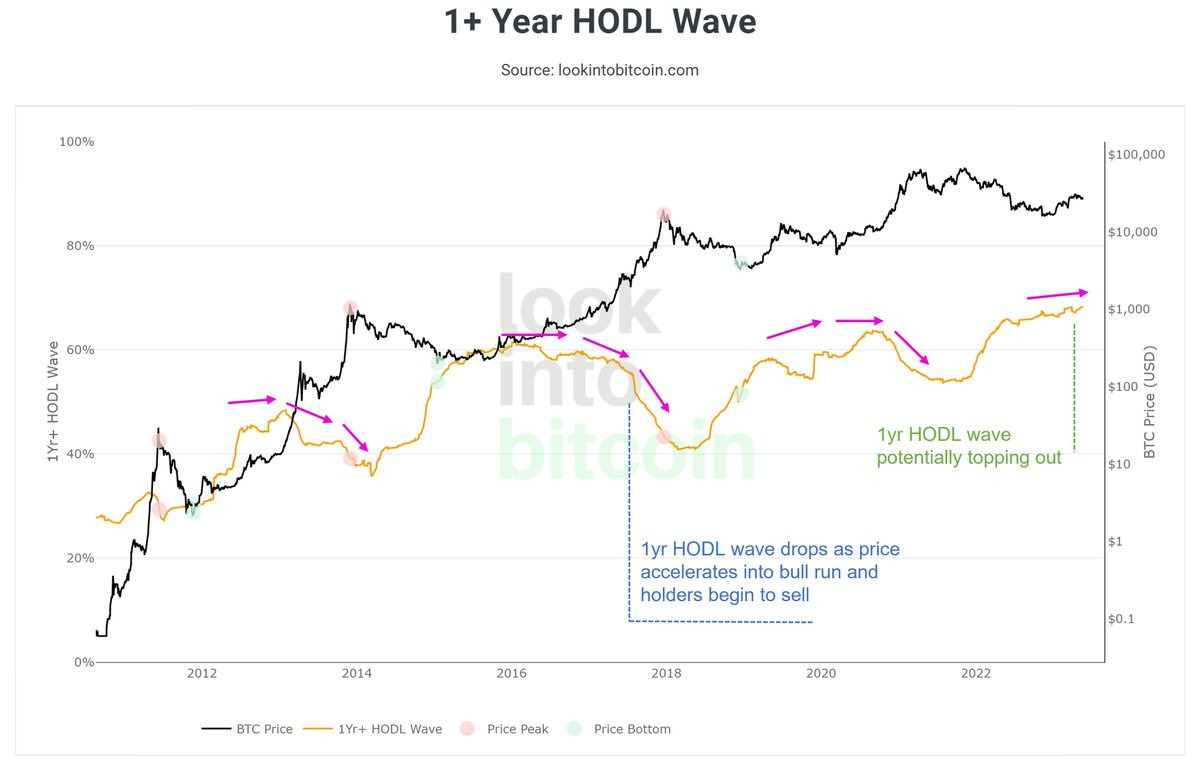

HODL Waves represent Bitcoin’s supply based on how long coins have remained unmoved. These charts can provide insight into market sentiment while allowing for trend and market cycle identification.

Sponsored

While long-term holder selling typically indicates bearish market conditions, prominent Bitcoin analyst Philip Swift has asserted that the current flow of funds is positive for the asset’s price after analyzing the one-year HODL Wave and coming to conclusions similar to those shared by Glassnode.

"… when new participants (new demand) enter, HODL'ers who accumulated at the lows will begin to sell to them at higher prices. That movement of coins will cause the +1yr HODL Wave to trend down as BTC price trends up," Swift asserted.

Swift is notably not the only analyst optimistic about Bitcoin’s price at current levels, as another analyst Ali Martinez has urged followers to buy the asset in a pinned tweet.

Ali has recently pointed out that about 30 new Bitcoin whales have appeared on the network. At the same time, in a tweet on Friday, June 2, the analyst shared data suggesting miners were no longer dumping Bitcoin rewards.

IncomeSharks has, however, suggested that Bitcoin has to form a strong daily close between $27,000 and $28,000 or risk falling as low as $25k or $20k to form a double bottom chart pattern.

Bitcoin’s new demand is likely due to the meme coin craze that has found its way to the leading blockchain with the explosion of BRC20 tokens and Ordinal inscriptions.

On the Flipside

- The increased demand for Bitcoin block space has led to higher fees and network congestion.

Why This Matters

Bitcoin’s price action typically dictates the price action of other crypto assets.

Read this article to learn more about Bitcoin’s price action:

Bitcoin Price Action Stumps Traders Amid Growing Liquidity Concerns

The CFTC is planning to revamp its risk management rules. Find out why crypto is a crucial consideration: