- The cryptocurrency market has been staging a comeback as the banking sector struggles with instability.

- Bitcoin and Ethereum have reached their highest price levels in approximately nine months, with new money flowing into the market.

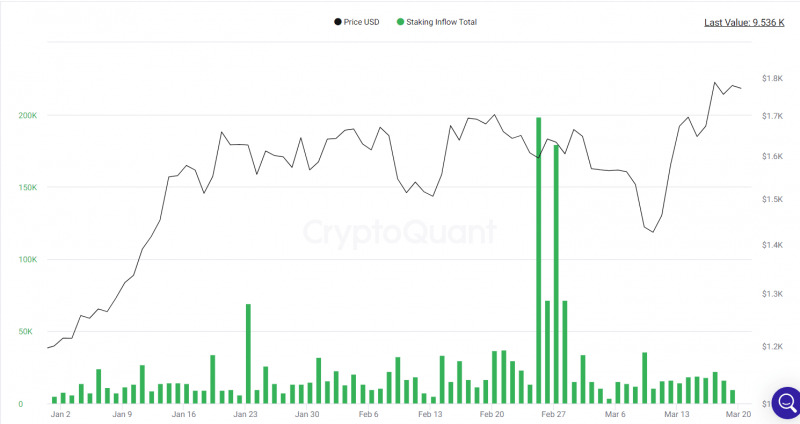

- Investors have been keeping an eye on staking inflows for ETH as a decline may indicate high demand for unstaking.

The recent collapse of crypto-facing banks such as SVB, Silvergate, and Signature has caused instability across financial sectors, leaving investors uncertain about how the markets would react.

Nevertheless, the crypto sector has rallied against expectations since the beginning of March, with the total cryptocurrency market cap surging 12.85% to reach a high of $1.166 Trillion on Sunday, the 19th.

This surge in value has been attributed to various factors, including inflation data exceeding expectations, renewed optimism about a dovish Federal Reserve, and the growing importance of decentralized finance (DeFi) and digital assets.

Sponsored

The value of several cryptocurrencies has surged to their highest levels in approximately nine months. Bitcoin (BTC) experienced a 23.8% increase in March to reach a high of $28,480, while Ethereum (ETH) climbed nearly 15% to trade near the $1,850 level before consolidating at $28,000 and $1,770 levels, respectively.

Funding Rates Flip Green, Indicating Bullish Trend For Bitcoin

BTC has been steadily holding above the $28,000 level, trading up 1.41% in the last 24 hours, taking advantage of the current uncertainty in the traditional markets in the wake of U.S. banks like SVB and Signature’s recently collapsing. The event has served to spark renewed interest in the importance of decentralized finance (DeFi) and digital assets.

This week’s FOMC meeting is expected to be a major factor in determining the market’s direction. Although Bitcoin is gearing up to test the $30,000 threshold, it will most likely encounter resistance in the run-up to the event. Nonetheless, there has been a noticeable increase in bullish sentiment beyond the price charts.

Sponsored

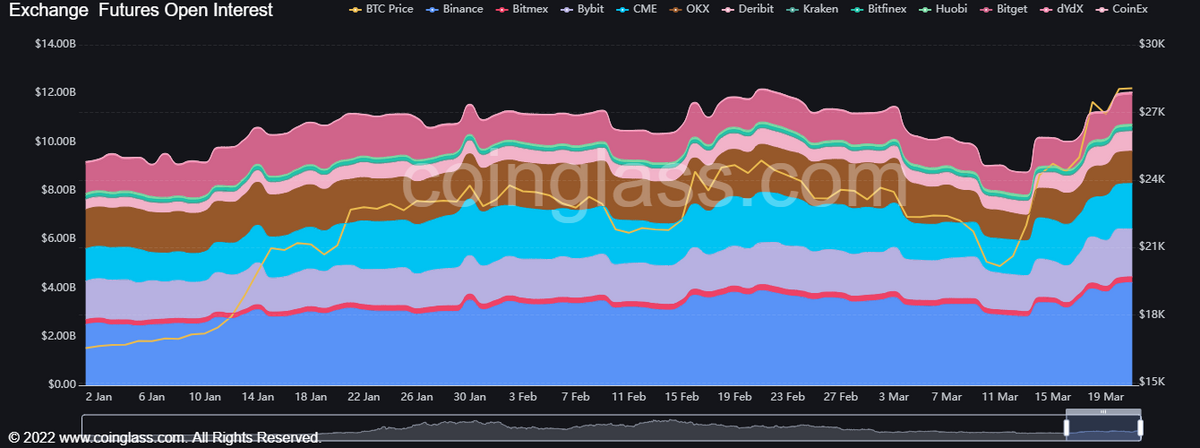

Data from CoinGlass has shown that the dollar value locked in the number of open BTC futures contracts is increasing, signifying a rise in speculative interest in the market and a potential for more price volatility. The nominal value of open interest has reached a yearly high of $12 billion, marking a 7% monthly gain.

Exchange Futures Open Interest. Source: Coinglass

While an increase in open interest implies that new money flows into the market, it doesn’t always reveal whether traders are positioning for price gains or losses.

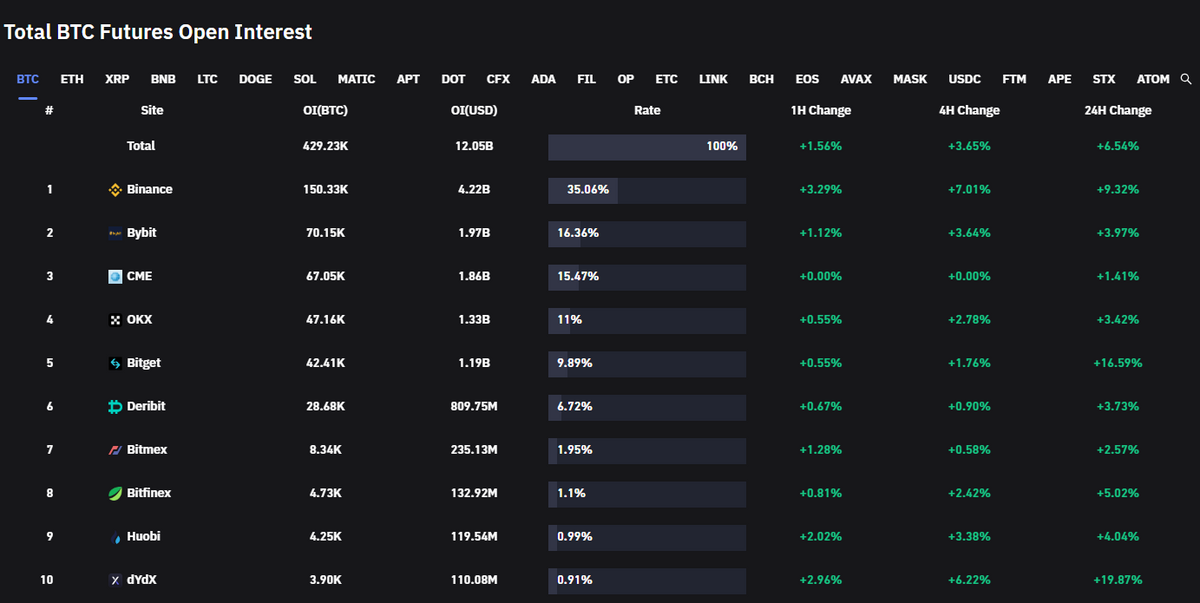

Nevertheless, in Bitcoin’s case, it appears that new money is betting on price gains, given that the funding rate has flipped into the green after spending most of the early parts of the Asian trading day in the red.

Total BTC Futures Open Interest. Source: Coinglass

Favorable funding rates usually indicate a bullish trend, as long positions compensate for short positions. Conversely, negative funding rates indicate bearish sentiment, with short positions receiving payment from those holding long positions.

Ethereum Network Shows No Signs of Overload as Price Surges

On Saturday, the 18th of March, the price of ETH reached a high of $1,840, the highest it has been in the past seven months, surpassing levels previously seen on August 18th, 2022. However, on Monday 20th, ETH had a mixed start to its trading day, initially dipping to $1,735 before recovering and reapproaching the $1,800 level.

The network has managed to handle the increased demand without experiencing significant transaction barriers, which bodes well for Ethereum’s potential to continue its upward momentum toward $2,000 in the next upgrade.

There were no new updates on the Shapella upgrade on Sunday, and despite a bullish session, ETH staking inflows decreased significantly. According to CryptoQuant, staking inflows fell from 16,192 ETH on Saturday to 9,536 ETH on Sunday, the lowest since March 5th.

The metric is a significant indicator as staking inflows may suggest high demand for unstaking ETH after the Shapella upgrade.

Ethereum Staking Inflow Total. Source: CryptoQuant

On the Flipside

- Despite the recent market surge, there is still a lot of uncertainty in the cryptocurrency market due to its inherent volatility and lack of regulation.

- While the increasing interest in DeFi is encouraging, there are still significant challenges regarding scalability, security, and usability.

Why You Should Care

Bitcoin and Ethereum have both experienced significant price increases recently. This surge in value indicates renewed interest in the crypto market.

As Bitcoin and Ethereum are considered leading coins, their performances serve as an indicator for the rest of the industry. They will ultimately influence the potential for further growth in the market.

Want to know more about Bitcoin’s potential to reach $1 million? Check out this article:

Bitcoin’s Strong 30% Weekly Surge Amid Market Chaos

Interested in Bitcoin’s recent price surge? Read more about it in this article:

Bitcoin’s $1M Dream: Gokhshtein to Delete Socials on One Condition