Once again, the world’s largest cryptocurrency exchange, Binance, has come under regulatory scrutiny. This time, its U.S. arm is under investigation by the Securities and Exchange Commission (SEC) over its relationship with two affiliate market makers.

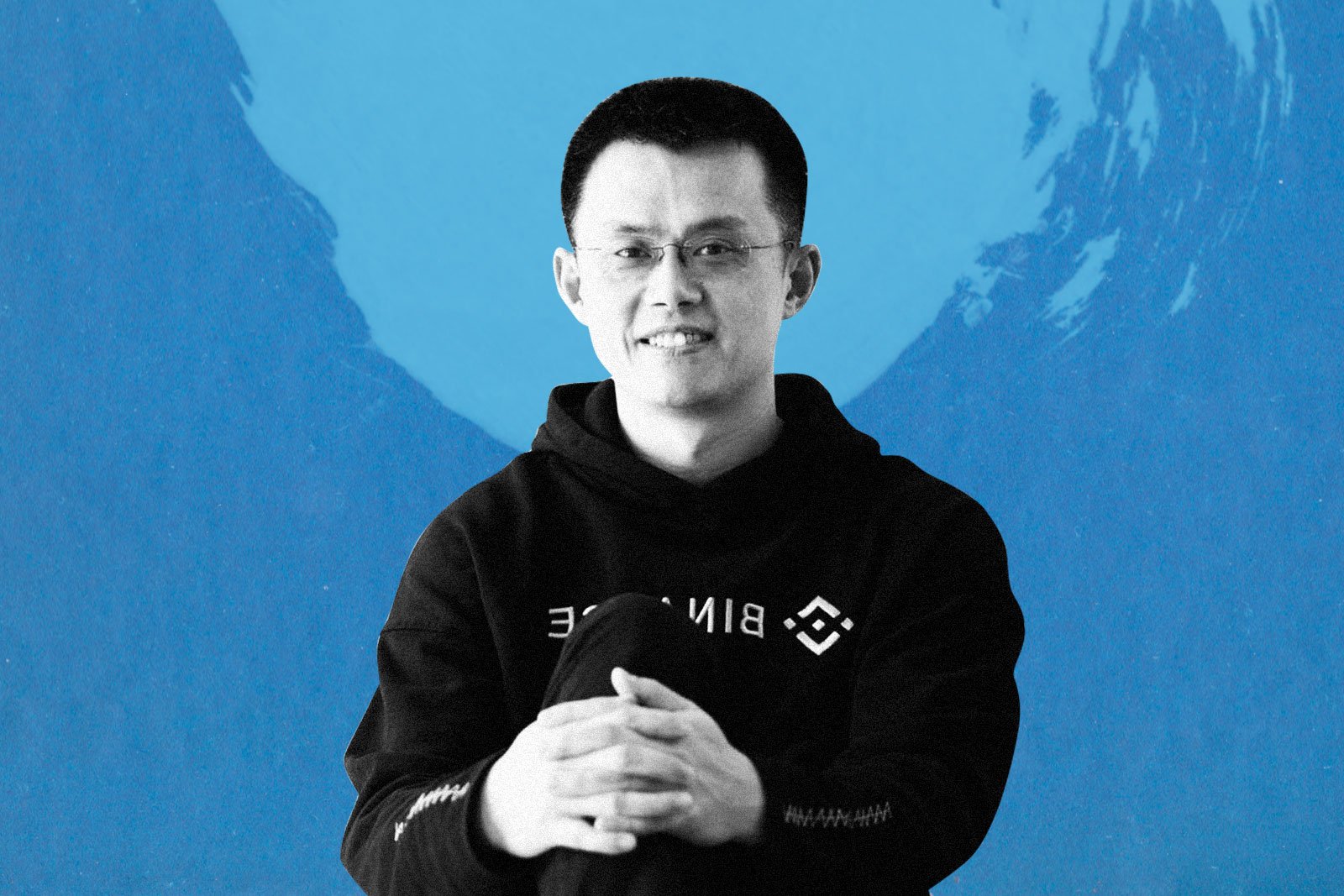

According to the report, the two firms, Sigma Chain AG and Merit Peak Ltd., are owned by the CEO of Binance, Changpeng Zhao. The report shows corporate documents from 2019 tying CZ to both firms.

The SEC Investigates Binance.US Ties with Sigma and Merit Peak

Both trading firms continuously buy and sell crypto on Binance.US, which reduces price volatility. While helping to ease price volatility, market makers profit from the small differences in the bid and ask prices.

Sponsored

While market-making activities are commonplace in both the traditional finance and crypto industry, Binance.US does not name any of its market maker partners on its website.

The regulatory agency has now requested information from Binance U.S. on the two affiliate trading firms. In addition, it has launched an investigation on whether they received preferential treatment from the exchange regarding access or speed.

Sources familiar with the case explained that another area of focus for the SEC is how Binance.US disclosed its links to the trading firms to customers. However, it remains unclear how the SEC might proceed with any enforcement action for now.

On the Flipside

- According to a Binance spokesperson, the company, which is privately held, is not obliged to disclose details of its investors to the public but is open to sharing information with regulators.

Why You Should Care

The probe primarily seeks to clarify the convoluted relationship between Changpeng Zhao and the two market makers.

Sponsored