- Binance embraces Circle’s native USDC on the Polygon network.

- The exchange now supports a dual-token system.

- Users can enjoy flexibility and more ways to access the stablecoin.

Stablecoins are a vital part of the cryptocurrency industry, facilitating smooth transactions and bridging the traditional financial system and the digital frontier. Leading issuer Circle has been taking charge with its native USDC stablecoin, expanding its presence across various blockchain networks for increased accessibility.

Looking to leverage the buzz, cryptocurrency exchange Binance has announced its adoption of the USDC on Polygon.

Binance’s Integration of USDC on Polygon

On October 23, 2023, Binance announced its adoption of Circle’s native USDC on the Ethereum Layer-2 scaling protocol Polygon network to simplify user access within its platform.

Sponsored

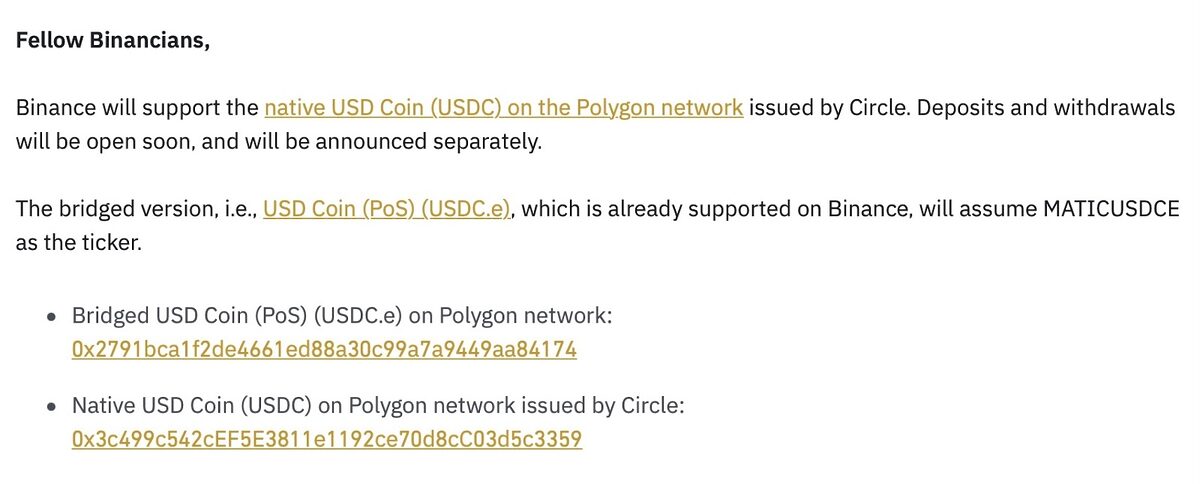

The integration establishes a dual-token system encompassing the pre-existing bridged version of USDC on Polygon (USDC.e), denoted as MATICUSDCE, and the native USD Coin (USDC) on the Polygon network.

Users will enjoy a more diversified selection of stablecoin options in executing transactions, and the adaptation will allow cost-effective and time-efficient transaction options for various use cases such as payments, trading, and remittances.

While the operational changes are underway to accommodate the integration, Binance will temporarily suspend the deposits and withdrawals of the Polygon-based USDC. Services, including spot trading, margin trading, futures trading, and Binance Earn, will be unaffected, and all services on MATICUSDCE will continue without disruption.

Sponsored

The exchange further noted that an official announcement would be made once deposits and withdrawals of native USDC are available, granting users access to its many benefits.

Native USDC On Polygon And Features

On October 11th, Circle introduced the minting of USD Coin (USDC) directly on the Ethereum Layer-2 scaling protocol Polygon.

The feature eliminates the necessity of bridging USDC from Ethereum to other blockchains, leveraging Polygon’s scalability.

The Polygon-based USDC provides a gateway to low-cost global payments and access to trading, borrowing, and lending on popular DeFi platforms.

On the Flipside.

- Amid these developments, Binance still grapples with tightening regulatory scrutiny and challenges, including a year-long conflict with the United States Securities and Exchange Commission (SEC).

- Circle will discontinue deposits and withdrawals for USDC.e on Polygon on November 10th, with a caution that assets sent to Circle Mint accounts may become irretrievable after that date.

- Circle also unveiled plans to launch a cross-chain transfer protocol to enhance interoperability with other blockchain networks and allow seamless transfers of Polygon-based USDC to and from the Ethereum blockchain.

Why This Matters

Binance’s adoption of Circle’s USDC on Polygon simplifies user access to a stablecoin optimized for the Polygon network. The integration offers the potential for faster, more efficient transactions and underscores the importance of collaboration and adaptability in the growing industry.

Read more on Circle’s integration of its native USDC stablecoin across various blockchain networks:

USDC to Enhance Interoperability of Polkadot Parachains

Binance gains the support of a leading blockchain advocacy group amid mounting challenges with the SEC:

Blockchain Advocacy Group Opposes SEC Binance Lawsuit