In 2021, the cryptoverse was distinguished by numerous high-profile investments and milestones which ultimately drove it to become a multi-trillion-dollar industry.

As its pioneer cryptocurrency, the industry’s growth largely centered around Bitcoin. Now, with 2021 winding down, let’s take a look at what on-chain data says about Bitcoin’s year.

Bitcoin Gained in 2021

Entering 2021 on the wave of a major milestone, Bitcoin continued to be on an uptrend throughout the course of the year. Starting out at $29.4k in January, Bitcoin touched $40k for the first time ever, before dropping to below $30k, all within in the same month.

Sponsored

The trend continued through Q1 as Bitcoin broke through the $50k level in February and, $60k in March. From its high of $63.5k in April, an extended bearish trend saw Bitcoin once again drop below $30K as July rolled by.

Bitcoin’s January – June Price Chart: Tradingview

Over the three months that followed, a steady uptrend ensured that Bitcoin would set a new ATH at $68.8k on November 10th. However, those gains will be lost once more in the ensuing weeks, as Bitcoin dipped to below $45k.

The July – November Price Chart

While the volatility that has become Bitcoin’s call sign continued to raise eyebrows, Bitcoin ends the year with a surge that saw its value increase by over 70%. Compared to its 300% gains in 2021, it could be said that Bitcoin underperformed. However, there are some strong points going forward for Bitcoin in 2022.

On the Flipside

- While Bitcoin performed outstandingly well in 2021, it remains down by more than 30% from its November 10th all-time high.

- As a result, 3.48 million BTC, or 18.34% of the circulating supply, is currently being held at a loss.

More Investors Have Turned to HODLing

Unlike the previous trends, during which investors would short Bitcoin, buying low and selling high, in 2021 the number of long-term holders has significantly increased.

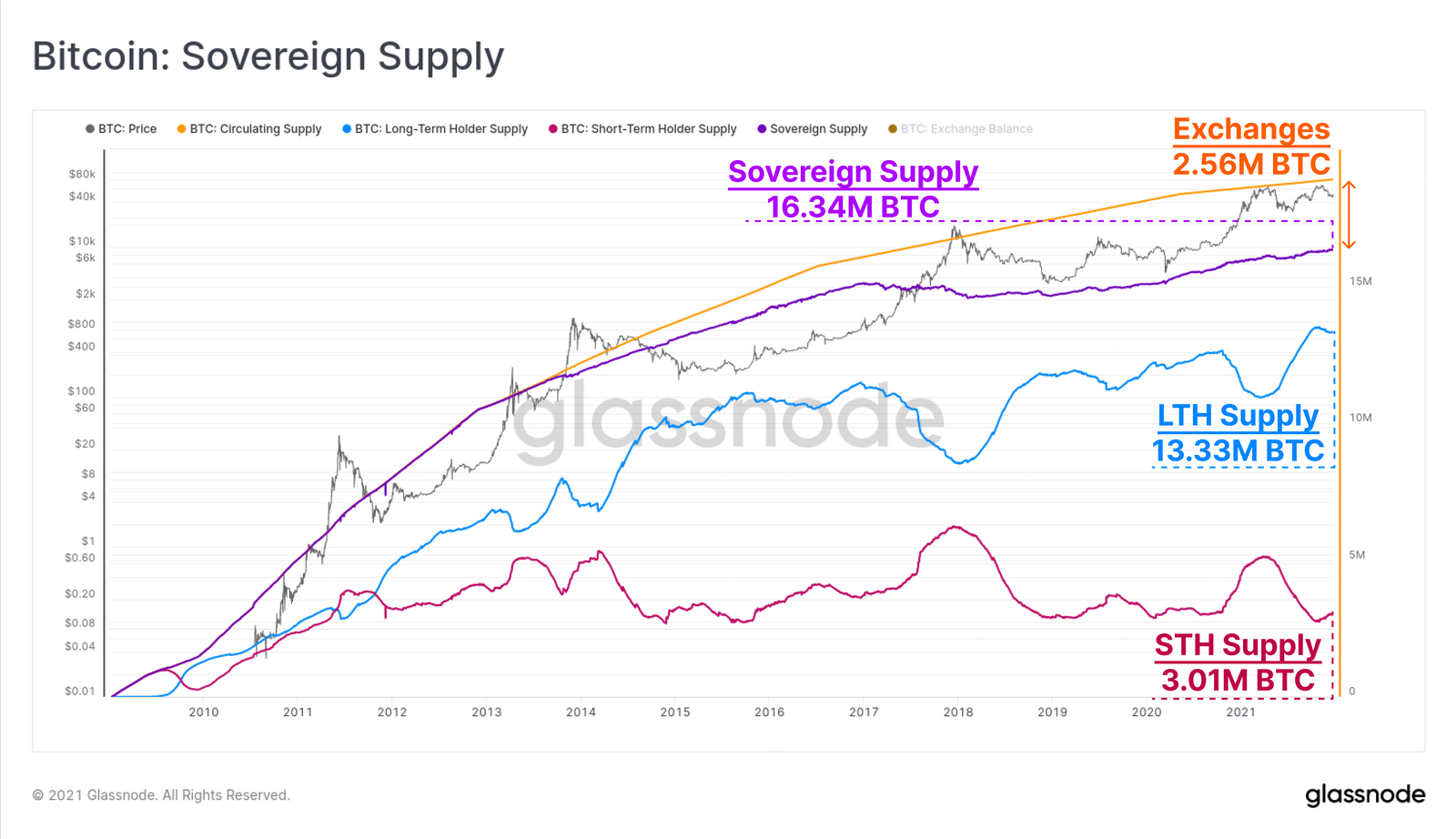

According to on-chain data, from weeks 1 to 52 long-term holders added 1.846 million BTC to their holdings. At week 52, their holdings totaled 13.33 million BTC – a 16% increase year-to-date.

On the other hand, short-term holder supply has declined by 1.428 million BTC in 2021. This category now holds a total of 3.01 million BTC, representing 32% less year-to-date.

Bitcoin held outside of exchange reserves (Sovereign Supply) is currently at an all-time high of 13.34 million BTC.

As long-term holders increased, so too did the amount being held in futures. Year-to-date, Open Futures Interest increased by 97%, standing now at $9.57 billion. However, the futures trading volume of Bitcoin declined by 16% down to $36.7 Billion/day.

2021’s Decisive Moments for Bitcoin

The outstanding performance of Bitcoin in 2021 was driven by breakthroughs and the widespread adoption of the crypto. Some of the key moments for the world’s largest cryptocurrency in 2021 were:

- The launch of the first Bitcoin ETF – After years of waiting, the green light was given for the ProShares Bitcoin ETF in October, sparking a rally that drove the price of Bitcoi over the $68k mark.

- Bitcoin became a legal tender – On September 7th, El Salvador officially adopted Bitcoin as a legal tender, solidifying the concept that Bitcoin can indeed act as a means of exchange.

- 20,000 new Bitcoin ATMs installed in 2021 – As Bitcoin pushed on towards mainstream adoption, there was an huge spike in the installation of Bitcoin ATMs globally.

- Bitcoin received its first update in four years – The long wait for Taproot was worth it. The upgrade allowed Bitcoin to perform more complex transactions, opening up the network to the possibility of smart contracts.

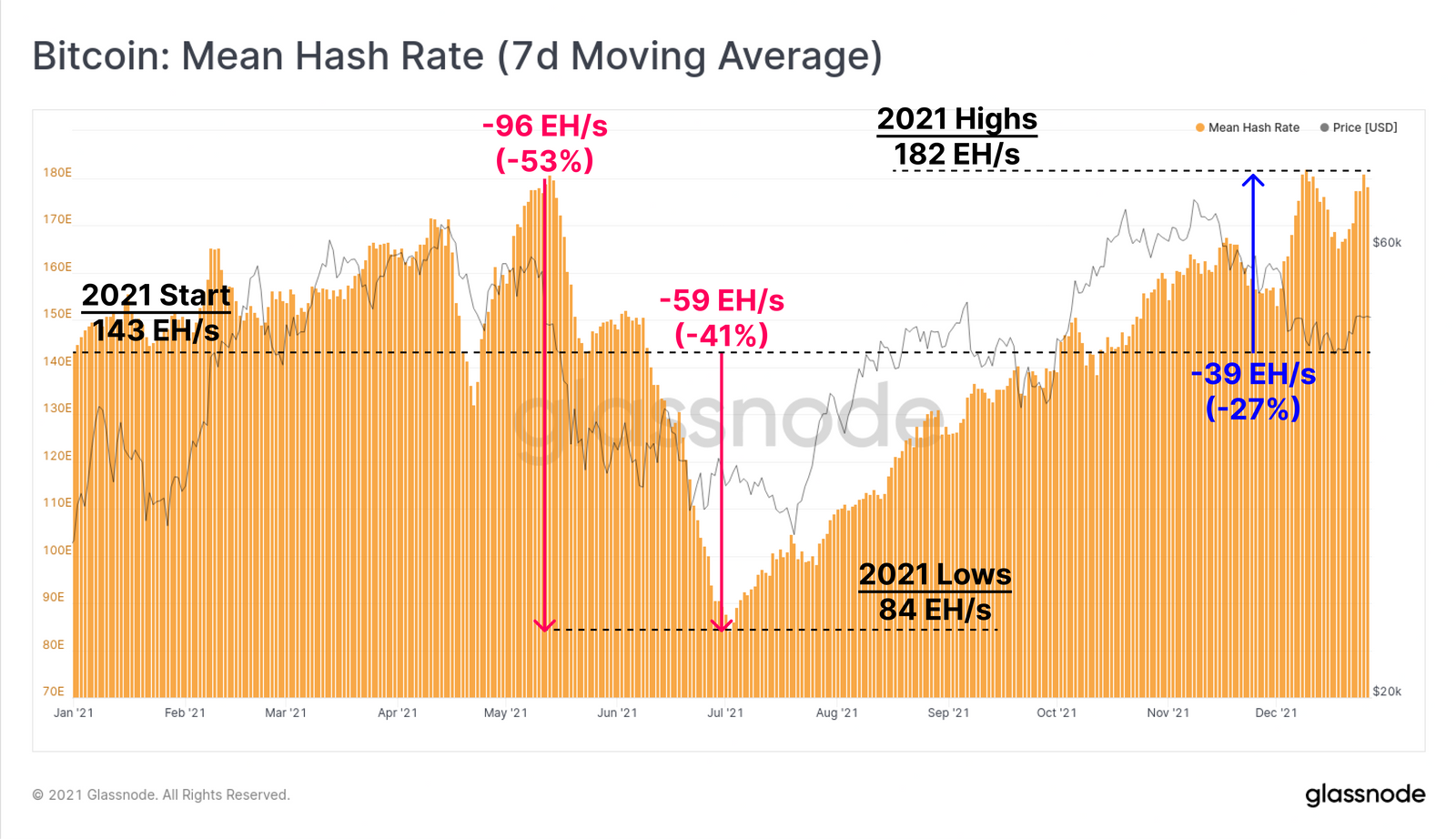

- China’s crackdown on Bitcoin and mining – While it led to a major downtrend, and a reduction in the hashrate of Bitcoin. It proved the resilience of Bitcoin as it bounced back from both downtrends.

- Massive adoption from institutional investors – In 2021, more institutional investors turned to Bitcoin, who acknowledged the asset’s use as a good hedge against inflation.

Following China’s ban on mining, approximately 53% of all Bitcoin mines were shut off almost overnight. In July, the hash rate of Bitcoin dropped below 68 Ehash/s – its lowest point since September 2019.

However, miners swiftly sought out other locations, leading to the great mining migration. As a result, Bitcoin’s mining hash rate recovered quickly, reaching an ATH of 182 EH/s. It now finishes 2021 by being 27% up from January’s rates. In addition to this, aggregate miner revenue has risen by 58% year-to-date.

Why You Should Care

Although Bitcoin is ending 2021 at a low point overall, the world’s largest crypto has reached some significant milestones this year, and those could prove to be the springboard for greater achievements in 2022.