Today, The European Central Bank (ECB) presented research on how much of the Eurozone population owns crypto. The survey indicated that one out of ten households in territories where the euro (EUR) is the official currency hold crypto assets such as Bitcoin (BTC) or Ethereum (ETH).

A dramatic increase in the size and complexity of crypto markets means the sector is on track to become a risk for financial stability that must urgently be regulated, the European Central Bank says https://t.co/TYsz0pRgjL

— Bloomberg Crypto (@crypto) May 24, 2022

The Netherlands Holds the Most Crypto

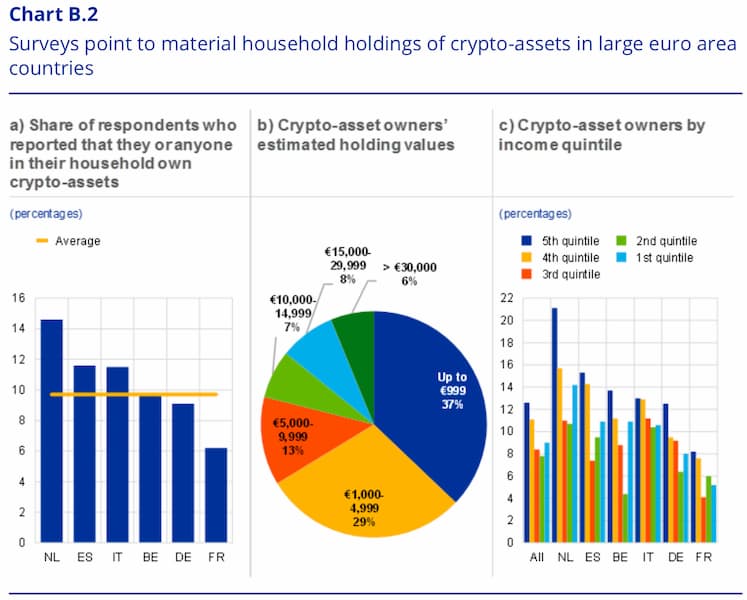

According to research conducted by the ECB, more than 14 out of 100 respondents in the Netherlands reported that either they, or someone in their household, has crypto holdings. Spain and Italy trail the Netherlands by just two points, as 12 out of 100 respondents owned crypto assets. Behind the leaders comes Belgium with 10 out of 100, Germany with 9 out 100, and France with 6 out of 100. These summes up to an average total of 1 in 10.

Retail Investing Is Gaining Momentum

The biggest slice of the pie was retail investors who invested under €1000. This category took up 37% pie chart, while another 29% was covered by investors who hold up to €5000 worth.

According to the Consumer Expectations Survey, the people most likely to hold crypto are young educated males. Interestingly enough, financial literacy seemed to be a key factor, but citizens who with low financial literacy are far more likely to invest in cryptocurrencies than those in the middle.

The same rules applied to income. It is logical to assume that those who earn the most would also invest more. Indeed, 20% of the wealthiest interviewees in each of the 6 countries held the majority of crypto. However, the lowest income households of the 6 countries tended to invest in cryptocurrencies more frequently than those with an average level of income.

An EU Crypto Bill Is on the Way

New EU regulations for crypto are already in the works, and the ECB has stressed the demand for a legal framework: “As this is a global market and therefore a global issue, global coordination of regulatory measures are necessary. Based on the developments observed to date, crypto asset markets currently show all the signs of an emerging financial stability risk”.