- The proposal to turn the fee switch on for selected pools on Uniswap V3 has gone through and will be rolled out in phases.

- The traders on Uniswap should largely stay unaffected as long as the TVL in the selected pool doesn’t change drastically.

- According to a study, more than 90% of liquidity providers surveyed said they would be “very supportive” or “somewhat supportive” if the funds would increase Uniswap trading volume.

- The impact on UNI holders uncertain as there has been no indication that the protocol fees would be distributed to token holders.

Uniswap’s proposal to test a “fee switch” for some pools was first put forward in July, but the vote was postponed pending further engagement from the community. The motivation behind the proposal has been to gauge the impact of a fee switch on growth, liquidity, and trade on some of the biggest pools on the platform. The proposal has sparked some engaging debates, and on December 2, the decision was made to move forward with it.

Update from @lay2000lbs and @guil_lambert on the fee switch proposal https://t.co/VB2pEngV6Y

— Uniswap Foundation (@UniswapFND) December 2, 2022

The fee switch will reduce the fees accrued to LPs and potentially increase rewards for UNI token holders. If there is no fall in liquidity for the selected pools, the proposal may be considered a success and lead to the activation of the fee switch for other pools in the future. The key objective of such a proposal is to identify and fulfill the protocol’s goals – growth, liquidity, and sustainability.

Impact on Traders

The traders on Uniswap should largely stay unaffected as long as the TVL in the respective pool doesn’t change drastically. Since lower liquidity in a pool leads to greater price impact, a large fall in the TVL could impact the prices quoted to traders.

Sponsored

However, since the pools selected for the pilot are the ones with some of the largest TVLs, traders should see no noticeable difference, and any impact on the volume could be attributed to broader market conditions.

Impact on Liquidity Providers

Fees form the basis for liquidity provision and are meant to be a key motivator for LPs. Any reduction in the fees should impact the behaviour of LPs, but since Uniswap dominates over 65% of DEX volume, they may have very few alternative DEXs to go to.

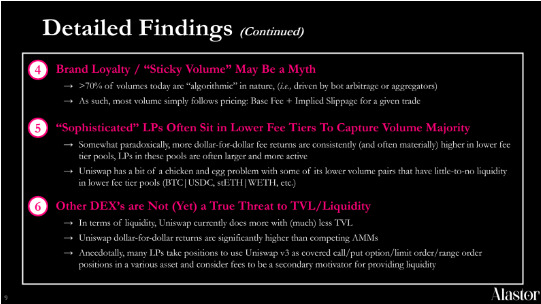

Source: Alastor Report

According to research funded by the Uniswap Foundation, over 70% of the volume on Uniswap today is algorithmic so trading follows the “Base Fee + Implied Slippage” pricing. Consequently, Slippage is impacted by the TVL of a pool, so if liquidity is driven away from the selected pools, the volume may also go down.

Sponsored

However, the same study found that more than 90% of liquidity providers surveyed said they would be “very supportive” or “somewhat supportive” if the funds would increase Uniswap trading volume. Naturally, the response aligns with our expectations, as liquidity providers always look for higher returns. The research also highlights that the “true competitor” for Uniswap TVL is not another AMM, as less than 30% of liquidity providers surveyed said that their second choice of capital allocation was providing liquidity on a competing AMM.

Impact on UNI Holders

There are open questions about how a fee switch is going to impact UNI holders. The initial proposal didn’t mention any plans to distribute the fees, so it would be interesting to see the impact the proposal has on the concentration of token holders. The funds generated could boost the Uniswap ecosystem through public goods funding, building protocol-owned liquidity, and funding grants for different projects.

Impact on Protocol

These risks generally fall into three categories: (1) legal issues surrounding fees on trading pairs, (2) impact on the UNI token, (3) having the right organizational structure for tax purposes.

— Porter Smith (@_portersmith) December 8, 2022

Certain legal risks associated with the impact of fee switch may impact the DAO itself. If the fee switch is turned on, the Uniswap DAO will have control over profits which might have tax implications. Additionally, the protocol earning profits from trading activity could involve investment contracts which can lead to the application of US securities law. Again, there are more questions than answers regarding the impact it will have on the Uniswap DAO, and is something that has become the center of discussion on the governance forum.

On the Flipside

- The fee switch proposal should not be seen as a bullish indicator, but rather as an experiment which will guide the protocol’s future actions. A fall in liquidity or TVL for Uniswap could mean they turn the fee switch off again.

Why You Should Care

Being one of the largest DEXs in the space, Uniswap’s allocation and impact of the fee switch will set a precedent for the industry and will affect many participants in the space. It will be interesting to see the development across certain metrics as the community prepares for the fee switch to be activated and rolled out in phases over the coming months.