You have probably noticed that ETH gas fees don’t look very attractive when the markets are busy. This problem arises every time the network gets more traffic than it can handle and we are finally on the verge of discovering viable alternatives.

xDai is a sidechain for the Ethereum network and unlike ETH it uses the xDai token to settle transaction fees. This allows users of this chain to get fast and reliable transactions for a fraction of a cent. Such flexibility has allowed new projects to offer alternative solutions and one of them is Honeyswap, a Uniswap fork running on the xDai chain that has all the same functionality but without the costs.

Transitioning to a Layer 2 solution

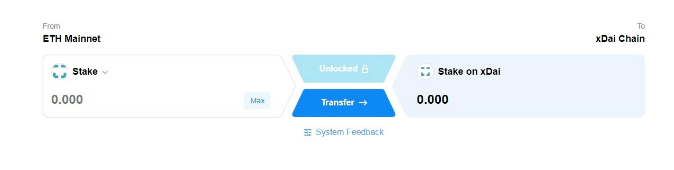

Users that want to move their Ethereum-based tokens to a sidechain would need to use a token bridge. In this case that would be the xDai OmniBridge.

Sponsored

Bridging your tokens is very straightforward and easy. The only tricky part would be adding the xDai network to your Metamask. Once the process is complete users are free to interact with the network in the same way as with ETH mainnet. As more time passes more Ethereum-based projects will be forked over giving more functionality and usability to this new scaling solution.

How can Layer 2 benefit you as a user?

Ethereum users that make trades on decentralized exchanges will find Honeyswap more than useful.

Not only does it provide a place where you can trade with almost no fees but it has the same governance model as Uniswap so providing liquidity is an option but with much lower costs. Due to low activity on the chain daily volume isn’t anywhere near Uniswap but it is constantly on the rise.

Sponsored

As far as governance goes, decentralization is the main theme on the xDai chain. Honeyswap was born out of the 1Hive DAO that follows strict rules and makes sure that everyone has a say in decision making. Those that own Honey (HNY) are able to vote on proposals and shape the future of Honeyswap with decentralized governance.

On the inside, Honeyswap works just any other Uniswap fork but the vibrant community around it is what makes it more valuable with every passing day. Thanks to their proposals liquidity providers can occasionally farm Honey and get even more value out of their pooled tokens. Those that contribute to the growth and healthy development of Honeyswap can also be rewarded which further strengthens the case for distributed and decentralized governance.

Is moving to Layer 2 worth the trouble?

It really depends on the services you require. Currently, it is more profitable to be a liquidity provider on Uniswap but the costs of participating in pools due to high network fees make it impossible for small investors to participate. Those that would pool a few hundred dollars worth of crypto on Uniswap would need to keep it there for at least a few months before they make back what they spent on the transaction fees alone.

All of the problems that come with high network fees on ETH can be solved with L2, it is just a matter of solving the convenience issue. Once bridges become more efficient and easy to use, users should slowly start to migrate towards the cheaper and faster solutions provided by xDai.

When is Layer 2 adoption expected to happen?

2021 is set to be the year of sidechains because the migration has already started. User numbers on sidechains are constantly increasing and xDai is already averaging 100k transactions per day with over 700,000 wallets created.

For most traders, they are already proving to be a gamechanger because transactions come at almost no cost so making a mistake won’t cost you a few dollars in Ethereum. There is a lot of room for growth when it comes to L2 as they are still growing and evolving. For those that are interested in joining the discussion, 1Hive has a dedicated forum where new ideas are discussed and implemented.