Whether you have knowledge of finance or not, there is a good chance you have come across the term “collateral” at some point. You have likely encountered “collateral” as a term used by people who want to borrow money or other valuable assets from a financial institution, such as a bank, lending institute or other related organizations.

This definition of “collateral” is absolutely correct. However, there are more intricacies for what collateralization can mean. So, let’s quickly run through what collateralization is and what it entails as a financial process.

Understanding Collateralization

Although it is described differently across various sources, collateralization is essentially the process by which a borrower pledges a pre-owned asset as assurance that the lender can recoup their capital in the event that the borrower defaults on their loan, or fails to fulfill the lending terms.

Sponsored

Prior to the inception of decentralized finance (DeFi), collateralization was a term commonly thrown around in traditional finance. Aside from the banks, collateralized loans are also common in the stock and forex markets.

To give an example, in margin trading, an investor borrows money or other valuable assets from a broker in order to buy stocks. However, to do this, the investor must set aside a sum in their brokerage account as collateral (typically either equal to, half of, or greater than the agreed upon amount).

Once this is done, the loan increases the number of shares the investor can buy, thereby multiplying their potential gains if the shares increase in value.

Sponsored

In the same vein, this move also increases an investor’s exposure in the event that the shares don’t increase in value. In this case, a broker can retain possession of the collateral, while the borrower tries to fulfil the obligations laid out in the terms of the borrowing agreement.

While collateral has been used for hundreds of years, not much has changed in terms of how it functions. However, collateral management did not begin until the 1980s, when institutions like Bankers Trust and Solomon Brothers began accepting collateral against credit exposure, at around the same time that collateralization of derivatives exposures was becoming more widespread.

Ultimately, collateralization is the use of a valuable asset to secure a loan; if the borrower defaults on the loan, the lender may seize the asset and sell it to offset their losses. Collateralization can be compared to insurance, but for lenders. With all that said, how does collateralization work?

How Does Collateralization Work?

While collateralization means the same thing across the board, it is used differently across different financial verticals. For instance, a home mortgage, car loan, and business loan are three major instances in which collateralization is required, however, there are major differences in their respective collateral values, interest rates, payment plans, and security.

According to Investopedia, the principal amount made available in a collateralized loan is typically based on the appraised collateral value of the borrower’s property. In most cases, a typical secure lender will only lend an amount equivalent to around 70% – 90% of the collateral value. This also means that a typical secure borrower offers more in collateral than they intend to borrow.

Next, we will look at how collateralization works in three major financial verticals: Real Estate, Investment (stock trading), and DeFi.

Example #1 – Real Estate

One of the major sectors for which collateralization is commonly used is the real estate sector, with the most common form of borrowing being mortgages. So how do mortgages work?

Let’s say, for instance, a man named Henderson wants to buy a house that is worth $1 million, but he doesn’t have the entire sum available to him to pay for it. Or, where he does have the funds, he is not willing to use the entirety of it to acquire a home at that point in time. So what can he do to purchase the house despite this?

Henderson can simply approach a bank (let’s say ABC bank) and request a loan to acquire the aforementioned house, and at the same time he uses the house as collateral. Generally, most banks adopt a maximum ‘loan-to-value (LTV)’ ratio when issuing such loans, implying that the loan amount cannot exceed the asset’s value.

In our case, ABC bank offers up to 70% LTV, which may differ across various banking institutes. Thus, Henderson can only receive a maximum loan of $700,000 (i.e 70% x $1,000,000) for the real estate property. Should he fail to repay that loan, plus the interest accrued, within a set period, Henderson would forfeit the property to the bank.

Example #2 (Investment in Stock/Forex)

In traditional finance, collateralization is utilized for stock and forex trading, and, more specifically, during margin trading. Generally, margin buying and trading refers to the use or investment of borrowed funds in the trade market.

In this case, the borrower utilizes other assets in their trade account (known as securities) as collateral. In most cases, this collateral is equal to a percentage of the requested loan amount, as determined by the lender.

For example, our old friend Henderson wants to borrow $10,000 for margin trading. The lender can charge 30%, 50%, or even 100% as collateral, depending on their choice, based on risk evaluation. As such, Henderson may have to reserve $3k, $5k or $10k in his brokerage account as collateral, where 30%, 50% or 100% is charged accordingly as collateral.

Regardless of which percentage is agreed upon, it is important for the borrower to strategically optimize their return on investment in order to settle the loan capital alongside the interest, while still holding onto a tangible profit after all is said and done.

Example #3 (Collateralization in DeFi)

Collateralization in decentralized finance is not entirely different from that of traditional finance, except that the former is automated using smart contracts which replace the intermediaries and risky functions found in the traditional financial system. Currently, collateralized loans are viewed as the backbone of open lending protocols in DeFi.

In DeFi, a borrower interacts with a lending protocol (system) and borrows from a liquidity pool which consists of investments made by people who can otherwise be described as lenders. Just as in TradFi, a borrower must stake a specific amount in order to be able to access a loan from the liquidity pool.

Aside from a few cases, most DeFi lending protocols offer over-collateralized loans, implying that the borrower must be willing to stake more than they are planning to borrow from the liquidity pool. Depending on the protocol, a borrower may be required to stake between 100% – 300% of the borrowed amount as collateral.

As such, if Henderson is looking to borrow $10,000 from a lending protocol like Maker DAO, which typically requires 150% of the loan value in collateral, he would be required to stake the equivalent of $15,000 until he fulfills the lending obligation outlined in the protocol’s smart contract.

Such lending obligations include the amount repayable including capital and interest, loan duration, repayment plan (if available), and so on. By now you are likely wondering why the collateral ratio is so much higher in DeFi than in TradFi. Let us explain.

Why Is the Collateral Ratio so High in DeFi?

To answer the question of why the collateral ratio is higher in DeFi, one must first establish the fact that the vast majority of cryptocurrencies on the market are highly volatile. The implication of this is that, sometimes, a lender may run at a loss, even after the borrower pays their loan back with interest. This usually occurs in the event that the value of the asset borrowed significantly increased over the period.

For instance, if a borrower takes out a loan of 1 ETH in January when the hypothetical cost of an ETH is equivalent to $10, the value of a single ETH may rise to $30 by the end of the loan’s tenure, meaning that the lender is on the safe side. However, if the value of 1 ETH drops below $10, then the lender would have run at a loss.

To correct this, various lending protocols adopt different collateral ratios and liquidity penalties which are usually in the favour of the investor (i.e. lender).

In Maker DAO, for instance, an average 150% of the borrowed amount is charged as collateral. So let’s say Henderson collateralizes his loan of 100 DAI with $150 ETH—any drop in the price of ETH below $150 would subject his loan to the 13% liquidation penalty.

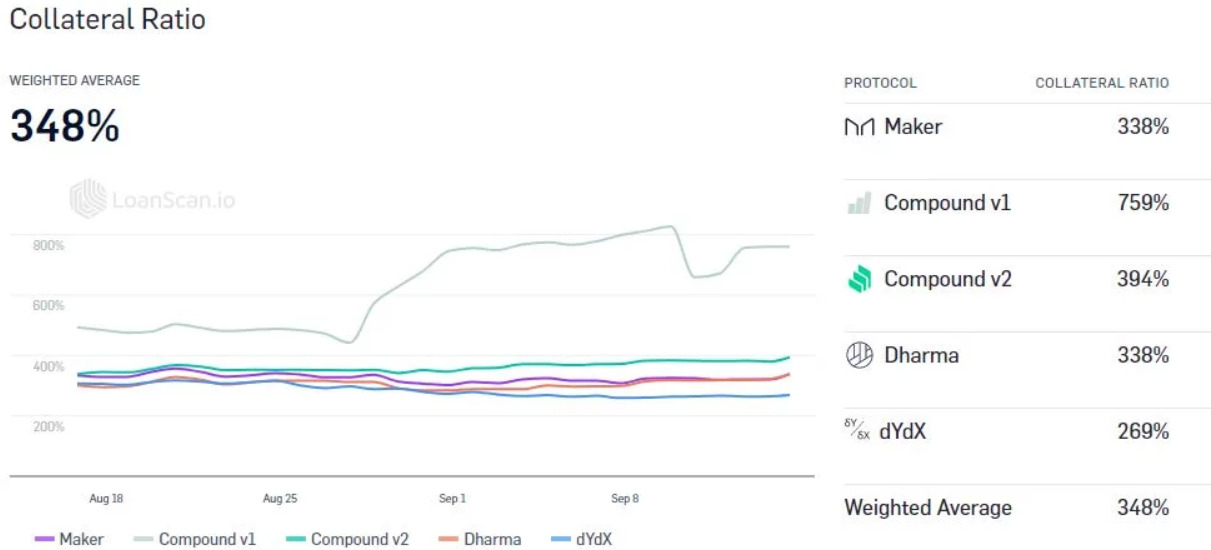

As a result, Henderson would prefer to; (1) take out less Dai or; (2) collateralize more Ether in order to avoid this penalty. With this in mind, most individuals will collateralize their loans at well over 200%, with the average collateralization ratio across the majority of platforms being 348%.

Image via LoanScan

As mentioned earlier, lending protocols typically over-collateralize their loans to give investors some safety padding in the event of volatility in the crypto markets, thus avoiding liquidation penalties on the part of borrowers.

Although the weighted collateralization ratio across most platforms is 348%, as seen in the graph above, some lending platforms, like ‘Compound’, charge collateral ratios as high as 759%.

Ultimately, most financial institutions adopt a collateralization model as a security measure, enabling them to provide a secure lending system to their customers. While there have been various attempts to build a non-collateralized lending system in both TradFi and DeFi, so far they have proven to be less-effective.