- Alameda already blew up in the second quarter of 2022.

- According to research by CoinMetrics, enormous funding from FTX helped it float.

- The funding ultimately brought trouble for the cryptocurrency exchange.

One of the biggest cryptocurrency exchanges in the world, FTX, came dangerously close to collapsing, which has shaken the market for digital assets.

In response to a “significant liquidity crunch” triggered by a large deluge of withdrawals, FTX reached a rescue agreement with its key competitor Binance, as reported by DailyCoin on Tuesday. Doubts about FTX’s financial health are said to have caused $6 billion in withdrawals in just three days.

Binance says that an agreement has been made for the purchase of FTX’s international operations, which will happen after due diligence is done. Binance CEO Changpeng “CZ” Zhao and FTX co-founder and chief rival Sam Bankman-Fried are two of the most powerful figures in the cryptocurrency industry.

Behind the Scenes of the Alameda-FTX Turmoil

Behind the scenes of the latest FTX drama, there has been a lot more going on. Sam Bankman-Fried said that the company was doing well, but he was really trying to get new funding from Wall Street and Silicon Valley whales.

Sponsored

Just a few hours later, SBF requested assistance from Binance. Sources familiar with the situation told Semanfor:

"The firm was seeking more than $1 billion in financing before the Binance deal was sealed, with one adding that by midday Tuesday, the hole appeared far deeper — closer to $5 billion to $6 billion."

Even though SBF denied it, this clearly shows that FTX did have a very serious lack of liquidity. The deal has had a big effect on the cryptocurrency market as a whole, which has dropped by a huge 10% in the last day. The result is that the entire market for crypto assets has plummeted by an incredible $100 billion in the last 24 hours alone.

Alameda Research and FTX Problems Began in Q2

Lucan Nuzzi, who is the head of R&D at CoinMetrics, put together a detailed report that says Alameda Research was already having big problems in the second quarter of this year. Nuzzi says that Alameda was only able to stay in business because FTX gave them a lot of money. However, this came back to hurt the cryptocurrency exchange in the end.

Sponsored

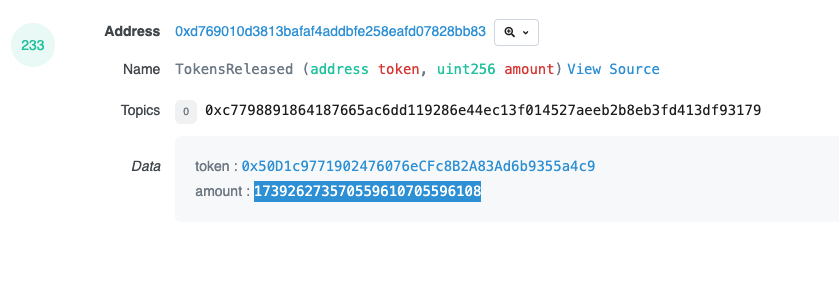

Nuzzi claims that the problem first came up 40 days ago, on September 28. That’s when 173 million FTT tokens worth $4 billion became instantly active on the blockchain. On the same day, $8 billion in FTT was transferred onto the blockchain. This was one of the largest daily ERC20 movements, and according to Coinmetrics, the biggest move of FTT in the token’s lifetime.

To Nuzzi’s surprise, he also uncovered a 2019 transaction that involved interaction with a contract related to the FTT tokens ICO. He explains that the beneficiary of the funds was Alameda Research. However, we are certain that FTX and Alameda Research are linked in some way. But what transpired next was fascinating! According to Nuzzi, Alameda moved the entire amount to the FTX-controlled address of the deployer (developer) of the FTT ERC20, adding that:

"In other words, Alameda auto-vested $4.19 billion worth of FTT just to send it immediately back to FTX."

Nuzzi alleges that Alameda blew out during the second quarter, alongside 3AC and others. It only made it to this point because, after four months, it was authorized to secure the FTX collateral worth $4 billion. As Nuzzi elaborates:

"Remember, the FTT ICO contract vests automatically. Had FTX let Alameda implode in May, their collapse would have ensured the subsequent liquidation of all FTT tokens vested in September. It would have been terrible for FTX, so they had to find a way to avoid this scenario."

Alameda’s rescue of Voyager Digital also added to FTX’s reputation as a financially stable and socially aware platform. However, FTX was actually saving Alameda from certain doom. This hurt FTX’s finances and has now come back to bite it.

On the Flipside

- After Bankman-Fried tweeted that he and Binance had agreed to a strategic transaction to sell FTX, the scenario took a sudden turn. Although the details remain unknown, the news clearly sounds like an emergency bailout in the depths of a bank run.

Why You Should Care

It’s safe to say that FTX is a major player in the global exchange market. As far as crypto companies go, Binance’s purchase of FTX is probably the biggest ever.

Read more on FTX -Binance deal: