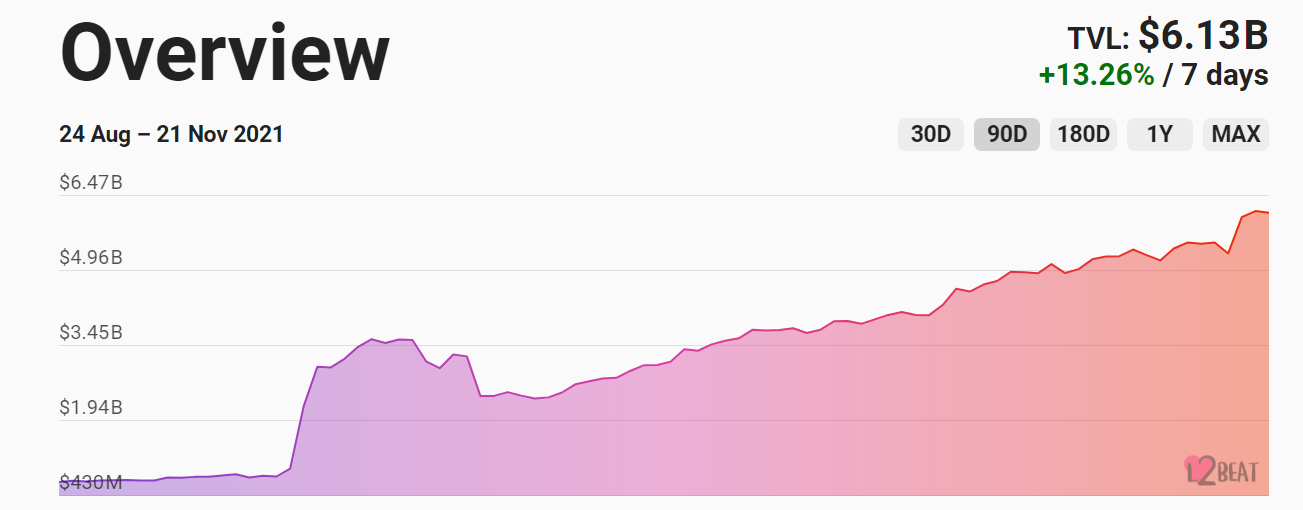

In 2021, the TVL (total value locked) in Ethereum layer two (L2) networks has grown steadily as the adoption of such protocols increases. Layer 2 is the collective term used for solutions designed to scale applications on the Ethereum Mainnet (layer 1).

By taking transactions off of the mainnet, these layer 2 solutions serve to decongest the mainnet, providing much higher transaction throughput, and most notably, lower transaction fees. These advantages have seen them receive greater adoption in 2021.

TVL in Ethereum L2 Solutions Hits ATH

As of January 1st, only $48.2 million was locked across all Ethereum L2 solutions. However, as of November 21st, the cumulative value locked in L2 solutions now stands at $6.13 billion – its highest ever.

The new ATH for Ethereum L2 solutions comes in the wake of a 13.26% surge over the last 7 days.

The total value locked (TVL) in Ethereum L2 as of November 21st. Source: L2Beat

The new ATH of L2 solutions comes as a result of increasing institutional inflow to these protocols. For example, in September, we reported on the $2 billion injected into Arbitrum.

On the Flipside

- Despite L2 solutions reducing transaction fees, gas fees on L1 have remained a source of malcontent for Ethereum users.

Top L2 Contributors

Arbitrum, an L2 solution that allows Ethereum users to settle their transactions away from the Ethereum mainnet, stands as the largest contributor, with $2.67 billion or $43.5%.

dYdX decentralized derivatives exchange is the second largest L2 contributor with $975 million, while the Boba Network is third with $863 million. Loopring’s L2 DEX is in fourth place with $580 million.

Why You Should Care

L2 solutions are playing an essential role in the growth of the Ethereum network, a fact that has been made increasingly evident by the rapid development of L2 solutions.