- USDC, the second-largest stablecoin, has encountered a surprising supply contraction.

- Circle’s decision to discontinue minting services for retail customers has stirred industry repercussions.

- Tether’s USDT has taken advantage of USDC’s challenges, racing towards a remarkable market cap.

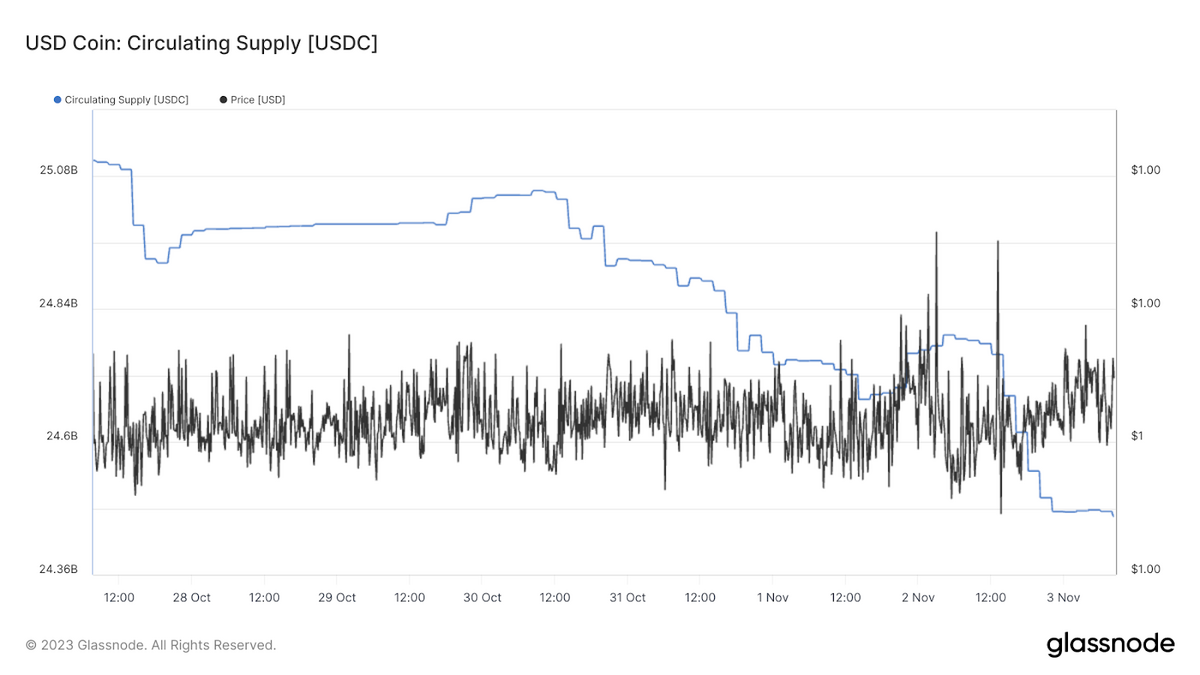

In the ever-evolving landscape of cryptocurrencies, recent developments have cast a spotlight on USD Coin (USDC), the second-largest stablecoin in the market. The recent data analysis has unveiled a noticeable decrease in USDC circulating in the market. USDC, the second-largest stablecoin, has fallen below the 25 billion mark, a level not seen since 2021.

USDC Landscape Altered By Circle’s Decision

The main reason behind this drop is the decision made by Circle to stop providing minting services to retail consumers. While this shift doesn’t directly impact business or institutional accounts, it undeniably shapes the broader USDC landscape, causing a noticeable decline in its overall supply. The supply dropped from 25.04 billion on October 30 to 24.4 billion by November 3.

Tether Benefits from USDC’s Decline

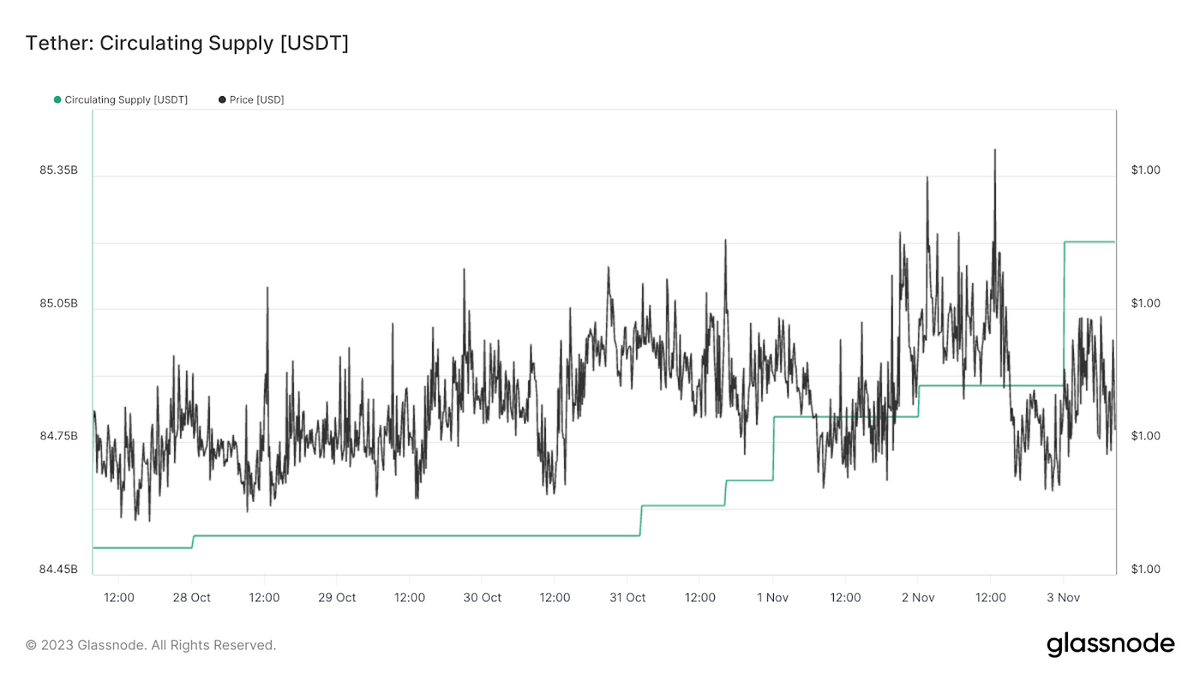

This decrease in supply follows a previous issue where USDC was connected to the U.S. banking crisis in March 2023. During this time, Tether’s USDT has been benefitting from USDC’s troubles, and it’s on its way to achieving an all-time high in market capitalization, reaching an impressive $85 billion.

On the Flipside

- The previous setback in March 2023 involving USDC’s exposure to the U.S. banking crisis has prompted increased transparency and scrutiny.

- Tether’s USDT success during this period is due to its already established position in the market, and it remains important to monitor how both USDC and USDT adapt to changes in the cryptocurrency landscape.

Why This Matters

Circle’s decision to suspend USDC minting services and the subsequent decrease in its supply could potentially affect the stability and trustworthiness of this widely used stablecoin. As Tether’s USDT gains ground, the overall crypto market dynamics may shift, impacting investors and traders.

Sponsored

To learn more about the UK’s approach to regulating fiat-backed stablecoins, read here:

UK Offers Three Agencies to Regulate Fiat-Backed Stablecoins

For insights into Japan’s significant overhaul of stablecoin regulations, click here:

Japan Set for Major Stablecoin Regulation Overhaul

Sponsored