The European Union, the world’s second-largest crypto economy, will tighten stablecoin regulations this summer by implementing its comprehensive Markets in Crypto Assets (MiCA) regulations.

For some popular stablecoins, the new rules will mean an exile, while for others, they will bring new opportunities to tap into the $11.79 trillion EU banking market.

How will this impact everyday cryptocurrency users, both within Europe and globally? Stablecoin market participants and experts share insights with DailyCoin.

MiCA’s Wind of Change

As MiCA comes into force on June 30 this year, stablecoin regulation will instantly change across all 27 EU member countries.

Sponsored

Experts predict that enforced new transparency and compliance standards will profoundly change Europe’s crypto economy, which has a population of 448 million.

The delisting of off-shore-based stablecoins and a surge of EU-native euro stablecoins are among the most expected outcomes.

Sponsored

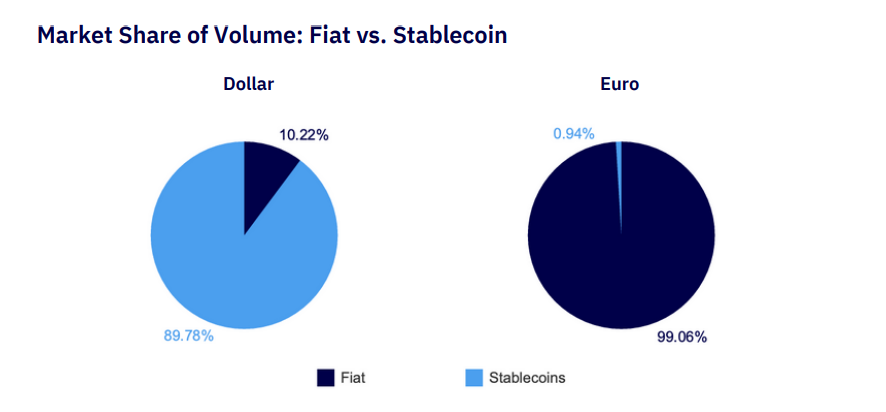

As Europe accounts for almost 20% of the global cryptocurrency trading market, the euro (EUR) ranks as the third most-used fiat currency on crypto exchanges after the US dollar (USD) and Korean won (KRW).

However, the union’s fiat currency vastly surpasses euro-pegged stablecoins in usage. More than 99% of transactions are accomplished in EUR.

The situation completely differs from the US dollar, where nearly 90% of transactions happen in dollar-pegged stablecoins, mostly Tether’s USDT and Circle’s USDC.

But even if EUR stablecoins are massively underrepresented (7.7%) compared to their USD counterparts (49%), their trading volumes are rising and doing it faster than USD stablecoins, says crypto researcher firm Kaiko.

What Exactly Is Changing?

As the initial and most obvious change, MiCA will classify stablecoins into two separate categories:

Stablecoins backed by a combination of fiat and other asset classes will operate under Asset-Referrenced Tokens (ATR).

Stablecoins solely backed by fiat currencies will fall under the classification of an Electronic Money Token (EMT) license and will be treated equally to electronic money.

This means extremely strict rules. Issuers must hold a credit institution or Electronic Money Institution (EMI) license.

In other words, they must fully meet the EU’s regulatory and capital standards, have a registered office in the EU, and have a liquid 1:1 reserve that allows fluent asset redemption at any time.

Clear governance and risk management rules, customer protection measures, compliance with anti-money laundering, and terrorist prevention requirements are also necessary.

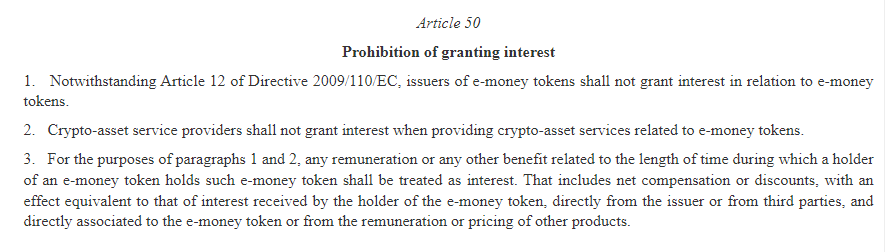

Another significant change relates to stablecoin interest rates. As MiCA aligns fiat-backed stablecoins with e-money regulations, which prevent e-money issuers from resembling banks, authorized crypto asset service providers (CASPs) will no longer be allowed to offer interest from holding and staking EMTs (thus fiat-pegged stablecoins).

“Crypto asset service providers shall not grant interest when providing crypto-asset services related to e-money tokens,” states MiCA’s Article 50.

Despite this, the stablecoin industry experts that DailyCoin has talked with agree that implementing MiCA will bring more benefits than disadvantages to the European and global cryptocurrency markets.

Euro Stablecoins Expected to Surge

“MiCA is a meaningful step forward — even if the new rules are far from perfect — and will encourage entry into the market by a number of new Euro stablecoin issuers,” claims Professor Christian Catalini, the founder of the MIT Cryptoeconomics Lab and former co-creator of Diem (ex-Libra) stablecoin.

There are fundamental reasons why such a scenario could become realistic.

With the implementation of MiCA, EU member states can offer legal clarity, which typically encourages investors and business activities.

Meanwhile, the ongoing political battles and regulatory uncertainties in the US only distance the country’s authorities from issuing clearly regulated USD-pegged stablecoins.

As of today, the combined market cap of the top five euro stablecoins sits below €310 million ($331 million). This is only 0.34% of the world’s biggest stablecoin market cap, USDT.

Yet, the emergence of fresh private initiatives for euro stablecoins is altering the scene. Moreover, euro stablecoins could become a dominant force soon, believes Svein Valfells, the co-founder and CEO at Monerium, Europe’s first MiCA-complaint euro stablecoin.

“Multiple industry observers and analysts—including a recent report by Cumberland—are predicting an explosion of euro-pegged stablecoins in the coming years.”

He further suggests that the primary advantage of the emergence of euro stablecoins will be an enhanced on-chain experience for individuals who use euros as their fiat currency.

Ultimately it will bring more competition and diversification in the stablecoin space. As stablecoin issuers will compete on features and transparency, this should also drive innovation.

Tokenization Should Push the Adoption

However, the main key to increased demand and adoption of EUR stablecoins would be tokenizing assets that already reside in the Eurozone or its influence areas.

As Claudio Tessone, Professor of Blockchain and Distributed Ledger Technologies at the University of Zurich told DailyCoin, such assets could be real estate or, someday, even euro-denominated bonds.

“Fractionalisation of these assets is the next level of increased utility for these assets. Moreover, if financial obligations and flows adhere to initiatives such as ACTUS [A protocol that aims to unify financial operations across all product lines at the enterprise level - DailyCoin’s note], you would have a solid foundation for sustained demand for regulated stablecoins all across the board.”

At the same time, he questions the potential growth of euro stablecoins after MiCA. Since only credit institutions and EMIs will be allowed to issue fiat-pegged stablecoins, this may automatically affect their supply, as not all potential issuers will meet the requirements.

“This is reassuring for the users but will stifle innovations. The limitations to sustainable growth of Euro-nominated stablecoins come from the end of supply and the concomitant range of services that can be built on top.”

Instead, professor Tessone sees the European Union evolving into “a sort of frontier where proven products can grow as a second stage” while internal innovations remain restricted.

Dollar Stablecoins Will Have Space Too

In the meantime, the biggest question for the European crypto community is whether EUR-pegged stablecoins will replace USD-pegged ones and what outcomes the changes will bring.

Valfells remains skeptical, as euro stablecoins remain “worlds apart” from their dollar-pegged counterpart.

“First off, euro-pegged stablecoins are starting from a very low base, with an approximately $250M market capitalization versus over $100B for USD-pegged stablecoins. They’re worlds apart in terms of usage.”

Then, in his opinion, most euro stablecoin issuers do not comply with existing e-money regulations that mandate that fiat-based stablecoin issuers hold EMI licenses, a requirement confirmed in MiCA.

Finally, MiCA rules do not prohibit authorized European issuers from launching USD-pegged stablecoins in any of the 27 EU member countries.

The only thing that Monerium’s co-founder is certain of is that a clear legal environment will wipe out unregulated and off-shore stablecoin issuers that do not meet compliance criteria:

“In Europe, compliant USD stablecoins, like the USDe, will replace the offshore stablecoins, like the USDT and the USDC.

We believe there will be an on-chain eurodollar market where we see global markets adopting European USD stablecoins because there’s more clarity here than in the US,” states Valfells.

As of the time of writing, USDT and USDC are still the most widely used stablecoins across cryptocurrency exchanges, with 75% to 85% of weekly trades accounting for both coins.

Worries of Liquidity Leaving the EU

Crypto market participants also see various issues the EU stablecoin market will face as MiCA comes into force.

After crypto exchanges are forced to delist non-compliant stablecoins with MiCA, Jean-Baptiste Graftieaux, a global CEO of Bitstamp crypto exchange, expects disruption in the EU markets.

“This is going to be a hard ask for many, particularly those based outside the EU. However, it’s unlikely to impact the market in stablecoins outside of the EU, so we will still see the stablecoins maintaining liquidity globally.

Our prediction is that the stablecoin market as a whole will not be impacted when MiCA regulations are introduced, but there’s a real possibility it could slightly move away from the EU.”

In addition, we should not forget the interest granting ban, which will be imposed on European CASPs dealing with fiat-based stablecoins, notes Tessone.

The professor predicts that liquidity providers may focus on crypto-assets instead or move outside the EU. However, this will not cause any significant negative impact.

“It is not a big challenge to anybody; most of them are global anyways and can move to jurisdictions that are more understanding of these options.”

Issues With Proper Enforcement

Meanwhile, the Monerium EMI co-founder points out that the biggest challenge is the lack of proper enforcement of the MiCA rules.

He notes that Europe has led by implementing comprehensive regulations like MiCA for digital assets. The region is “head and shoulders above most of the world in this regard,” yet effective supervision is the key for those rules to be effective.

“Regulations are ineffective unless enforced. If the rules aren’t enforced, non-compliant issuers will gain an unfair advantage, including some of the biggest issuers currently in the stablecoin market.”

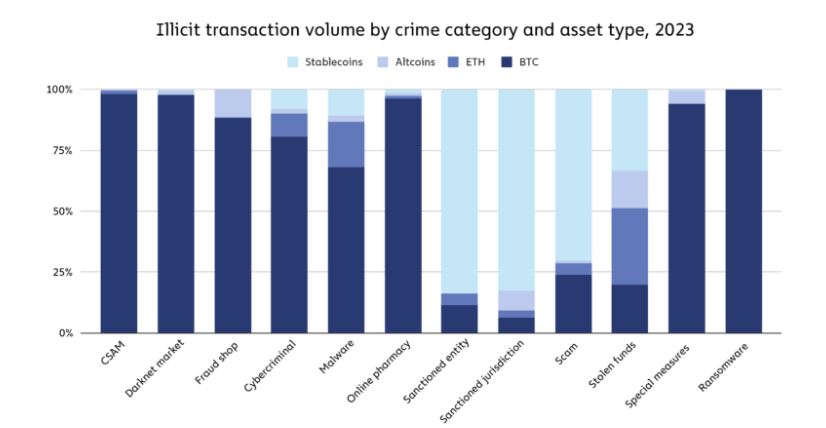

As of today, the usage of stablecoins in illicit financial activities has reached an all-time high, per the recent crime trends report from the crypto intelligence firm Chainalysis.

The majority (61.5%) of criminal financial activity is driven by sanction evasion. In the meantime, the offshore-based stablecoin Tether has increasingly appeared in investigations related to terrorist financing, sanction evasion, and money laundering.

Meanwhile, enforcement of anti-money laundering (AML) measures within the EU has issues. Even though Crypto Asset Service Providers (CASPs) are obliged to report suspicious transactions, it doesn’t mean they always do so.

For example, in Lithuania, where over 500 new companies received CASP licenses last year, crypto service providers reported only 63 suspicious transactions, as a local Financial Crime Investigation Service (FCIS) spokesperson told DailyCoin.

Effect on Innovations

Experts agree on the significant role of MiCA in clarifying the cryptocurrency space across the European Union. However, their opinions differ regarding its impact on innovation development.

While some argue that added stability will foster further innovation in cryptocurrency markets, others believe the European Union has jumped too early into regulating crypto technology.

According to them, that will inevitably stifle innovations, particularly when it’s unclear which aspects of the technology could drive competition in payments and financial services.

Nevertheless, with the legal clarity that MiCA brings, the relevance and demand for euro stablecoins will further increase, eventually unlocking the $11.79 trillion EU banking market.

Check out how the EU’s new CASP will affect the investors:

MiCA Tames CASPs, But How Does It Affect Retail Investors?

Dig deeper into the roots of Tether (USDT):

Tether (USDT): A Giant With Feet of Clay