Stablecoins, which are cryptocurrencies that essentially have their value pegged to the U.S. dollar or other FIAT currencies, have increased in overall size and volume over the past few months, while Bitcoin (BTC), among other cryptocurrencies, have seen a rapid decrease.

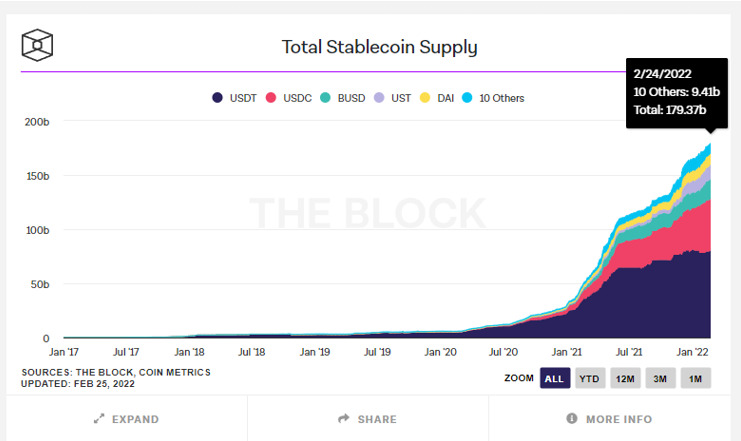

Aaccording to Coin Metrics Data compiled by ‘The Block‘, the total market capitalization of stablecoins stands at $179.37 billion, as of this writing, which is a laudable increase from the $38 billion recorded just a year prior.

Crypto Traders Are Moving Their Holdings to Cash

This surge in market value showcases that cryptocurrency traders are increasingly moving their holdings to cash. Bitcoin’s prices have consistently collapsed since November, and many smaller coins have posted even larger declines as a result.

Companies such as Voyager Digital have also announced plans to allow users to buy traditional stocks using USD Coin (USDC).

On the Flipside

- Rather than move money out of crypto-trading exchanges by converting them back into FIAT currencies, which could potentially be a more costly process, it is easier for investors to simply wait out the volatility through the utilization of stablecoins instead.