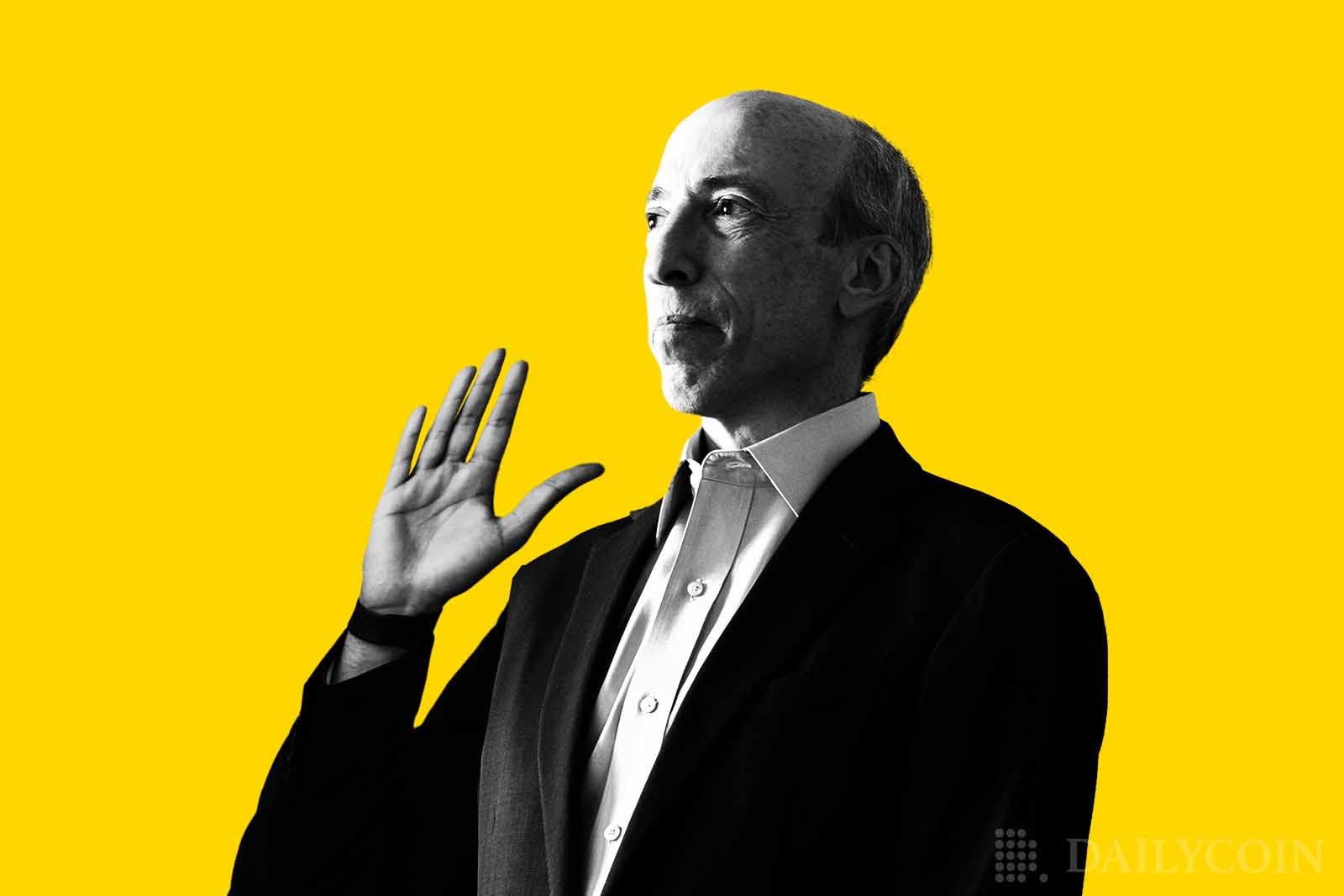

Gary Gensler, Chair of the U.S. Securities and Exchange Commission (SEC), will be testifying in front of the U.S. Senate Banking Committee, Eleanor Terrett, a journalist at Fox Business reported. “Will be interesting to see whether Gensler is asked to respond to Behnam’s answers on crypto,” said Terrett, who is recently being hailed as “crypto mom” on Twitter.

As per Terrett’s sources, Gensler will be answering Senate Banking and Housing Democrat questions on September 15, 2022.

She added that Rostin Behnam, commissioner of the Commodity Futures Trading Commission (CFTC) will testify in front of the U.S. Senate Committee on Agriculture, Nutrition, and Forestry too.

Sponsored

The CFTC and key industry players will testify on the recently introduced digital assets bill, which will give CFTC authority to regulate all digital commodities, before it is up for vote. “Unlikely to pass this year I’m told,” said Terrett.

First time anyone’s called me Mom 😂 I think I’m more in favor of Crypto Girl 💫 https://t.co/0CEfOoCR5D

— Eleanor Terrett (@EleanorTerrett) August 30, 2022

Congressman Raja Krishnamoorthi Questions Top Crypto Leaders

Terrett also threw shed light on Congressman Raja Krishnamoorthi’s tweet that said that he has launched an investigation related to fraud and consumer abuse in the crypto world, as bad actors have sought to prey upon investors.

I launched this investigation because, as cryptocurrencies have exploded in reach, popularity and value, so too has the growth in related fraud and consumer abuse as bad actors have sought to prey upon investors. https://t.co/66GJ4X0d1R

— Congressman Raja Krishnamoorthi (@CongressmanRaja) August 30, 2022

In a recent Washington Post story, Representative Krishnamoorthi, chair of a key House oversight panel, has penned an open letter addressed to federal watchdogs and top crypto leaders asking them what they are doing to protect consumers.

Sponsored

The letter written by Krishnamoorthi is addressed to Treasury Secretary Janet L. Yellen, Securities and Exchange Commission Chair Gary Gensler, Federal Trade Commission Chair Lina Khan, and Commodity Futures Trading Commission Chair Rostin Behnam.

“Without clear definitions and guidance, agencies will continue their infighting and will be unable effectively to implement consumer and investor protections related to cryptocurrencies and the exchanges on which they are traded,” stated Krishnamoorthi.

Outlining the shortcomings of the SEC, a recent Forbes article pointed out that while $1 Billion was lost due to crypto fraud in 2021, $15 Billion has been lost due to the SEC v/s Ripple (XRP) lawsuit when the SEC brought a $1.3 billion non-fraud lawsuit against the enterprise blockchain company.

On the Flipside

- The SEC Chair Gary Gensler is perceived to be hostile towards crypto companies. Recently, he compared the crypto market to the capital market and said that they shouldn’t be treated differently.

Why You Should Care

The SEC has been criticized for targeting crypto asset companies and filing over 200 lawsuits against them since 2017. The SEC has also been held responsible for not providing direction around regulations to crypto companies.