- Robinhood has received approval from its board of directors to buy back 55 million shares worth $578 million.

- The shares were purchased by FTX Founder Sam Bankman-Fried and Co-Founder Gary Wang through Emergent Fidelity Technologies in May 2022.

- The shares in question have been the subject of multiple disputes, including being seized by the US Department of Justice on January 9th.

Robinhood is reclaiming its ownership after FTX and Emergent Fidelity both declared bankruptcy. With FTX filing for protection in November 2022 and Emergent Fidelity on February 3rd, 2023, Robinhood has been allowed to purchase back the 55 million shares, worth $578 million at the time of writing, acquired by FTX through Emergent Fidelity Technologies in May of the previous year.

The shares in question were initially purchased by FTX with loans from sister company Alameda Research and served as collateral for a loan from BlockFi. However, disputes arose over the shares, and the U.S. Department of Justice eventually seized them on January 9th.

Robinhood’s Crypto Decline and Growth Strategies

Despite the challenges posed by the ongoing disputes, Robinhood remains optimistic about its business and prospects. In the fourth quarter of 2022, Robinhood’s net revenue increased by 5% to $380 million, despite reporting an overall net loss of over $1 billion in 2022.

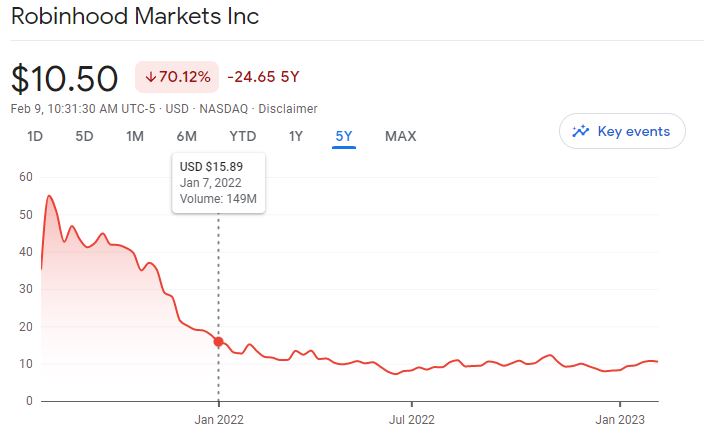

Source: Google Finance

Robinhood’s cryptocurrency-based transaction revenues from its “Robinhood Web3 Wallet” declined by 24% to $39 million in the previous quarter. However, the firm could still roll out the Robinhood Web3 Wallet to more than one million waitlisted users during the same period.

The decrease in crypto-related revenue does not detract from Robinhood’s commitment to growth, as evidenced by its latest buyback and expanding user base. This indicates a positive outlook for the company’s future in the financial industry.

On the Flipside

- Despite the optimism shown by Robinhood, some experts are concerned that the company’s recent financial struggles could pose future challenges.

- The disputes over the shares and the seizure by the U.S. Department of Justice highlight the potential risks involved in such financial transactions and raise questions about the stability of Robinhood’s business practices.

- The potential buyback plan, which Robinhood has been working on with the DOJ, has not yet been finalized.

Why You Should Care

Robinhood is a significant player in cryptocurrency, offering a popular platform for trading and investing in cryptocurrencies. The repurchase of the shares by Robinhood and its positive outlook for the future, despite recent financial struggles, are significant indicators of the stability and viability of the company, which can impact users’ confidence.

Read about Robinhood’s latest launch below:

Robinhood Launches Upgraded Wallet Amid Shares Controversy

Sponsored

For more information about the seized shares:

BlockFi and FTX Lay Claim to Robinhood Stocks to be Seized by US DOJ