B2Prime, a global Prime of Prime multi-asset liquidity provider, is dedicated to setting industry benchmarks and meeting the evolving needs of its clients. To continuously enhance its product offerings, B2Prime has improved regulatory compliance, expanded liquidity options, and enhanced leverage packages. Moreover, B2Prime has recently revamped its website, exemplifying its focus on innovation, transparency, and customer-centric service.

These changes exemplify B2Prime’s commitment to delivering educational and informative content to its clients. The following sections present comprehensive details about these improvements.

Building Trust and Ensuring Compliance

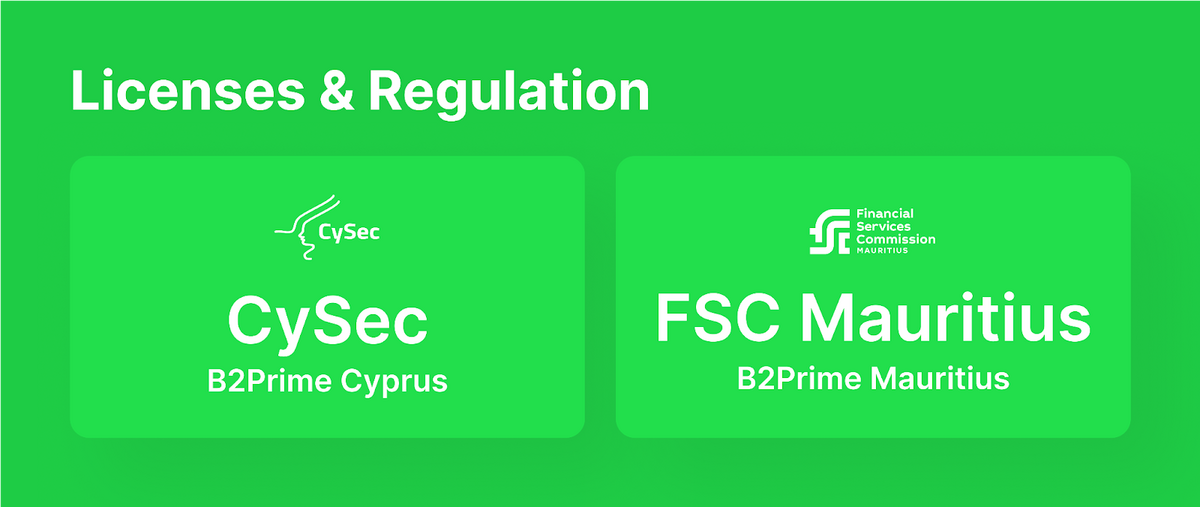

B2Prime prioritises regulatory compliance, ensuring trust and reliability for clients at the core of its operations. The company has substantially broadened its regulatory framework, enhancing its educational commitment and providing informative content.

B2Prime Cyprus (CySec)

B2Prime Cyprus is a jurisdiction established for institutional market players and European corporate clients. It offers European brokers, including those in Cyprus, access to a reliable EU-regulated liquidity provider. This provider offers various crypto CFD pairs and rare instruments such as NDFs and natural gas. Additionally, B2Prime Cyprus is authorised to onboard corporate and institutional clients outside EU countries. These countries include Malaysia, the Cayman Islands, Hong Kong, India, Indonesia, Kuwait, and Vietnam. For a complete list of countries, please refer here.

B2Prime Mauritius (FSC Mauritius)

B2Prime Mauritius, the latest addition to regulatory measures, serves institutional market players and corporate clients outside of Europe. They have introduced a new solution for settlements in this jurisdiction. Platforms like OneZero and Prime XM support fiat (EUR/USD) and digital currencies (major coins + stablecoins) for deposits and withdrawals to the margin account. This offer is designed for brokers prioritising a fully regulated liquidity provider rather than offshore entities lacking transparency and stability. For those unable to deposit fiat via bank accounts, digital currencies can be used for settlements. As a result, licensed brokers in Mauritius can now work with a regulated liquidity provider in the same jurisdiction and gain access to crypto CFDs, NDF CFDs, and various other CFD assets.

B2Prime operates under two jurisdictions, B2Prime Cyprus (CySec) and B2Prime Mauritius (FSC Mauritius), with a unified approach. Both jurisdictions share a single website and commercial offer structure, demonstrating a commitment to transparency and consistency in all client products and services.

Diverse Liquidity Options

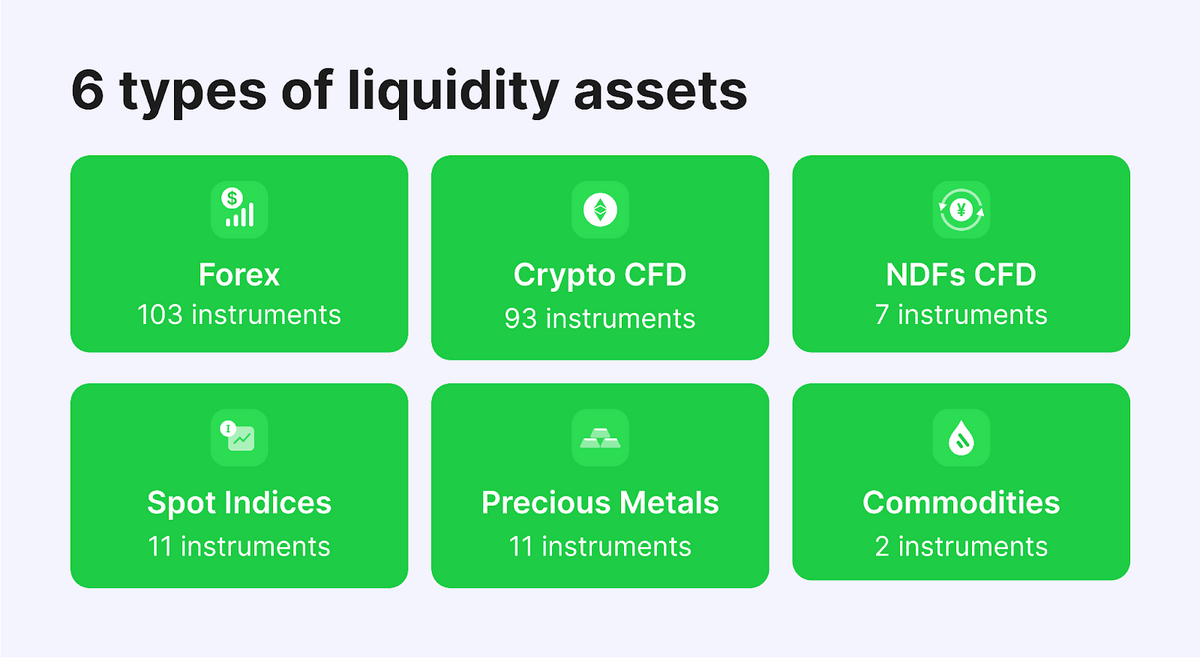

B2Prime is excited to introduce its extensive range of instruments, providing a multi-asset liquidity offering with great significance. Accessible through a single margin account, the standout feature includes 24/7 streaming liquidity for 93 crypto CFD pairs. This can be accessed via FIX API on renowned platforms like OneZero and PrimeXM, offering a competitive 10% margin on major pairs. With these features, B2Prime is at the forefront of EU-regulated liquidity providers, offering an unparalleled liquidity experience.

B2Prime offers a comprehensive range of instruments that cater to various needs. Clients can gain a distinct advantage in the industry by maximising capital efficiency. An innovative approach to offering NDFs as CFDs sets them apart from others in the industry.

Furthermore, the company has recently lowered margin requirements on 10 additional crypto CFD instruments, allowing brokers to access greater exposure with less upfront capital. This demonstrates the company’s commitment to providing unparalleled liquidity options. At B2Prime, the aggregation model ensures the finest offers in the market while maintaining competitive financing charges. With an extensive instrument offering, clients can benefit from various choices to meet their trading requirements.

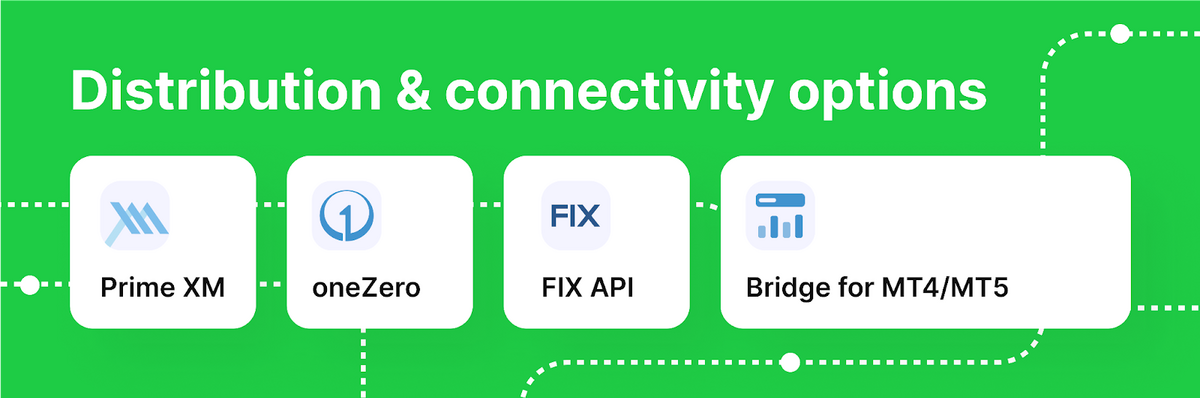

Modernised Distribution Techniques

B2Prime offers comprehensive distribution methods that are vital for delivering solutions. They possess unparalleled technological expertise with a strong focus on serving global financial institutions. Their commitment lies in providing top-tier multi-asset institutional liquidity and advanced aggregation and distribution technology solutions.

Notable tech vendors such as OneZero and Prime XM are part of their offerings, available based on the client’s discretion. Furthermore, B2Prime’s liquidity can enhance any FIX API-compatible solution. They also cater to clients with Metatrader, with Bridge Gateways for MT5 and Bridge Plugin for MT4. These options can be accessed through native OneZero/PXM solutions or Hub-to-Hub connections for those already equipped with Trading Liquidity Hub.

B2Prime seamlessly integrates with various platforms like cTrader, Centroid HUB, T4B Trading engine, YourBurse Hub, and FxQubic Bridge through the FIX API protocol. Onboarding with B2Prime allows brokers to operationalise a single prime margin account and access to all available pairs per their specification list.

Ultra-Competitive Margin Requirements

The business terms for B2Prime’s multi-asset liquidity have been carefully designed to provide clients with a competitive advantage at a cost-effective price. Here is a brief overview:

- Prime Margin Account setup: This is offered free of charge.

- The monthly minimum liquidity fee is $1,000, including one FIX API connector or a Hub-to-Hub connector.

- Optional MT Gateway/Bridge monthly fee: $1,000.

- Minimum account deposit: Clients must deposit at least $10,000, which can be used for trading.

It is important to note that the mentioned charges will be offset against the aggregated monthly commission charges based on the volume traded.

To learn more about commissions, please leave a request.

What’s New on the Website?

B2Prime has recently made several improvements to enhance its services. One notable change is the complete redesign of its website to align with its leading multi-asset institutional liquidity offering. The new layout ensures clear and intuitive navigation, making it easier for users to access vital information.

Additionally, each update prioritises the user’s experience, optimising functionality and content presentation. These improvements have provided all users with an educational and informative experience.

B2Prime has recently introduced several new features and redesigns to enhance user experience and provide a streamlined insight into its offerings and values.

One of the improvements includes visual air reduction, which involves streamlining the website to minimise visual distractions and create a more focused and clutter-free content experience.

Another noteworthy enhancement is the optimisation of Compact Blocks. By removing redundant data while preserving the essence of the information, each block becomes more concise, improving readability and navigation.

In addition, B2Prime now implements Location-Based Redirection. This smart feature redirects visitors based on their geographical location, benefiting the user experience and aiding the sales team in identifying lead origins.

Furthermore, the header and footer have undergone a revamp to be more compact, aligning with the latest UX/UI standards. This revamp allows for swift access to essential links and information.

Embracing a New Era at B2Prime

With new and improved regulatory compliance frameworks in place, B2Prime has established itself as a reliable and trusted entity. Its standout feature is the wide range of liquidity options, including an impressive offering of 93 Crypto CFD pairs. These pairs are available 24/7 and offer a competitive leverage of 10% for major pairs, positioning B2Prime as a leading regulated liquidity provider in the industry. The recently revamped website is a testament to B2Prime’s commitment to innovation and excellence.

Showcasing its dedication, B2Prime will be participating in the upcoming iFX Cyprus Expo, a prestigious conference attended by accomplished professionals in the field. This event will allow B2Prime to present its latest innovations, further reinforcing its position as an educational and informative industry leader.

This article contains a press release from an external source. The opinions and information presented may differ from those of DailyCoin. Readers are encouraged to independently verify the details and consult with experts before acting on any information provided. Please note that our Terms and Conditions, Privacy Policy, and Risk Warning have been recently updated.