The NFT hysteria took the global landscape by surprise and also sent shockwaves through blockchain networks. Christie’s auction house became the first professional art establishment to facilitate access to NFTs. The centuries-old auction house sold Beeple’s “Everydays: The First 5,000 Days” for an astonishing $69.9 million, accepting ETH payments for the first time in its history.

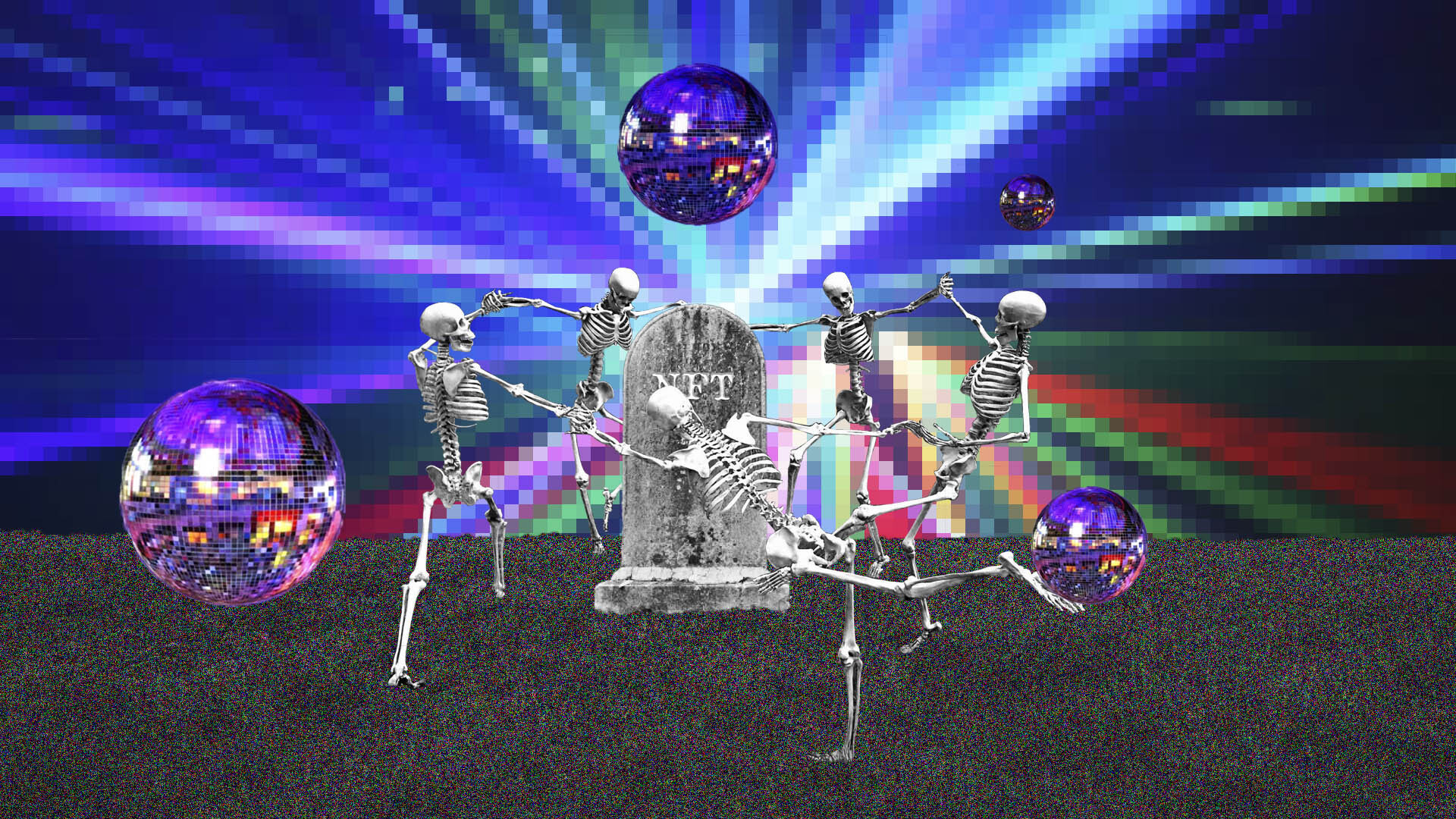

NFTs have since become scrutinized by many and have become associated with a bubble given their higher price mark-up. The concept of tokenizing digital assets has stirred enthusiasm within creative industries. That is because it allows artists to leverage their works’ unicity in exchange for financial gains. A niche previously unaware of its money-making capabilities – artists who create digital assets – generated an uplift in the market. The momentum shift in the digital space brought forth questions about its ongoing sustainability.

An Undying Necessity

Vogue writer Ann Tong asked in an NFT cover story, “Is the NFT gold rush over already or is it just beginning?” The answer depends on whomever you ask – as skeptics and devotees will offer different opinions. On May 11, Christie’s hosted a new NFT auction, this time selling nine CryptoPunk NFTs for $17 million. Inspired by the London punk movement, CryptoPunks are uniquely generated NFTs and are limited to 10,000 overall tokens. The highest-selling CryptoPunk NFT generated $7.9 million.

Sponsored

NFTs reach far beyond digital artworks that sell for millions. The vision of NFTs extends beyond mere price speculation. The highest bidder for Beeple’s “Everydays,” Sundaresan, founder of Metapurse, created a virtual universe where “virtual art” is being showcased. Additionally, metaverses, where NFTs are being put to use and showcased, are springing up across the blockchain industry. They are also making a solid case for why NFTs will hold value long after the gold rush is over.

Coming back to the gold rush sentiment of the NFT craze, journalist Amy Castor stressed the fact that NFTs caught attention because people can easily relate to the notion. Additionally, investors such as Mark Cuban agree with Castor that NFTs offer value to the digital industry. What’s more, NFTs create avenues for those previously not interested in crypto to “make money too.” As a result, we’ve seen artists and others sell unique assets left and right. Twitter’s CEO, Jack Dorsey, sold his first tweet for $2.9 million, and others such as Jake Paul joined the NFT bandwagon.

On the Flipside

- NFTs will make those that capitalized on the 2017 crypto bubble richer.

- In the current model, NFTs don’t provide the same advantages to those who are less well-known digitally.

- Static NFTs can hinder technological progress if blockchain interoperability is not granted.

The Digital Shift Of Power

NFTs are liberating prospects, and while most of the world described them as a bubble and insane, they extend a different dynamic to the intertwining digital landscape. Fears of a bubble are due to speculative factors and the promise of a digital change steered by blockchain technology. The Block recently reported that the weekly trading volume of NFTs has significantly dropped in the past three months, while NFT platform users have steadily increased, reaching a new all-time high of over 600,000.

Sponsored

Blockchain platforms, such as Decentraland and The Sandbox, mirror the progression and implementation of NFTs. In that regard, non-fungible tokens transcend the art world, enabling users to access a new reality, in which NFTs are the fuel that powers the evolution.

NFTs are bound to overinflate as the mania slowly creeps in, although it might have diminished already. However, the inherent value they bring to users and the growing digital economy overshadows the current roadblocks identified by media outlets. Additionally, venture capitalists have already framed NFTs as speculative; for now, however, they do stress that NFTs’ value will increase beyond the current gold rush.

From gaming to fashion, to sports and beyond, the technology and added value non-fungibility and blockchain bring are currently understated, as they could have a higher impact on the global economy.