As the turbulent crypto market witnessed the price of Bitcoin (BTC) plunge to $30k, MicroStrategy, one of the biggest corporate holders of the leading crypto, has seen its share prices drop to their lowest level since 2020.

MicroStrategy (MSTR) Drops Alongside Bitcoin

Business-intelligence software firm MicroStrategy, which led the world in institutional crypto investment, is feeling the effects of the recent Bitcoin crash, triggered by the Fed’s hike of interest rates.

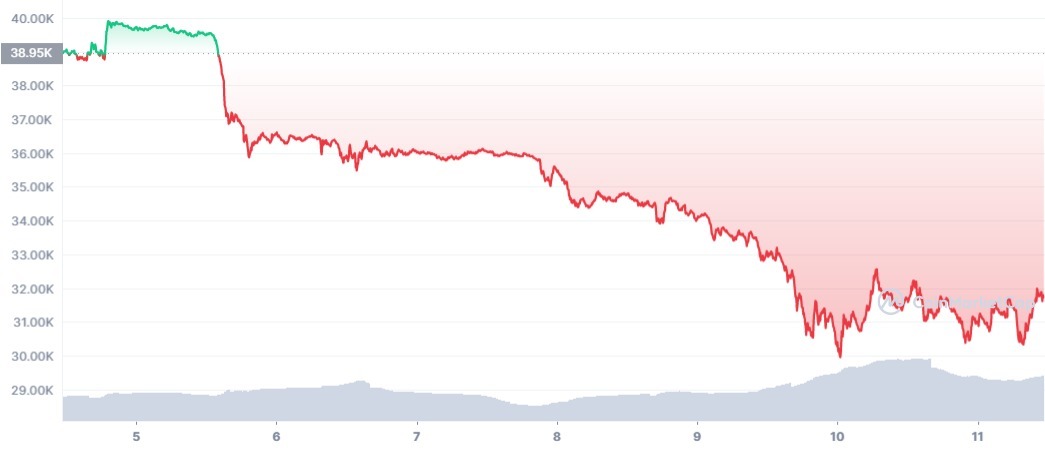

The 7 day price chart for Bitcoin. Source: CoinMarketCap

Over the last week, the price of Bitcoin has fallen by more than 20%, with the world’s largest crypto dropping to below $30k for the first time in 10 months. MicroStrategy, which holds a stash of 129,218 bitcoin (BTC), has seen its share prices plunge as a result.

The 5 day price chart for MSTR. Source: MarketWatch

MicroStrategy (MSTR) shares fell as much as 24% on Monday to their lowest level since 2020, as Bitcoin and the stock markets went into free-fall.

MicroStrategy Options Hedge Could Plunge by 96%

Although MSTR has recovered from its low of $208, recorded on Tuesday, to take its current price of $228.6 as of this writing, the company’s share prices could further diminish if Bitcoin sinks further.

Sponsored

In anticipation of further losses, some traders have put options targeting a drop to $10 – representing an approximate 96% decline from its current share prices of around $228. However, there has thus far been little interest in MSTR stock for as low as $40, $20, or even $10.

On the Flipside

- Regardless of the losses MicroStrategy has incurred due to Bitcoin’s crash, Michael Saylor, the founder of Microstrategy, has held firm in the pledge that his company would never sell its BTC.

Why You Should Care

MicroStrategy‘s committment to Bitcoin means that performance on the stock market closely that of Bitcoin.