- On Friday, FTX declared bankruptcy, upsetting the cryptocurrency market.

- Like Madoff, SBF was good at using his background and connections to make informed investors and regulators miss “red flags” that were right in front of their eyes.

- Madoff was the brains behind a $20 billion Ponzi scheme, which was the biggest financial scam in history.

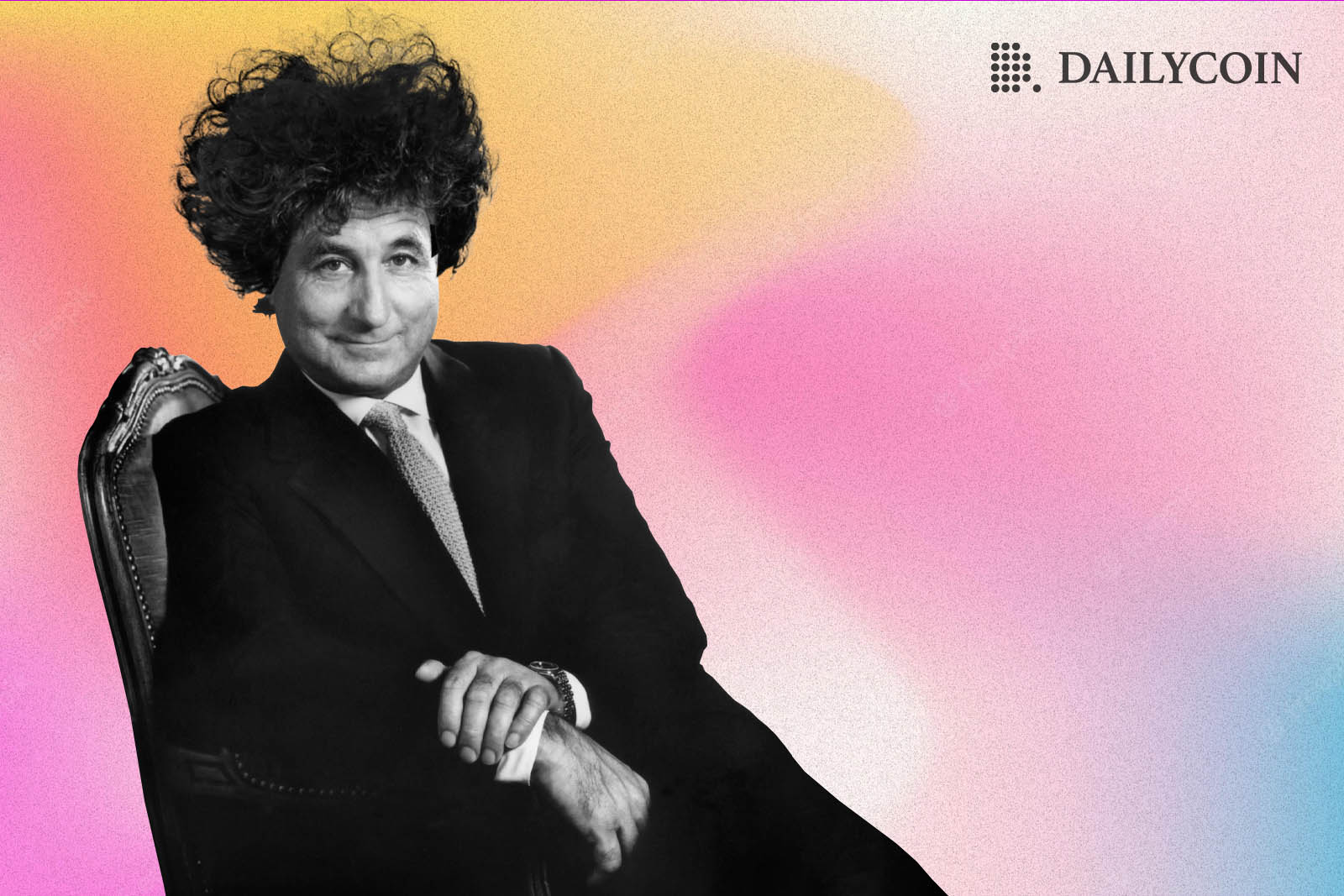

Sheila Bair, a crucial regulator during the 2008 financial crisis, said in an interview with CNN that there are striking parallels between the meteoric rise and collapse of Sam Bankman-Fried and FTX and those of renowned Ponzi scheme architect Bernie Madoff.

Sam Bankman-Fried spent only three years growing the FTX cryptocurrency exchange into a $32 billion market behemoth backed by A-list investors. All of it collapsed in a massive bankruptcy case in a matter of days. On Friday, FTX declared bankruptcy, sparking upheaval in the cryptocurrency market and posing the risk of massive losses for the exchange’s users.

According to Bair, who served as the 19th Chair of the U.S. Federal Deposit Insurance Corporation (FDIC), 30-year-old Bankman-Fried exhibited mastery at luring smart investors and regulators into overlooking “red flags” that were lurking in plain sight by utilizing his connections and lineage, similarly to how Madoff did it.

Bernie Madoff and SBF Similarities

Madoff was hailed as a Wall Street genius for many years prior to the downfall of his ponzi scam. He oversaw the finances of the affluent and famous while serving as chairman of the Nasdaq stock exchange and on advisory panels for the Securities and Exchange Commission.

Sponsored

Bankman-Fried, on the other hand, donated generously to Democratic candidates in 2022. His parents are both professors at Stanford Law School, and he has hired a number of former US regulators to work in senior positions at FTX. According to The Wall Street Journal, FTX had an application waiting with federal agencies to clear up derivatives before the bankruptcy filing.

In a statement released on Monday, Better Markets CEO Dennis Kelleher stated that FTX had a strategy of making “revolving door hires” from the Commodities Futures Trading Commission (CFTC) and other organizations “to use their knowledge, influence, and access at the agency and in Washington to move FTX’s agenda.” During his phone interview with CNN, Bair stated:

"Charming regulators and investors can distract [them] from digging in and seeing what’s really going on. It felt very Bernie Madoff-like in that way."

On the Flipside

- BlackRock, SoftBank, Sequoia, and other prestigious investors helped FTX attain its $32 billion value. The Bahamas government is now looking into the possibility of criminal wrongdoing in connection with the FTX downfall.

Why You Should Care

The good news is that, unlike Lehman Brothers in 2008, the former FDIC chief is not frightened about the FTX catastrophe endangering the whole financial system. In terms of the overall economy and financial industry, cryptocurrencies are still a new and small component. The bad news is that the crypto industry is still mostly unregulated, making it the financial world’s Wild West. And when anything goes wrong, investors are exposed.

Sponsored

FTX’s failure has hurt a lot of crypto companies, including New Huo Technology. Investors should be cautious about where they store their digital assets and who they do business with. Especially in these uncertain times.

Read more on the SBF and FTX implosion:

BlockFi has “Significant Exposure” to FTX, Denies Holding Majority of Assets on Exchange

Institutional Investors Forgo Digital Assets Following FTX Crash