- Israeli Chief Economist Shira Greenberg has outlined recommendations for crypto regulations.

- Both trading platforms and crypto issuers need comprehensive regulation, according to Greenberg.

- The economist also advocated for expanded powers for financial services providers.

- Greenberg wants policymakers to monitor the implementation of measures to ensure adequate banking services.

- Israel has, over time, made regular attempts to regulate the unstable digital asset market.

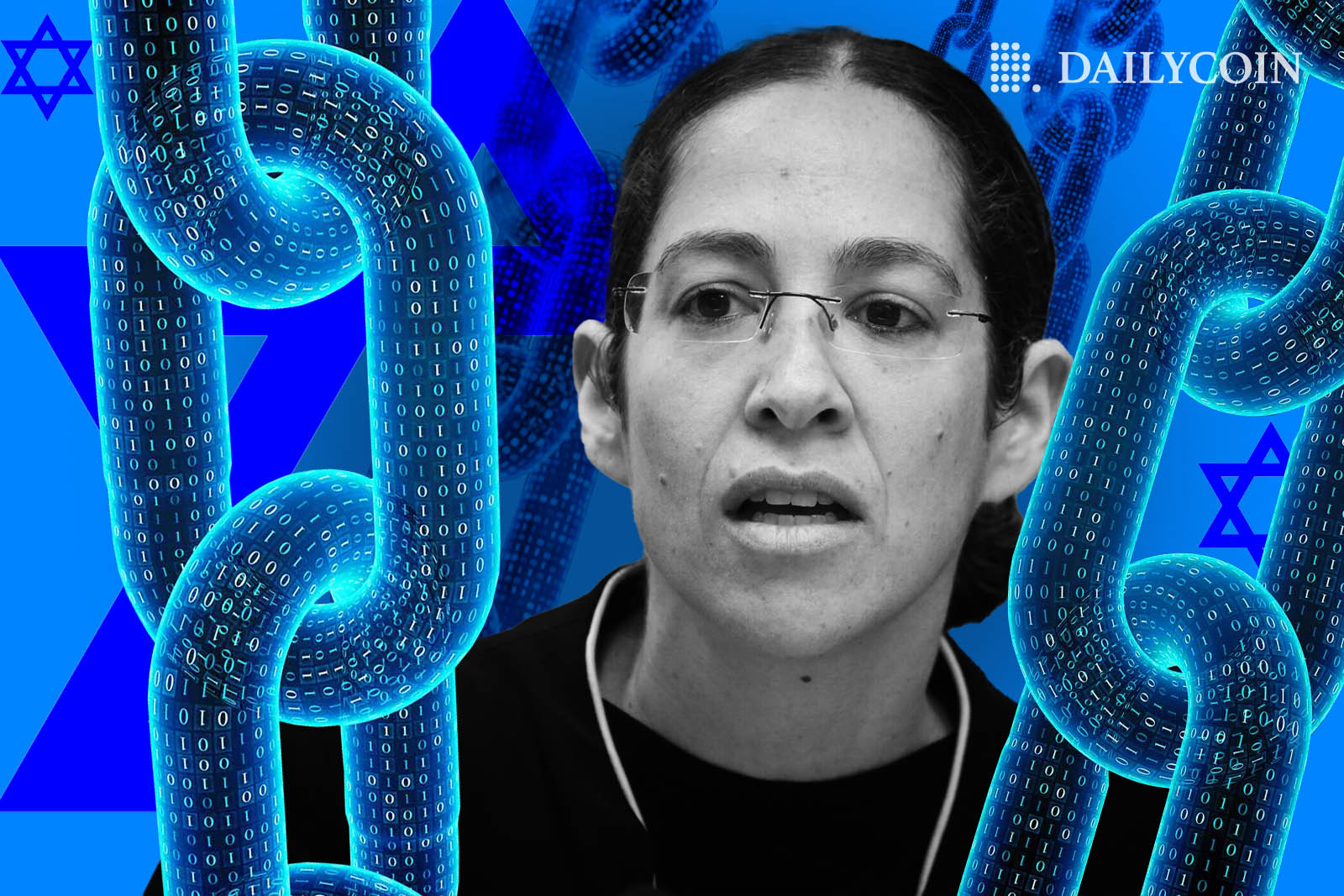

As countries around the world look to fully regulate the crypto sphere, the chief economist of Israel, Shira Greenberg, has issued a list of recommendations for policymakers in the country.

Through a 109-page report presented to the country’s ministry of finance, the economist warned policymakers against initiating policies capable of hindering crypto adoption. According to Greenberg, governments must devise a comprehensive regulatory framework to bring trading platforms and crypto issuers together by removing the barriers in the existing regulatory framework.

This, according to her, will be accomplished by clarifying government policies, which may increase the number of investment opportunities.

Sponsored

Greenberg also wants lawmakers to sustain the monitoring of the implementation of measures to ensure adequate banking services.

Call for Expanding Powers of Financial Service Providers

Shira Greenberg advocated for expanding powers for financial service providers and the Israeli Securities Authority. According to her, this helps resolve existing claims that digital assets do not fall within the scope of Israeli securities laws. Greenberg added that it would also grant the securities agency the powers to monitor every operation carried out by crypto payment service providers.

According to the economist, financial institutions must develop robust taxation frameworks for buying and selling digital assets within the country as their powers expand.

Israel And its Consistency in Regulating Digital Assets

It is worth noting that Israel has, over time, been consistent in regulating the unstable digital asset sphere. In 2017, the country inaugurated a committee to investigate and provide recommendations on the regulations of digital assets.

Following that, the committee recommended that digital assets constituting securities be required to disclose their ownership. It also advised the creation of an infrastructure for establishing a platform for trading crypto.

On the Flipside

- Despite Israel’s fintech-savvy economy and the presence of many blockchain-related startups that export their products, doing business locally with cryptocurrencies is difficult.

- In 2017, the Israeli tax authorities defined cryptocurrencies as “assets,” which created challenges.

- Crypto profits in Israel are subject to a capital gains tax, which can reach 33% depending on the value. Similarly to Belgium, Israeli businesses involved in crypto trading are subject to a 50% tax on their profits.

Why You Should Care

Due to the worsening conditions in the crypto sphere, the call for clearer and more robust digital asset regulations has undoubtedly begun to dominate the airspace. According to reports, this development has compelled policymakers across countries to be on their toes to initiate measures capable of regulating the industry and protecting investors from its inherent risks.

The latest move is yet another attempt to get clearer regulations that can bolster the crypto space and also safeguard Israeli investors.

Learn more about crypto regulations around the world:

Belgian Regulatory Body Argues Against ETH, BTC, and Other Coins Being Securities

Cryptocurrencies Could Get Attention At The G20 Summit Amid Rising Crime And Market Crisis