Since the Fed’s recent rate hike, Bitcoin and the broader crypto market have faced increased pressure, forcing investors to turn away from equities and cryptocurrencies’ riskier assets.

Sell-Off Worsens as Inflation Fear Rises

The initial impact of the rate hike saw the price of cryptocurrencies crash alongside equities. The first round of sell-off saw the price of Bitcoin fall approximately 9% after the Fed’s announcement.

However, the sell-off only worsened as the peg of TerraUSD (UST) broke. The crypto market was sent into total mayhem following the subsequent UST peg loss and Terra’s (LUNA) 99% fall.

Bitcoin Falls to 16-Month Low

The intense fear in the market sparked a sell-off, which has seen the price of Bitcoin fall by more than 30% in the last seven days.

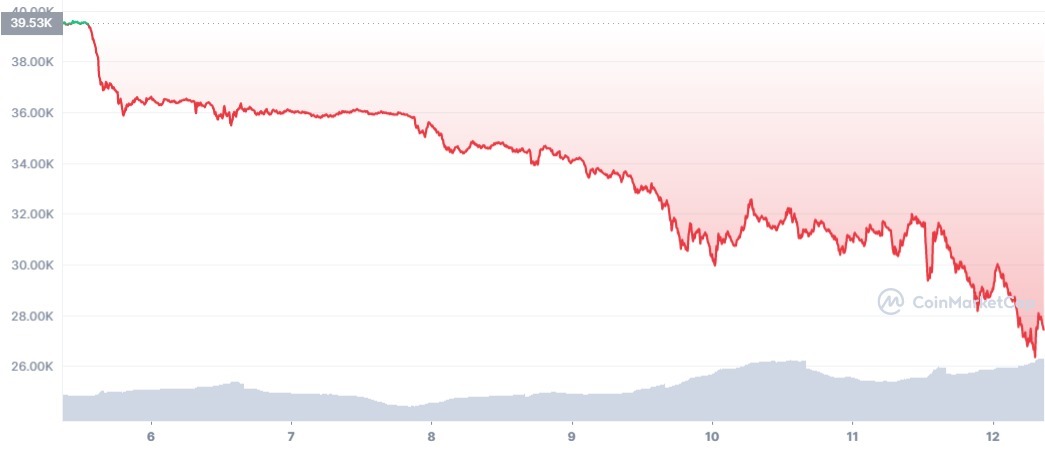

The 7D price chart of Bitcoin. Source: CoinMarketCap

The price of Bitcoin has dropped from its recent high of $39.5K to as low as $26,350. The market crash has seen Bitcoin fall under $27,000 for the first time in 16 months, wiping out all its gains in 2021.

As Bitcoin fell under $27,000 in the last 24 hours, over 428,000 traders have lost a total of $1.22 billion.

On The Flipside

- Despite Bitcoin’s plunge under the critical $30,000 level, whales have continued buying the dip, with a spike in exchange inflows.

Why You Should Care

Indications that the Luna Foundation Guard had been selling its BTC holdings added even more panic and selling pressure, which drove the price of Bitcoin lower.

Sponsored