- The US Federal Reserve has raised its benchmark interest rate by 75 basis points for the fourth time.

- By consistently raising rates, the Fed believes it can control consumer prices and bring inflation down to 2%.

- The Fed’s persistent rate increases force borrowers to spend less by making loans more expensive.

- Fed rate hikes have also affected the stock market.

- The rate hikes may bring a potential decline in the market indices of BTC.

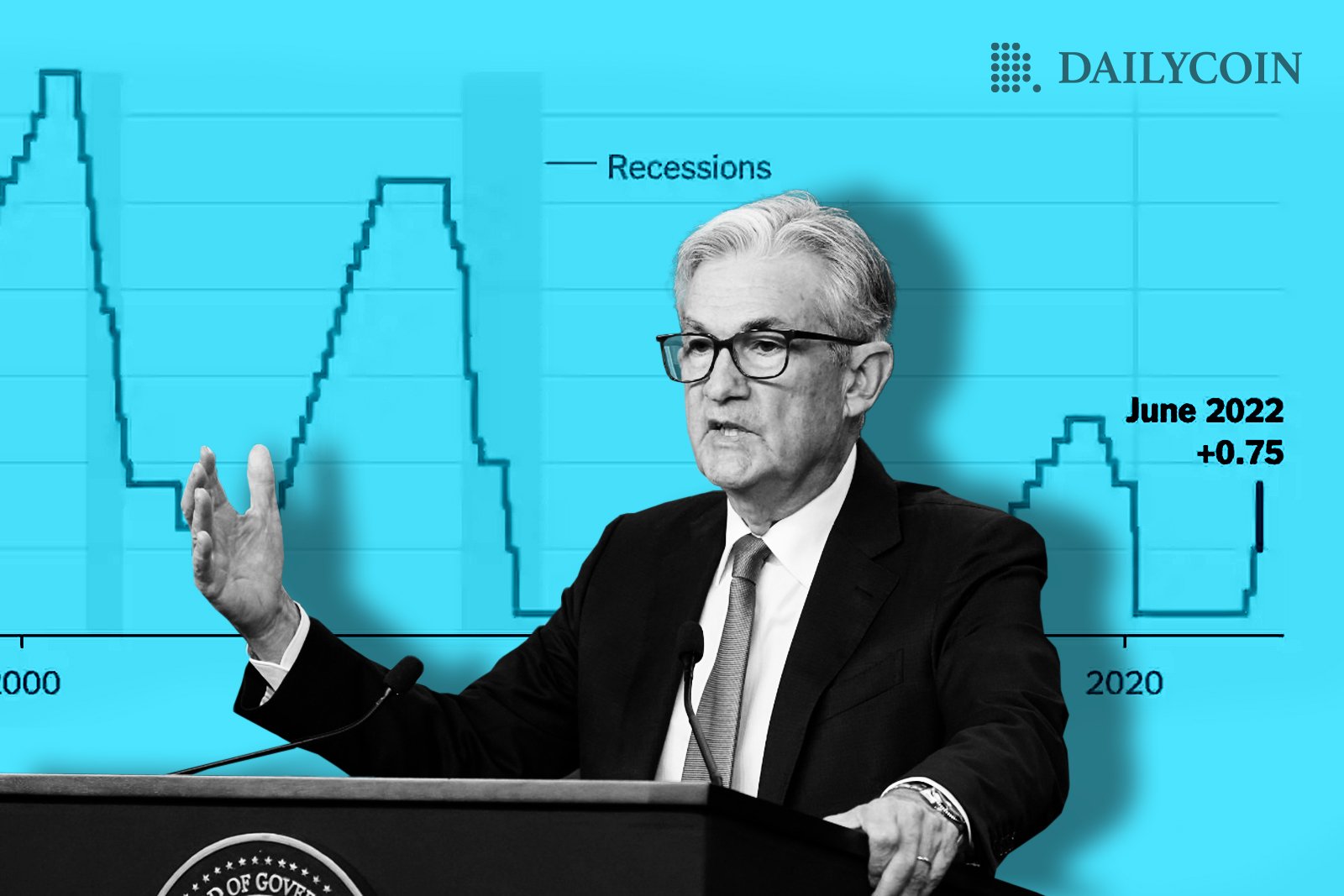

As a continuous effort to brace for rising inflation, the US Federal Reserve has hiked its benchmark interest rate by 75 basis points for the fourth consecutive time.

Recall that it has hiked the benchmark rates by 0.75% in June, July, and September, respectively. The Fed strongly believes that consistently increasing the rates can put consumer prices under control and bring down inflation to 2%. Jerome Powell, the Fed’s Chair, echoed the same sentiments in his Nov. 2 press conference.

Implications of Persistent Hiking of Interest Rate

Through persistent increases in rates, the Fed has continued to make taking loans costly, forcing borrowers to spend less. The interest rate reflects the costs associated with borrowing and saving by bank consumers. For instance, saving rates in many of the leading banks in the US have increased by 0.21% courtesy of the constant hike in Fed interest rates.

Sponsored

The stock market has also been experiencing the implications of the continuous hikes, as rising interest rates will diminish the value of each dollar in future earnings.

Moreover, the increase in interest rates will lead to a higher discount rate for future earnings and force incomes to plummet. All these macro indications will have a substantial impact on the prices of the stock, as well as digital assets.

Implications for Bitcoin

Meanwhile, the Fed interest rate hike has always had dire implications for BTC’s value. This is because the increment usually discourages investors from sustaining their BTC holdings.

Sponsored

The development will likely cause investors to explore the possibility of pumping their funds into less risky assets. This would compel them to withdraw a substantial amount from their BTC holdings, thus indicating another potential decline in the market indices of BTC.

Since the kickoff of the hike in June, numerous economic experts have been reflecting on the possible implications of the development. For instance, Mike McGlone, a renowned crypto analyst, said the prevailing market reset, occasioned by an imminent rate hike, has an enormous impact on risk assets, including cryptocurrencies.

However, he is optimistic that BTC and other risk assets will rebound.

“Bitcoin is a wild card that’s ripe to outperform when stocks bottom, but transitioning to be more like gold and bonds,” McGlone said.

McGlone still wants investors to maintain their BTC holdings, saying, “for both, pain is first to come.”

Meanwhile, the US is not the only country that has continued to employ interest rate increases to battle rising inflation. Countries like the Philippines, Indonesia, Taiwan, the UK, and others have embraced this strategy.

On the Flipside

- It is highly likely that the Fed will cut rates towards the end of next year, according to Erik Nielsen, the global chief economist at UniCredit.

Why You Should Care

- Recent hikes may affect consumer prices, stocks, and digital asset market caps, making it difficult for consumers to get their hands on them.

- As a result, the job market may also be affected, as companies may try to cut costs and lay off employees during this time.

You may also like: