- The Fed raised interest rates by 50bps, the highest since 2007.

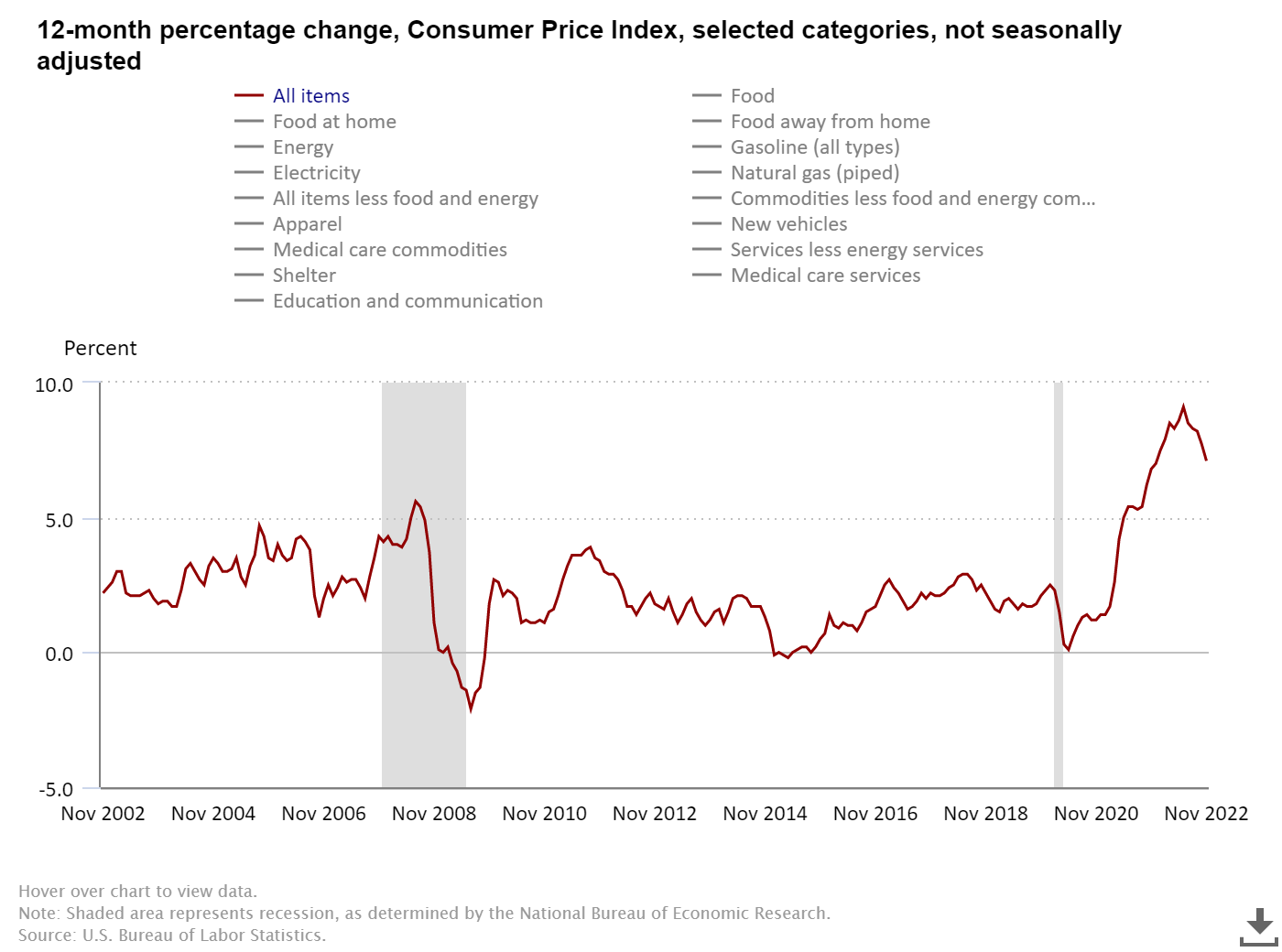

- Inflation has grown rapidly and is now three times higher than the Fed’s goal.

- In November, the Bureau of Labor Statistics reported prices rose 7.1% from 7.7% in October.

- Jerome Powell admitted that the current level of restraint is strong enough to push inflation down.

- The Fed aims to reduce demand and encourage saving.

- US stock and cryptocurrency prices were impacted due to the recent rate hike.

In a new assault against the prevailing inflation, the Federal Reserve has raised its rates by 50bps, its highest since 2007. With that, the Fed brought its benchmark target rate to a range of 4.25% to 4.5%.

Previously, the Fed intended to push the inflation rate to as low as 2%; instead, it has multiplied and is currently three times higher than its goal.

However, after more than a year of dwindling hopes, a more encouraging inflation picture is finally emerging. According to the Bureau of Labor Statistics, prices rose 7.1% annually in November, down from 7.7% in October.

Nevertheless, Powell reiterated that “historical experience cautions against premature loosening.”

Sponsored

“The inflation data received so far for October and November show a welcome reduction in the monthly pace of price increases,” Jerome Powell said in a press conference. “But it will take substantially more evidence to give confidence that inflation is on a sustained downward path.”

At four successive meetings before the last one, the Fed increased interest rates by 75 basis points.

Why is the Fed Slowing Down?

Last month, Reuters reported that Fed Chair Jerome Powell hinted at a possible slow pace during an event in Washington. Powell admitted that it’d be better if the Fed moderated the pace and divulged that they are currently at a level of restraint that’s strong enough to push inflation to their target.

Sponsored

The chair opined that moderating the increase rate might surface during the final Fed meeting for the year. With the submission of the chair, a possible 50bps hike at the next Fed meeting seems inevitable.

Growing Concerns Among Investors

With inflation at its highest point in decades, central bankers have raised their policy rates from zero to more than four percent to control it. Following the increase, investors are casting doubts over the Fed’s battle against the prevailing inflation.

However, in a statement, the FOMC submitted that the ongoing hikes would be appropriate to reach a “sufficiently restrictive” stance that will push inflation back to 2% with time.

Nevertheless, the interest rate hike hasn’t shown as many results as expected, yet inflation as of November is currently at its lowest rate since the start of the year.

In reaction to the recent FED signals, the price of cryptocurrencies like Bitcoin and Ethereum fell today, along with U.S. stocks. Bitcoin is currently trading at $17,682.53, down from its 24h high of $18303.89.

On the Flipside

- A recent Reuters report shows inflation forecasts are slightly higher than expected one month ago, suggesting there is no immediate need “to consider an imminent pause” on the Fed’s tightening policy.

Why You Should Care

While the approach of the Fed has been hawkish before the latest increment, one can easily deduce that the Fed looks to reduce demand and encourage companies and individuals to save.

You may also like:

Crypto Investors on the Lookout for the Fed’s Interest Rate Hike