Ethereum, along with its price, has long seen a steady downswing in its investment product inflows since mid-December. As a result, Ethereum went a total of nine weeks without recording any inflow from institutional investors.

Over this nine weeks, Ethereum lost $280 million to outflows, however, in the wake of this harsh period, Ethereum investment product inflows from institutional investors have seen a resurgence.

Ethereum Receives $21 Million in Institutional Investments

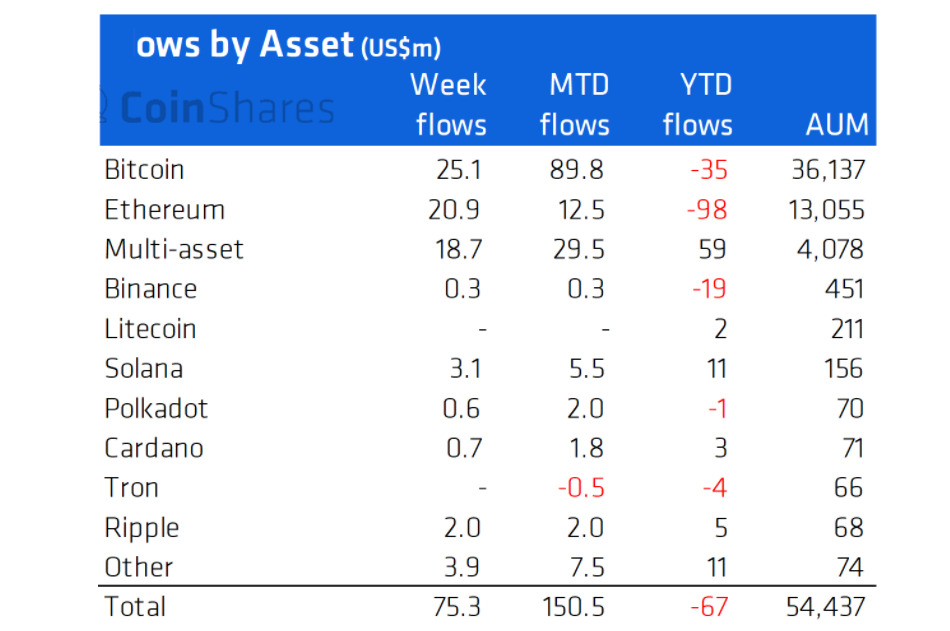

In the week ending February 11th, Ethereum recorded $20.9 million in investment product inflows, with the entire crypto industry recordeding inflows of $75.3 million.

Sponsored

There were some regional variances during the week, as $5.5 million of outflows was recorded in the Americas. On the other hand, European investment in crypto products stands at $80.7 million, without outflows.

Ethereum’s inflow was marginally behind Bitcoin, which attracted $25.1 million. This represents 28% of the week’s total inflow into crypto products.

Sponsored

The recent inflow brings Ethereum’s total assets under management (AuM) to $13.055 billion as of the week ending February 11th.

Institutional inflow into cryptocurrencies as of February 11th: CoinShares

On the Flipside

- Although this week’s inflow breaks the 9 weeks outflow drought for Ethereum, the newly recorded inflows pale in comparison to those recorded in the last quarter of 2021.

Why You Should Care

The re-emergence of institutional investors breaks a 2-month long outflow and will surely act as reassurance that investors see merit in the accumulation of Ethereum.