In the cryptocurrency sector, ‘The Flippening’ is a potential future event in which Ethereum could overtake Bitcoin as the market’s biggest digital asset. Despite the fact that ETH is severely lagging behind BTC and that it has not made a new all-time high yet, investors are still bullish on Ethereum’s dominance.

As 2021 begins, the overall crypto market is prepared to enter a stage of new price discovery. Many of us wonder which project will outperform the entire market. While developers assist Ethreum in this cycle, another COVID scare can possibly push institutions into Bitcoin.

How Bitcoin and Ethereum currently fare

Investors have continued the December rally into January, increasing the value of not only Bitcoin but of the altcoin market as well. 2021 began on a great note and numerous cryptocurrencies have revisited their old ATHs.

Since the last bull run nothing has changed as Bitcoin and Ethereum still represent the top two leading assets. However, prices tell us an entirely different story.

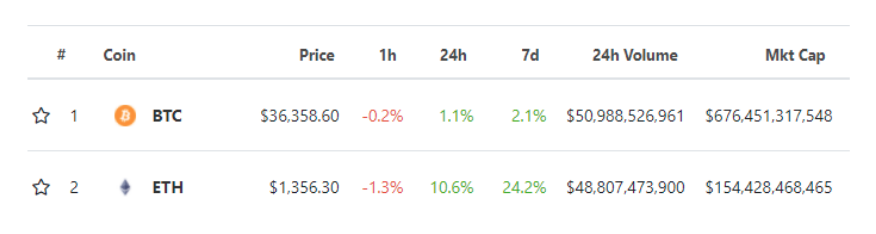

At the time of writing, these assets cost $36,394 and $1,372 respectively. BTC has more than doubled its ATH while ETH was only $20 away from breaking it.

In terms of trading activity, the two assets have nearly identical daily trading volume. Ethereum is only $2 million away from surpassing Bitcoin’s $52 million 24-hour volume.

The most important metric, market capitalization, looks especially terrible compared to the previous data. For Ethereum to get near Bitcoin, it must add $522 billion dollars onto its existing $156 billion market cap.

Will DeFi and Ethereum 2.0 help ETH outperform Bitcoin?

Most investors have two clear arguments why Ethereum will outperform Bitcoin this year: DeFi and Ethereum 2.0.

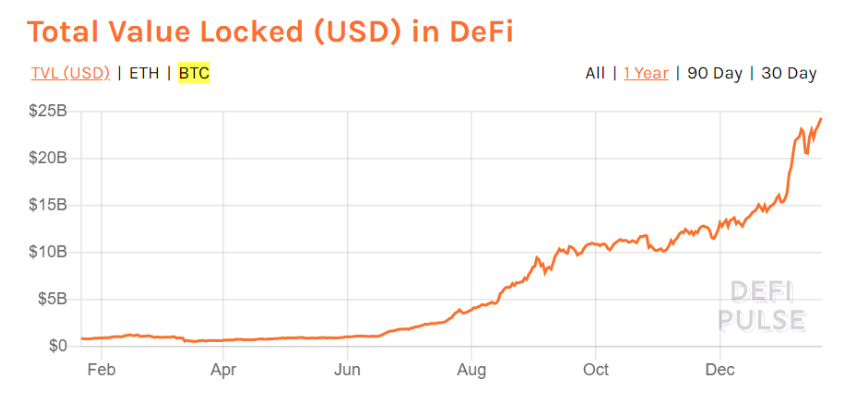

First, the explosive rise of decentralized finance (DeFi) will have a huge impact on Ether’s network effect. As such, it could replicate the same effect that ICOs had a few years back.

Market data from DeFi Pulse shows that DeFi massively increased in value in the past year. With a rise that is more parabolic than Bitcoin, this market grew from $800 million to $24 billion in less than a year.

A cynical line of thinking made many believe that DeFi is just a fad and that it will collapse soon. But after supporting a rally for such a long period of time it is clear that DeFi enthusiasts are not playing around. With the incoming network upgrade, this niche has the opportunity to drive Ethereum even further.

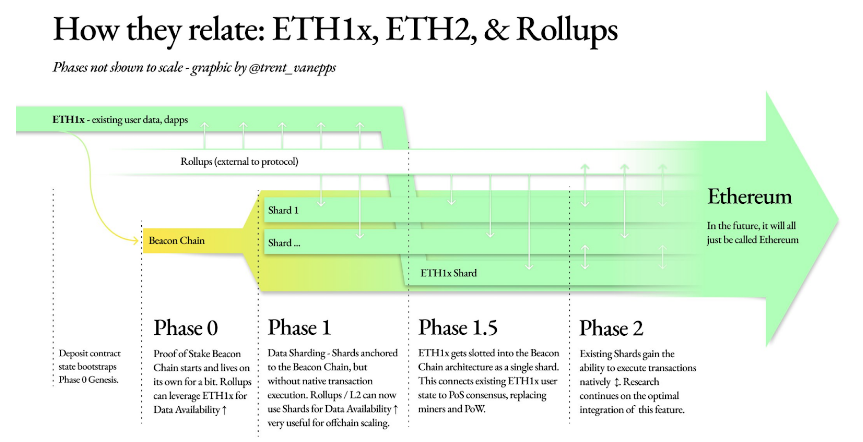

Ethereum 2.0 effectively launched on December 1, 2020, with the start of Phase 0. But for blockchain enthusiasts to see the full effects of the new Proof-of-Stake network we will have to wait until December 2021. By that date, developers are confident that Phase 1 and 2 will go live as well.

Once we get there, Ethereum should theoretically offer a scalable blockchain network that features low fees and high transaction throughput. The two characteristics would help the leading smart contract ecosystem support a much larger load and more users.

If 2021 flows smoothly, Ethereum could stop having its price dictated by Bitcoin. However, such an independent network would have to reach a sizable market cap as well.

At the current rate, Ethereum has a long road ahead as it must quadruple its market capitalization to visit Bitcoin’s range. Will DeFi and a PoS upgrade really be enough to achieve that feat?

On the Flipside

- Ethereum developers are infamous for postponing updates and delivering upgrades far later than originally promised

- A CipherTrace report notes that DeFi accounted for 50% of all crypto hacks in 2020, which might scare off new investors

- As alts only began to gain value only after Bitcoin started ranging in January, the ongoing altcoin rally might not last that long

COVID Scare Might Push Bitcoin’s SoV narrative

While smart contract fans can definitely remain confident with their DeFi and Ethereum 2.0 narratives, a much greater real-world threat currently favors Bitcoin instead.

Apart from the March crash last year, the ongoing pandemic and periodical lockdowns appeared to have supported Bitcoin’s price. Fearing that the severe measures might cripple the economy, many institutional investors have hedged against the market with Bitcoin.

BTC’s digital gold narrative assists it greatly in attracting new investors. A future set of quarantine measures could once again create a wave of institutional interest. In that case, market activity would shift to ‘tightening the belt’ and not to speculation.

As a result, most assets relying on speculation would have their bubble popped. This includes Ethereum, a project which in no way offers the same Store-of-Value features that make Bitcoin so popular today.

Therefore, what happens in the market this year will ultimately depend on external rather than internal factors. Whilst a healthier world definitely supports ‘The Flippening’ event, another deathly COVID blow will hinder Ethereum’s advances.

Bahrain-based cryptocurrency exchange Rain has received regulatory approval from the Central Bank of Bahrain (CBB). The exchange launched after raising $2.5 million in a seed funding round led by BitMEX Ventures and Blockwater, a Kuwait-based cryptocurrency fund.