Gaining more prominence as a replacement for traditional financial services providers, the Decentralized Finance (DeFi) industry saw tremendous growth in 2021, with more people joining than ever before.

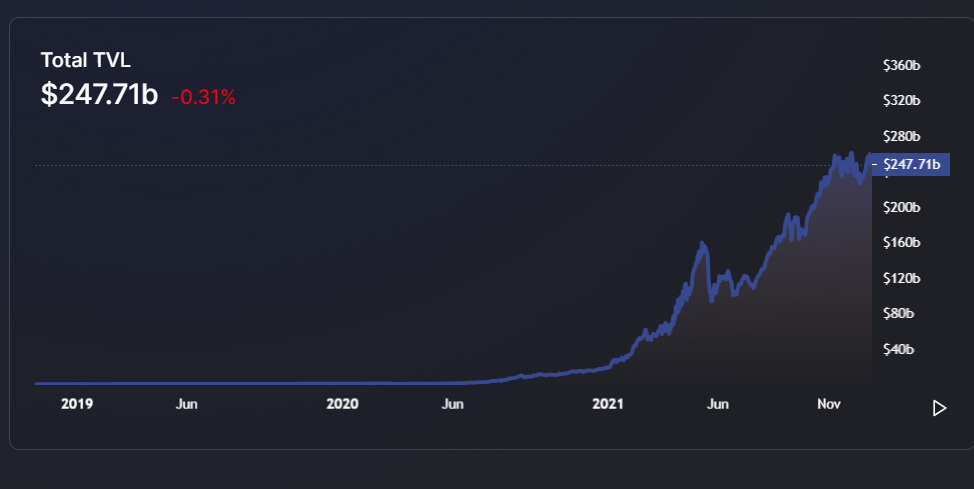

The increasing adoption of the DeFi protocols saw the total value locked (TVL) in the sector grow by more than 1,200% in 2021. TVL represents the total value of assets deposited in DeFi applications.

The DeFi Sector is Now Worth Above $240 Billion

On January 1, 2021, the TVL of the DeFi industry was capped at 18.71 billion. As more people looked to benefit from the decentralized lending, borrowing, derivatives, insurance, and crypto management services of DeFi protocols, the industry boomed.

Sponsored

Growing by more than 1,200% year-to-date, the TVL of the DeFi industry now stands at over $247 billion.

Ethereum, being the initiator of DeFi contributes the largest quota, with $153.82 billion and 376 DeFi protocols.

The biggest revelation of 2021 remains Terra. Bursting into the scene mid-year, Terra is now the second-biggest DeFi chain with a TVL of $18.2 billion and just 14 protocols.

With 252 protocols, the Binance Smart Chain is the third-largest, with a TVL of $16.7 billion.

Behind BSC is Avalanche with a TVL of $11.89 and Solana with $11.48.

On the Flipside

- A cancer of theft and scams have grown alongside the DeFi industry. More than $12 billion was lost to theft and fraud between January and November.

Why You Should Care

The DeFi industry has shown prominence and experts believe it will grow even further if their vulnerability to hacks is addressed.